Blackstone (BX): Reassessing Valuation After San Francisco Hotel Deal and New Retirement Savings Unit Launch

Blackstone, the alternative asset giant, grabbed attention after buying San Francisco's Four Seasons Hotel and rolling out a new retirement savings unit, a one-two move that pushed the stock up about 3%.

See our latest analysis for Blackstone.

Those moves land in the middle of a tricky year for Blackstone, with the latest $152.15 share price sitting against a negative year to date share price return but still backed by a powerful three year total shareholder return above 100 percent. This suggests momentum is trying to turn after a recent pullback.

If this kind of activity has you looking beyond Blackstone, it could be a smart moment to scout fast growing stocks with high insider ownership and see which other fast moving names insiders are backing.

With shares now trading below analysts’ targets but still boasting strong multi year returns, it raises the key question: is Blackstone quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 15.4% Undervalued

With Blackstone last closing at $152.15 against a most popular narrative fair value near $179.78, the story leans toward meaningful upside if assumptions land.

The firm is well-positioned to benefit from market dislocation with $177 billion of dry powder available for opportunistic investments, potentially increasing future earnings as capital is deployed in undervalued assets.

The expansion in private credit, particularly in investment-grade private credit, shows a 35% year over year growth, indicating potential for significant revenue streams due to larger spreads and structural tailwinds in the credit markets.

Want to see what kind of revenue engine those deployment plans are betting on? The narrative quietly bakes in aggressive growth, margin expansion and a rich future earnings multiple. Curious how those moving parts come together to justify that higher fair value?

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and potential delays in deploying that $177 billion in available capital could easily blunt the optimistic growth and valuation narrative.

Find out about the key risks to this Blackstone narrative.

Another Lens on Value

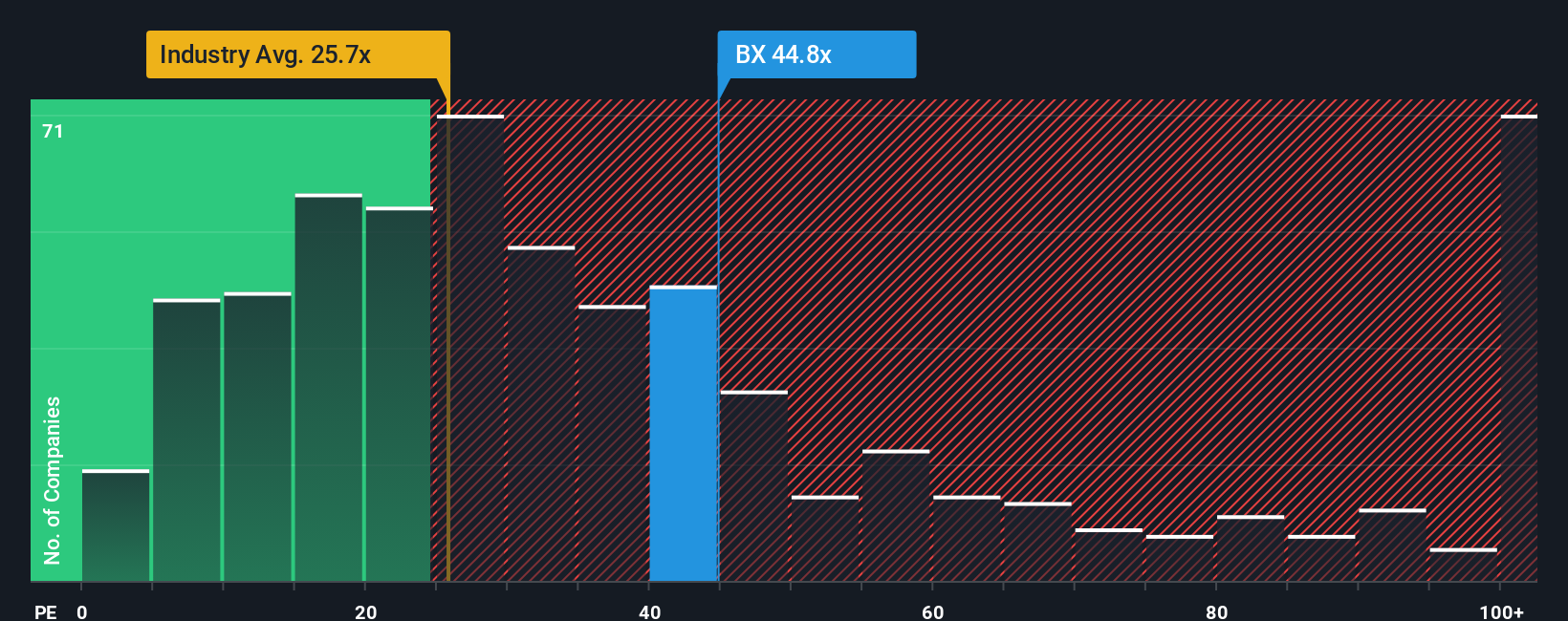

Step away from narratives and the earnings multiple sends a very different signal. Blackstone trades on about 44 times earnings versus 24.2 times for the US Capital Markets industry, and a fair ratio of 24.4 times, hinting at substantial valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes with Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning thesis could be waiting just outside Blackstone, so head into the Simply Wall Street Screener now before the most compelling opportunities move without you.

- Capture potential multibaggers early by scanning these 3574 penny stocks with strong financials that already boast strong financial foundations instead of fragile hype.

- Position yourself at the forefront of automation and software shifts by targeting companies in these 26 AI penny stocks reshaping how entire industries operate.

- Lock in more dependable income streams by focusing on these 15 dividend stocks with yields > 3% that balance attractive yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal