How LPL’s New Chief Legal Officer and Expanded Policy Focus Will Impact LPL Financial (LPLA) Investors

- LPL Financial Holdings has appointed Matthew Morningstar as group managing director and chief legal officer, adding him to the Management Committee to lead its Legal, Policy and Community Impact teams after senior legal roles at both LPL and MetLife.

- This leadership change comes as LPL marks the 15th anniversary of its IPO, underscoring how expanded legal and policy capabilities align with its growth to more than US$2.30 billion in client assets and a much larger advisor base.

- We’ll now explore how Morningstar’s expanded legal and policy remit may influence LPL’s investment narrative, including growth, risk and regulation.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

LPL Financial Holdings Investment Narrative Recap

To own LPL Financial, you need to believe its independent advisor model and scale can offset cyclical pressures on earnings and margins, especially from interest rate sensitivity and fee compression. Morningstar’s appointment as chief legal officer is unlikely to change near term catalysts, which still center on advisor recruitment, asset flows and successful M&A integration, but it could influence how LPL manages its biggest current risk around regulatory complexity and compliance costs over time.

The most connected recent update is LPL’s 15th IPO anniversary, highlighting growth to more than US$2.30 trillion in client assets and a significantly larger advisor base, which directly ties into the core catalyst of scaling its platform. Together with the new legal leadership, this growth context frames how LPL balances expansion, integration of acquired businesses and regulatory scrutiny while aiming to protect its economics per advisor and per dollar of assets.

Yet for investors, the bigger concern may be how heightened regulatory scrutiny could affect advisor recruitment and long term profitability if...

Read the full narrative on LPL Financial Holdings (it's free!)

LPL Financial Holdings' narrative projects $23.0 billion revenue and $1.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and about an $0.8 billion earnings increase from $1.1 billion today.

Uncover how LPL Financial Holdings' forecasts yield a $420.93 fair value, a 13% upside to its current price.

Exploring Other Perspectives

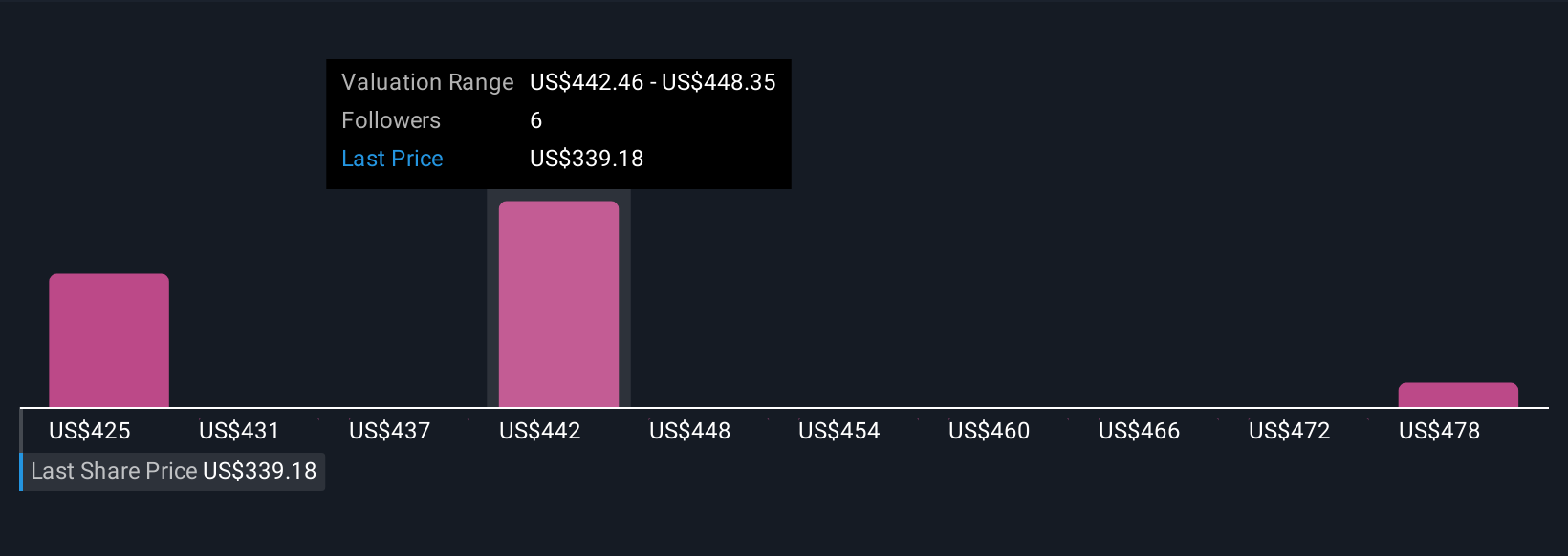

Three fair value estimates from the Simply Wall St Community span roughly US$360 to US$484 per share, showing how far apart individual views can be. You can set those side by side with the key risk that rising compliance expectations and regulatory ambiguity might pressure LPL’s costs and advisor growth, then decide which scenarios you think are more likely over time.

Explore 3 other fair value estimates on LPL Financial Holdings - why the stock might be worth just $359.50!

Build Your Own LPL Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LPL Financial Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free LPL Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LPL Financial Holdings' overall financial health at a glance.

No Opportunity In LPL Financial Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal