Reaffirmed 2026 Revenue Guidance and Rising Margins Could Be A Game Changer For Blue Bird (BLBD)

- In November 2025, Blue Bird Corporation reported past fourth-quarter sales of US$409.37 million and net income of US$36.5 million, with both revenue and earnings rising versus the prior year, and reaffirmed its fiscal 2026 net revenue guidance at about US$1.5 billion.

- The combination of stronger-than-prior-year margins, continued growth in full-year earnings per share, and insider share purchases has reinforced confidence in Blue Bird’s operational progress and earnings outlook.

- We’ll now explore how this reaffirmed US$1.5 billion revenue guidance and stronger quarterly profitability reshape Blue Bird’s existing investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Blue Bird Investment Narrative Recap

To own Blue Bird, you need to believe that school bus replacement demand and alternative powertrains, including electric, can support steady revenue and earnings, even as tariffs and funding remain uncertain. The latest quarter’s higher margins and reaffirmed US$1.5 billion 2026 revenue guidance support that view in the near term, while policy risk around EV incentives still looks like the key swing factor. Overall, the news mainly reinforces, rather than changes, the existing short term catalyst and risk balance.

The reaffirmation of Blue Bird’s 2026 net revenue guidance at about US$1.5 billion, coming alongside full year 2025 sales of US$1,480.1 million and higher earnings, is the most relevant update here. It ties the recent margin gains and operational improvements directly to management’s confidence in maintaining the current earnings trajectory, even as investors keep a close eye on how government programs for cleaner school buses evolve and how that might influence order timing.

Yet investors should also be aware that if EV related government incentives are scaled back or delayed, Blue Bird’s growing electric bus exposure could...

Read the full narrative on Blue Bird (it's free!)

Blue Bird's narrative projects $1.6 billion revenue and $152.3 million earnings by 2028. This requires 4.0% yearly revenue growth and about a $36 million earnings increase from $115.9 million today.

Uncover how Blue Bird's forecasts yield a $63.75 fair value, a 24% upside to its current price.

Exploring Other Perspectives

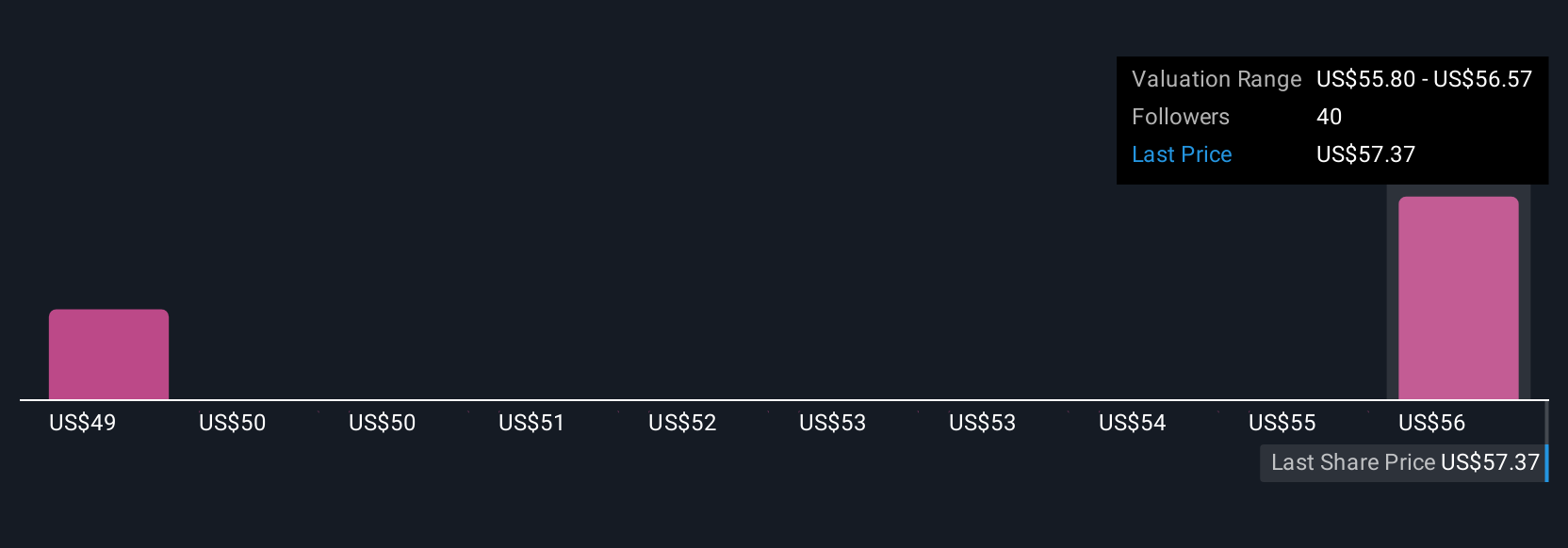

Three members of the Simply Wall St Community currently estimate Blue Bird’s fair value between US$63.75 and US$94.49, highlighting how far opinions can stretch. Set that against the reliance on EV related incentive programs, and you get a sense of why it can pay to compare several different views on what might drive Blue Bird’s next phase of performance.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth just $63.75!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal