Shinko Shoji (TSE:8141) Has Announced A Dividend Of ¥6.50

Shinko Shoji Co., Ltd. (TSE:8141) will pay a dividend of ¥6.50 on the 17th of June. However, the dividend yield of 1.2% still remains in a typical range for the industry.

Shinko Shoji's Projected Earnings Seem Likely To Cover Future Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Shinko Shoji was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

If the trend of the last few years continues, EPS will grow by 2.9% over the next 12 months. If the dividend continues on this path, the payout ratio could be 45% by next year, which we think can be pretty sustainable going forward.

See our latest analysis for Shinko Shoji

Dividend Volatility

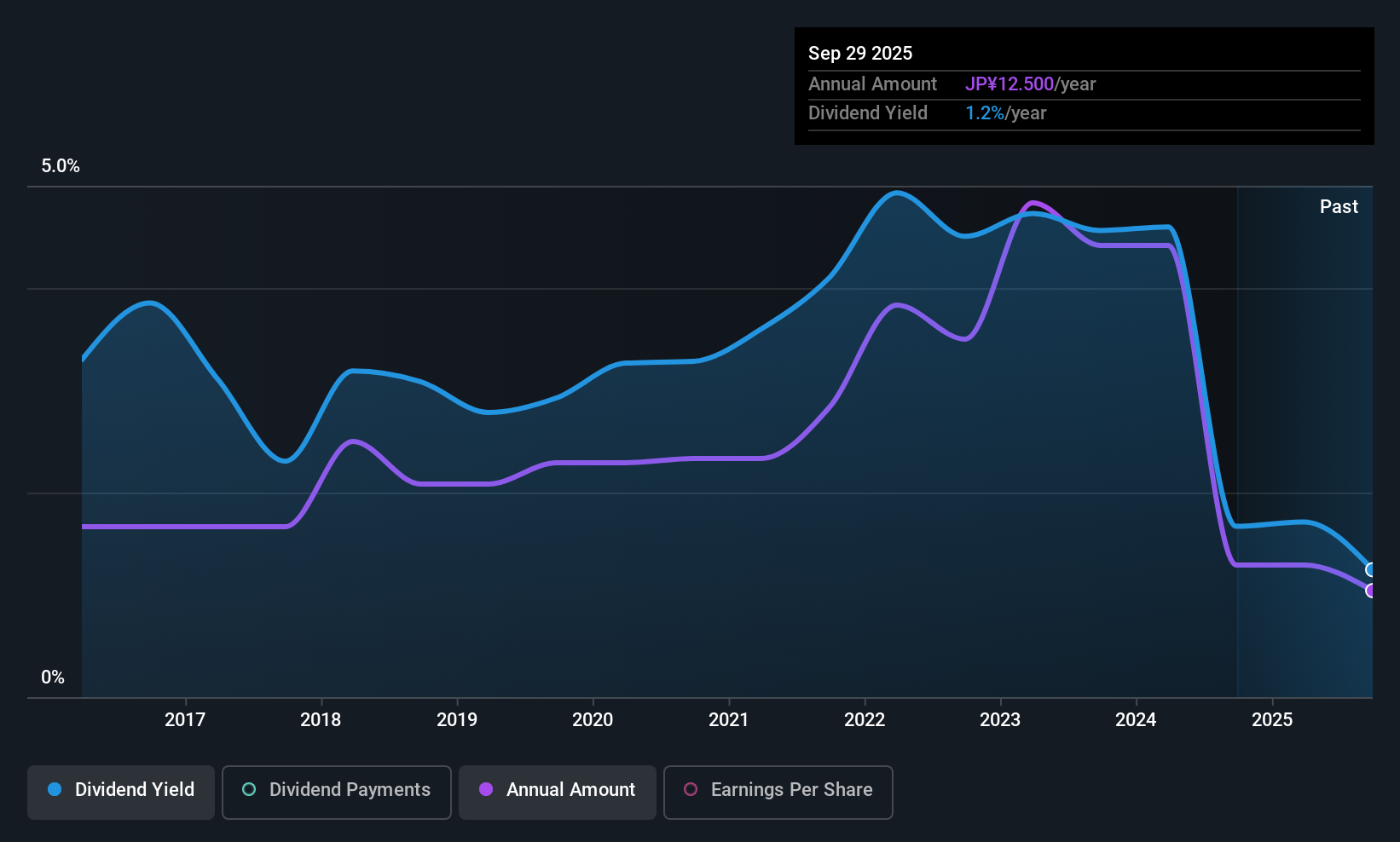

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the annual payment back then was ¥15.00, compared to the most recent full-year payment of ¥12.50. The dividend has shrunk at around 1.8% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings has been rising at 2.9% per annum over the last five years, which admittedly is a bit slow. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

In Summary

Overall, we think that Shinko Shoji could make a reasonable income stock, even though it did cut the dividend this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Shinko Shoji (of which 1 is concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal