S&P Global (SPGI) Valuation Check as New AWS AI Data Integrations Expand Its Enterprise Offering

S&P Global (SPGI) is leaning further into AI, rolling out new integrations with Amazon Web Services that let clients query its financial and energy data through AI agents directly inside their AWS setups.

See our latest analysis for S&P Global.

These AWS integrations land alongside fresh senior note offerings and conference appearances. While the latest 1 year total shareholder return is slightly negative, the strong 3 year and 5 year total shareholder returns suggest long term momentum is still intact, even as the recent 90 day share price return has cooled.

If this kind of AI driven data play interests you, it is worth exploring other names in the space with our screener for high growth tech and AI stocks to see what else fits your strategy.

With growth still solid and the stock trading at a meaningful discount to analyst targets, has recent underperformance left S&P Global undervalued, or is the market already looking ahead and fully pricing in its AI driven expansion?

Price to Earnings of 35.8x: Is it justified?

S&P Global last closed at $498.52, and its valuation looks rich when you compare its 35.8x price to earnings ratio to peers.

The price to earnings multiple compares what investors pay today for each dollar of the company’s current earnings, a key yardstick for mature, profitable franchises like S&P Global.

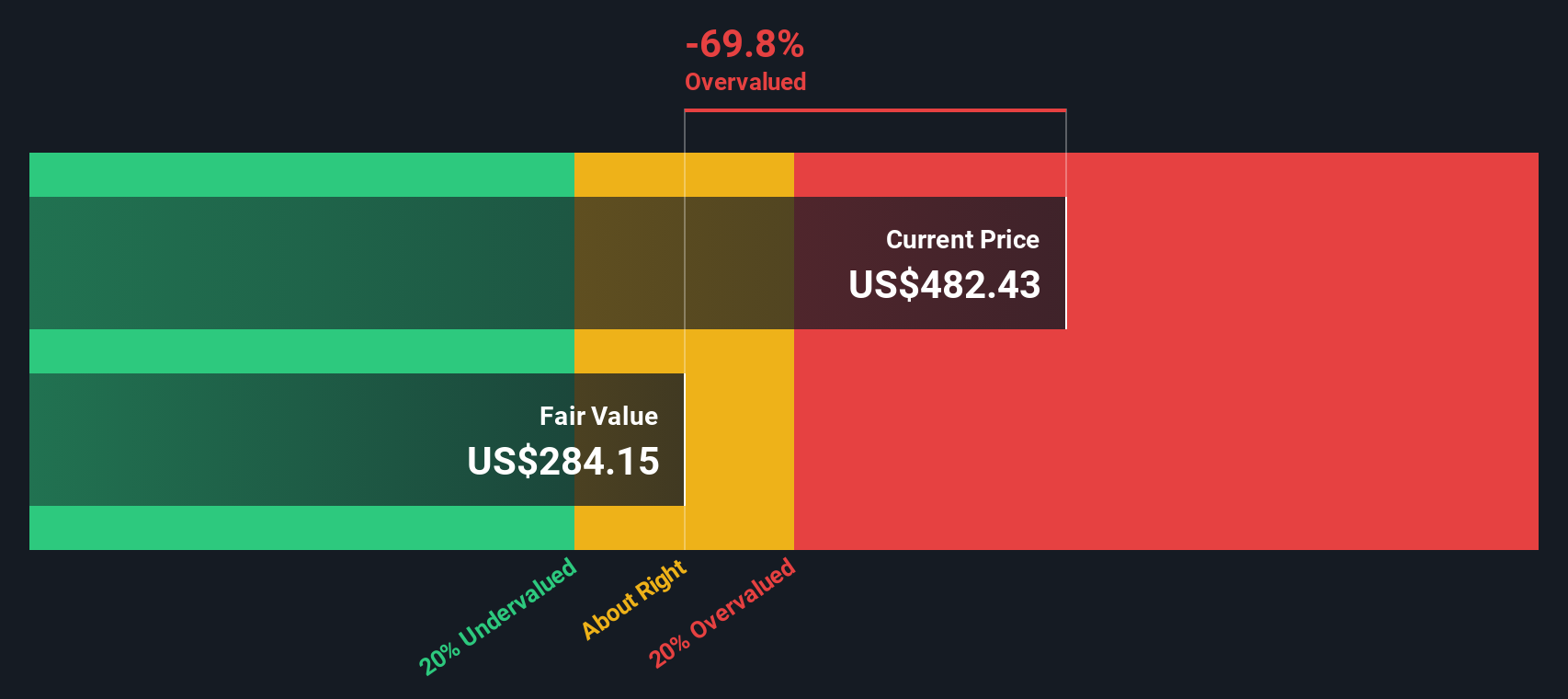

At 35.8x earnings, investors appear willing to pay a premium for SPGI’s consistent profit growth and high quality earnings, even though our SWS DCF model estimates fair value closer to $311.89 per share. That premium looks even more stretched against an estimated fair price to earnings ratio of 17.8x, a level the market could ultimately gravitate toward if expectations cool.

Compared to the US Capital Markets industry average multiple of 24.2x and a peer average of 31.5x, SPGI’s 35.8x price to earnings ratio stands out as decisively more expensive.

Explore the SWS fair ratio for S&P Global

Result: Price to Earnings of 35.8x (OVERVALUED)

However, tighter regulation of credit ratings or a slowdown in global capital markets could pressure growth and undermine optimism around S&P Global’s AI driven expansion.

Find out about the key risks to this S&P Global narrative.

Another View: DCF Points to a Bigger Gap

Our DCF model paints an even starker picture, suggesting fair value around $311.89 per share, well below today’s $498.52 price. This implies SPGI is overvalued on cash flow terms as well. Is the market overpaying for quality, or underestimating future AI driven growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out S&P Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own S&P Global Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding S&P Global.

Looking for more investment ideas?

Before you move on, lock in an edge by testing your thesis against fresh stock ideas from our powerful screener tools that surface opportunities others might overlook.

- Target stronger potential upside by focusing on quality names trading below their estimated worth with these 908 undervalued stocks based on cash flows.

- Ride structural growth trends in automation and machine learning by scanning for tomorrow’s standouts using these 26 AI penny stocks.

- Boost your income strategy by zeroing in on reliable payers through these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal