The Bull Case For RB Global (RBA) Could Change Following Q3 Earnings Beat And CTO Departure - Learn Why

- In November 2025, RB Global reported revenue of US$1.09 billion, an 11.3% year-on-year increase that exceeded analysts’ expectations on both revenue and earnings.

- Around the same time, Chief Technology Officer Nancy King left the company, with Chief Operations Officer Steve Lewis stepping in to oversee the technology organization on an interim basis.

- With strong quarterly results and interim technology leadership now in place, we’ll explore how this earnings beat shapes RB Global’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

RB Global Investment Narrative Recap

To own RB Global, you need to believe its global equipment marketplace and value added services can keep attracting volume and fees, even as digital competition and macro uncertainty create bumps in activity. The latest earnings beat supports that thesis near term, while the CTO departure looks manageable given interim coverage by the COO, so the most immediate risk remains softer transaction volumes rather than leadership disruption.

The November 2025 quarter, with US$1.09 billion in revenue and an 11.3% year on year increase, is the most relevant update here, as it underpins confidence in RB Global’s ability to monetize its growing digital and international footprint. That kind of performance strengthens the case for ongoing investment in technology and multi channel auctions, which is central to the company’s main catalyst of shifting more commercial asset transactions online.

Yet despite the strong quarter, investors should still be aware of how quickly digital alternatives could pressure RB Global’s auction margins if...

Read the full narrative on RB Global (it's free!)

RB Global's narrative projects $5.7 billion revenue and $913.2 million earnings by 2028.

Uncover how RB Global's forecasts yield a $122.70 fair value, a 23% upside to its current price.

Exploring Other Perspectives

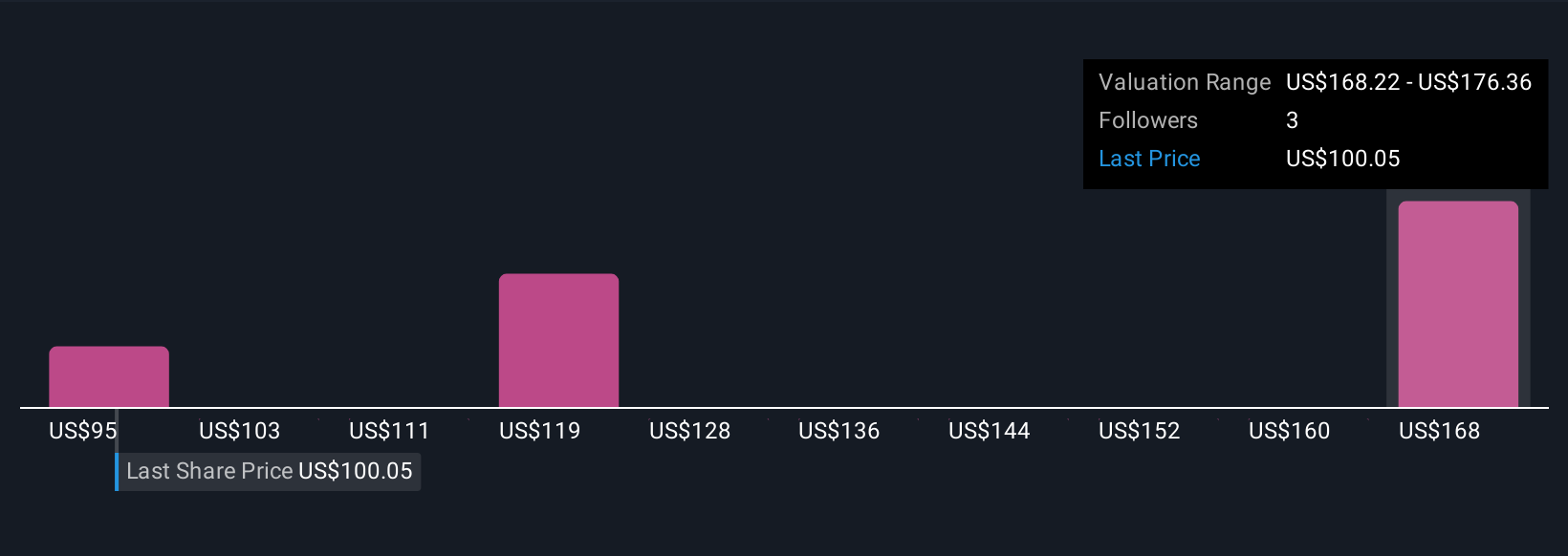

Three fair value estimates from the Simply Wall St Community span roughly US$95 to about US$182 per share, showing how differently individual investors are weighing RB Global’s prospects. As you weigh those views, consider how much of your own thesis rests on continued success in shifting more equipment sales onto RB Global’s online and multi channel platforms, given the competitive and cyclical pressures discussed above.

Explore 3 other fair value estimates on RB Global - why the stock might be worth as much as 83% more than the current price!

Build Your Own RB Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RB Global research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free RB Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RB Global's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal