Mirum Pharmaceuticals (MIRM): Reviewing Valuation After Strong Q3 Beat and Upgraded 2025 Revenue Outlook

Mirum Pharmaceuticals (MIRM) just turned in an upbeat third quarter, topping earnings and revenue expectations and nudging its 2025 sales outlook higher, a combination that tends to pull fresh attention toward the stock.

See our latest analysis for Mirum Pharmaceuticals.

Even after a softer reaction today, with the latest 1 day share price return at minus 4.26 percent and the stock now trading around 68.48 dollars, Mirum’s year to date share price return of 62.89 percent and three year total shareholder return of 277.09 percent suggest momentum has been building as investors warm to both its rare disease franchise and the new Fragile X program.

If Mirum’s run has you rethinking your healthcare exposure, this could be a good moment to explore other specialist healthcare stocks that might be under the market’s radar.

With Mirum now trading at a sizable discount to analyst targets despite brisk revenue and earnings momentum, investors face a familiar dilemma: is this a fresh entry point, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 22.2% Undervalued

With Mirum closing at 68.48 dollars against a narrative fair value of 87.99 dollars, the stage is set around whether its growth runway truly merits that gap.

Multiple late-stage pipeline catalysts, including three pivotal study readouts (VISTAS, VANTAGE, EXPAND) over the next 24 months and the initiation of the Phase II Fragile X study, set the stage for further product label expansions and new indication launches, underpinning future revenue diversification and potential earnings acceleration.

Want to see what kind of revenue climb and margin shift might justify this bolder price tag, and why the implied future earnings multiple looks so punchy? Dive in to unpack the assumptions powering this narrative.

Result: Fair Value of $87.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained upside hinges on timely, positive data. Any clinical delays or disappointing results could quickly challenge the current undervalued thesis.

Find out about the key risks to this Mirum Pharmaceuticals narrative.

Another Angle on Valuation

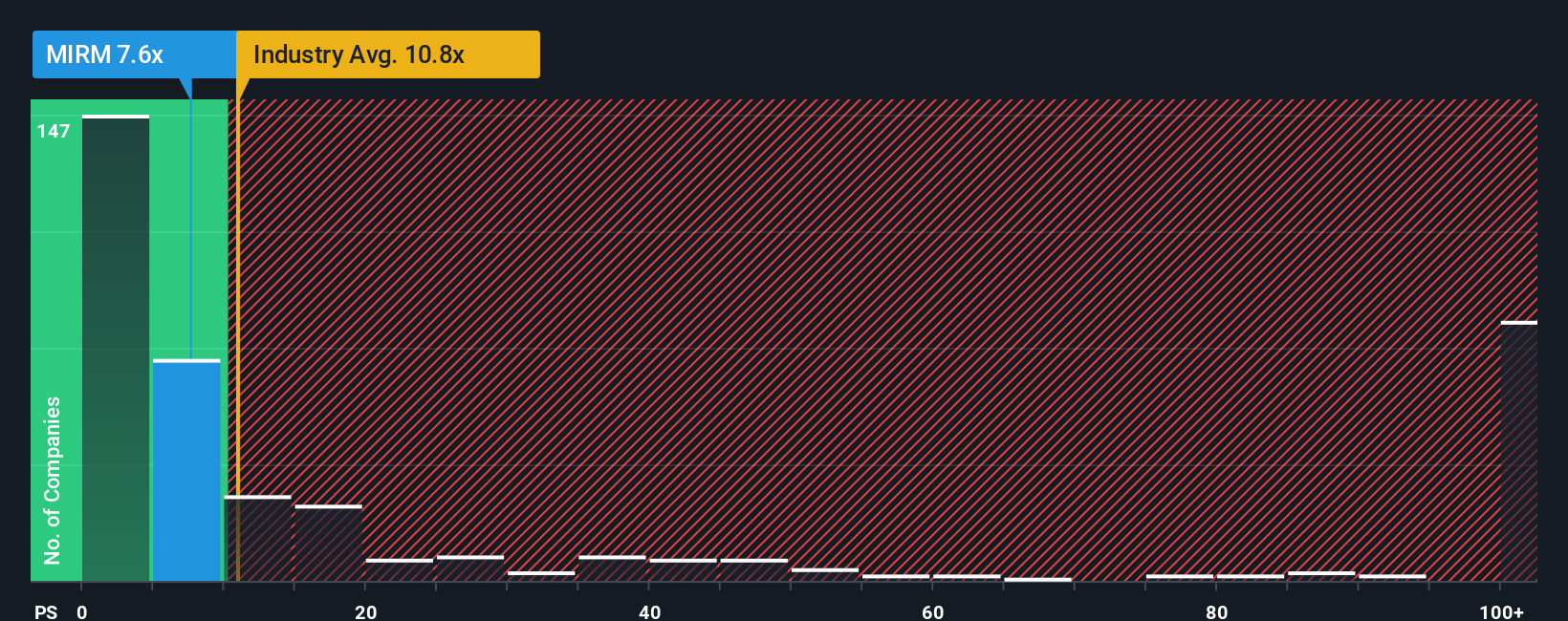

While the narrative fair value points to upside, the market is sending a mixed signal on simple sales metrics. Mirum trades on a price to sales ratio of 7.5 times, richer than its fair ratio of 6.9 times, but cheaper than biotech peers at 10.7 times, so is this really a margin of safety or just relative value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirum Pharmaceuticals Narrative

If you are not completely sold on this view or would rather examine the numbers yourself, you can build a personalized storyline in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mirum Pharmaceuticals.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to pinpoint focused themes that could upgrade your portfolio’s growth, income, and innovation potential.

- Capture rapid growth potential by scanning these 3574 penny stocks with strong financials that already show strong financial foundations instead of just hype.

- Position yourself at the forefront of innovation by targeting these 26 AI penny stocks that blend breakthrough technology with scalable business models.

- Strengthen your portfolio’s income engine by filtering for these 15 dividend stocks with yields > 3% that can support regular cash returns without sacrificing quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal