Why MSC Industrial Direct (MSM) Is Down 6.8% After Slower Growth Raises Margin Concerns - And What's Next

- Earlier this week, MSC Industrial Direct reported third-quarter revenue of US$978.2 million, topping expectations but revealing slower growth than other maintenance and repair distributors, prompting concerns about how softer demand and intense competition could affect its profit margins.

- The key issue for investors is not the revenue beat itself, but whether MSC Industrial Direct can defend profitability while lagging peers on growth.

- Next, we’ll examine how worries about slower growth and margin pressure could influence MSC Industrial Direct’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

MSC Industrial Direct Investment Narrative Recap

To own MSC Industrial Direct, you need to believe its core role in industrial maintenance can support steady cash generation, even when growth trails peers. The latest quarter reinforced that the main short term catalyst is management’s ability to protect margins in a slower demand backdrop, while the biggest near term risk is that soft demand and aggressive competition squeeze profitability more than expected. So far, the revenue beat itself does not materially change that balance.

Against this backdrop, MSC’s continued commitment to a rising quarterly dividend, now US$0.87 per share, is especially relevant. It signals that management still sees room to return cash to shareholders even as revenue growth lags competitors and margin pressure becomes a central concern, which ties directly into how investors might weigh income potential against the risk of further profitability strain.

But investors also need to be aware that if softer demand persists and pricing comes under more pressure, then ...

Read the full narrative on MSC Industrial Direct (it's free!)

MSC Industrial Direct's narrative projects $4.3 billion revenue and $293.5 million earnings by 2028. This requires 4.5% yearly revenue growth and a roughly $95 million earnings increase from $198.5 million today.

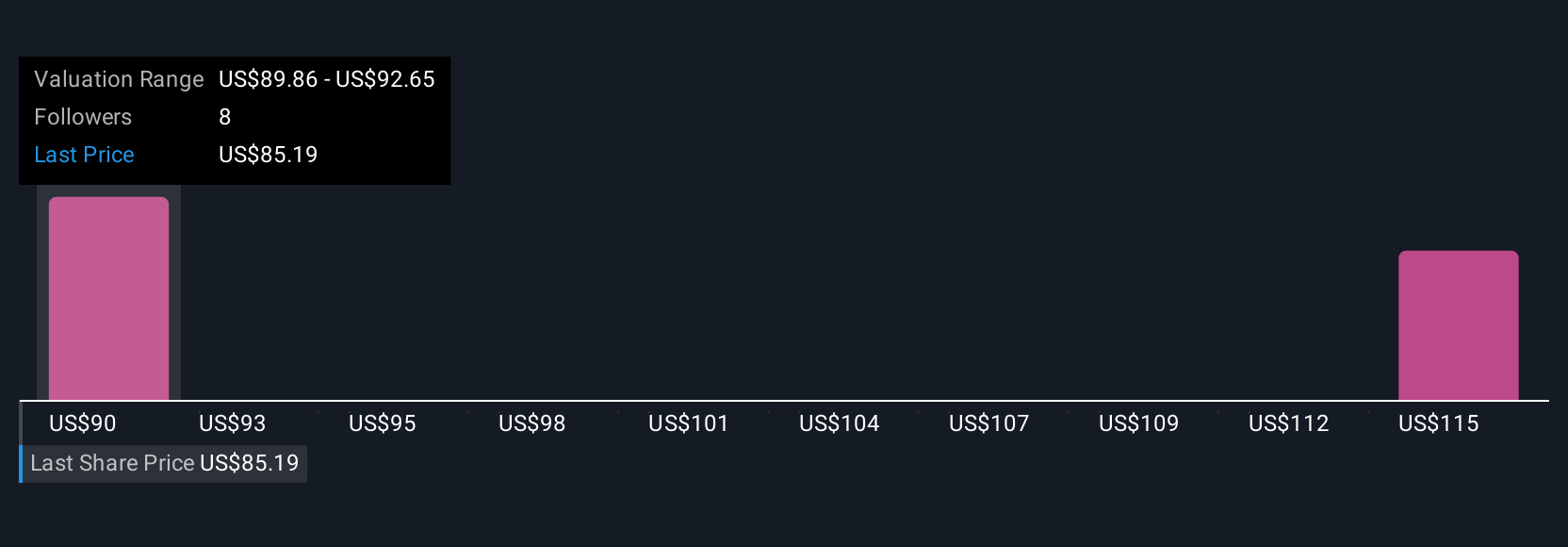

Uncover how MSC Industrial Direct's forecasts yield a $87.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from about US$60 to US$88 per share, underscoring how differently investors can view the same business. In light of concerns about soft demand and potential margin pressure, it is worth exploring these varied opinions to see how others are thinking about the company’s ability to sustain profitability.

Explore 2 other fair value estimates on MSC Industrial Direct - why the stock might be worth 27% less than the current price!

Build Your Own MSC Industrial Direct Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSC Industrial Direct research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MSC Industrial Direct research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSC Industrial Direct's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal