Did FDA’s TransCon CNP Review Delay Just Shift Ascendis Pharma’s (ASND) Investment Narrative?

- In November 2025, Ascendis Pharma A/S disclosed that the FDA deemed its November 5 submission for TransCon CNP (navepegritide) in children with achondroplasia a major amendment, extending the PDUFA target action date by three months to February 28, 2026.

- This extension introduces additional regulatory review and timing uncertainty for a key pipeline asset that analysts had viewed as an important future growth driver.

- We’ll now examine how the extended PDUFA review for TransCon CNP reshapes Ascendis Pharma’s investment narrative and future growth profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ascendis Pharma Investment Narrative Recap

To own Ascendis Pharma, you need to believe its TransCon platform can convert early commercial success in YORVIPATH and SKYTROFA into durable, diversified cash flows while the company manages high spend and regulatory risk. The TransCon CNP PDUFA extension to February 28, 2026 introduces timing uncertainty for a high profile catalyst, but does not yet change the core story that execution on current launches and pipeline approvals will be central to near term sentiment and the key risk around delayed regulatory outcomes.

The recent Week 52 ApproaCH trial publication in JAMA Pediatrics is especially relevant, as it reinforces the efficacy and safety profile of TransCon CNP that underpins its filing now facing a longer FDA review. Together with growing sales from YORVIPATH and SKYTROFA, this dataset keeps TransCon CNP positioned as a potentially meaningful future contributor, even if the immediate catalyst has shifted out by several months and regulatory outcomes remain uncertain.

Yet while the headlines focus on the new PDUFA date, investors should be aware that...

Read the full narrative on Ascendis Pharma (it's free!)

Ascendis Pharma's narrative projects €2.2 billion revenue and €826.6 million earnings by 2028. This requires 63.9% yearly revenue growth and about a €1.1 billion earnings increase from €-271.2 million today.

Uncover how Ascendis Pharma's forecasts yield a $257.66 fair value, a 25% upside to its current price.

Exploring Other Perspectives

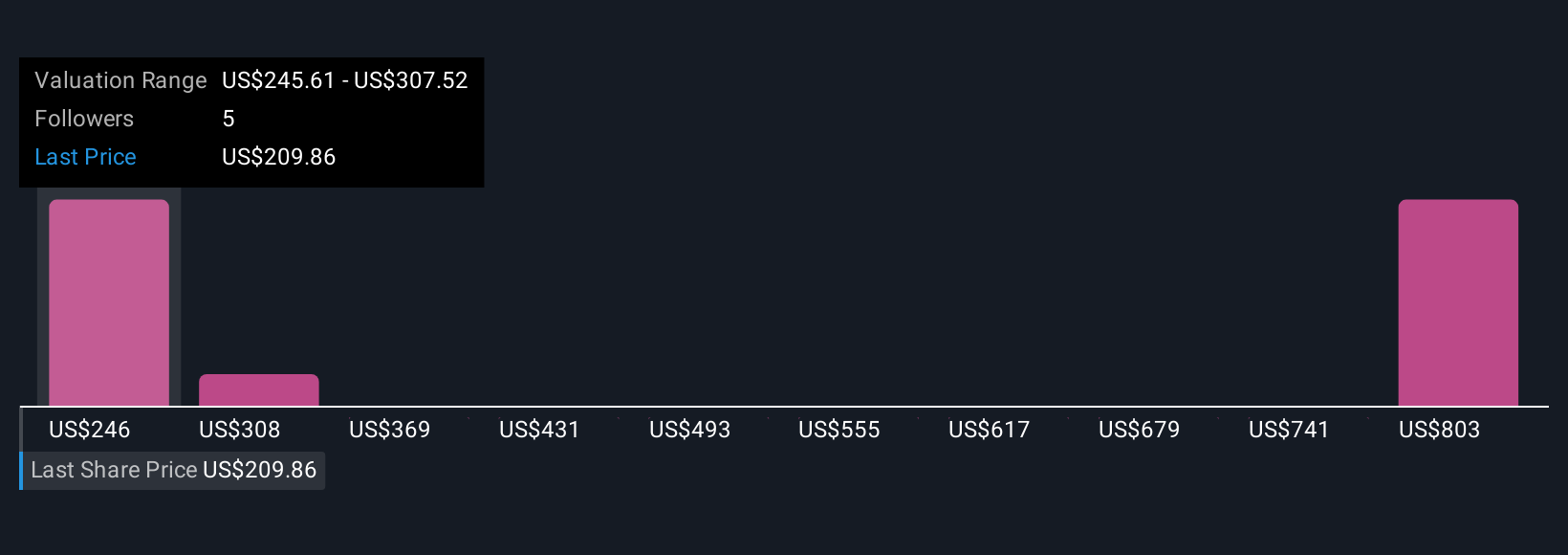

Four fair value estimates from the Simply Wall St Community span roughly US$193 to US$742 per share, underscoring how far apart individual views can be. Against that backdrop, the added uncertainty around TransCon CNP’s extended FDA review highlights why you may want to compare several different risk and growth assumptions before forming your own view on Ascendis Pharma’s longer term performance.

Explore 4 other fair value estimates on Ascendis Pharma - why the stock might be worth over 3x more than the current price!

Build Your Own Ascendis Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascendis Pharma research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ascendis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascendis Pharma's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal