Allpoint Deposit Deal With Knoxville TVA Might Change The Case For Investing In NCR Atleos (NATL)

- In December 2025, NCR Atleos announced that Knoxville TVA Employees Credit Union, a US$5.00 billion-asset institution, will offer its members nationwide cash deposit access through the Allpoint Network, including 3,500 enabled ATMs and 26 branded deposit locations across Tennessee.

- This move makes Knoxville TVA Employees Credit Union the first in Tennessee to offer Allpoint cash deposits and NCR Atleos the first non-bank ATM operator in the state to accept deposits, underscoring how outsourced networks can extend branchless cash services and brand reach for regional institutions.

- Next, we’ll examine how becoming Tennessee’s first non-bank ATM deposit operator through this Allpoint expansion could influence NCR Atleos’ investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

NCR Atleos Investment Narrative Recap

To own NCR Atleos, you need to believe outsourced ATM and cash networks can remain relevant as banks digitize, while the company converts that role into higher margin, recurring ATM‑as‑a‑Service revenue. The Knoxville TVA Employees Credit Union deposit deal supports the near term hardware and services catalyst by adding branded, deposit‑taking endpoints, but it does not materially alter the key risk that a long run shift away from cash could pressure the installed base.

The Knoxville TVA partnership fits alongside recent client wins such as Kuwait Finance House’s AI powered kiosk deployment, which together illustrate how Atleos is trying to layer software, services, and branding onto its cash infrastructure. For investors watching the hardware refresh cycle and ATM‑as‑a‑Service backlog, each new network use case helps clarify whether the company can offset slower cash growth with deeper wallet share per endpoint.

Yet, against these expansions, the long term risk that accelerating digital and contactless payments chip away at the very cash volumes Atleos depends on is something investors should be aware of...

Read the full narrative on NCR Atleos (it's free!)

NCR Atleos' narrative projects $4.9 billion revenue and $376.6 million earnings by 2028. This requires 4.4% yearly revenue growth and an earnings increase of about $248.6 million from $128.0 million today.

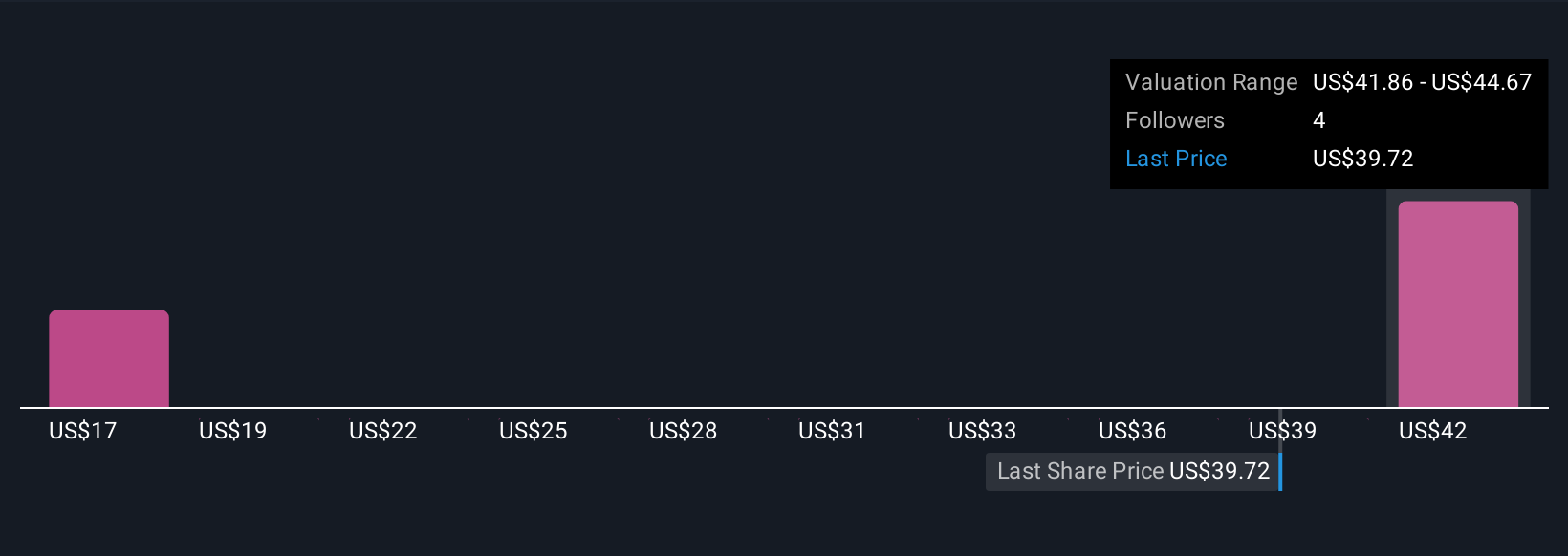

Uncover how NCR Atleos' forecasts yield a $44.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates span roughly US$16.90 to US$45.17 per share, underscoring how far apart individual views can be. When you weigh those opinions against the risk that structural declines in cash usage could pressure Atleos’ ATM centric model, it becomes clear why exploring several alternative viewpoints on the stock’s future is essential.

Explore 4 other fair value estimates on NCR Atleos - why the stock might be worth less than half the current price!

Build Your Own NCR Atleos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free NCR Atleos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NCR Atleos' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal