Is Zscaler’s Expanding AWS and Zero Trust Ecosystem Altering The Investment Case For Zscaler (ZS)?

- In recent weeks, Peraton, Orca Security, and TPx have each announced expanded collaborations with Zscaler, while Zscaler also received major AWS Marketplace Partner of the Year honors tied to more than US$1.00 billion in AWS Marketplace sales.

- Together, these developments highlight how Zscaler’s Zero Trust and cloud-native security platform is increasingly embedded in critical infrastructure, multicloud, and managed SASE offerings across government and enterprise customers.

- We’ll now examine how Zscaler’s deepening AWS and Zero Trust partnerships, particularly the Peraton alliance, affect its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zscaler Investment Narrative Recap

To own Zscaler, you need to believe its Zero Trust cloud platform will keep winning share as organizations re-architect security around cloud and AI, while the biggest near term risk remains intensifying competition and bundled offerings from hyperscalers and large security vendors. The recent Peraton, Orca, TPx, and AWS Marketplace milestones support the core growth story but do not materially change that core catalyst or the competitive risk profile in the short term.

Among the recent updates, the expanded Peraton partnership stands out, because it embeds Zscaler directly into hybrid multicloud and mission critical government environments, where Zero Trust adoption can translate into larger, multi-year platform deals and higher ARR per customer. For investors focused on whether Zscaler can extend its Zero Trust Everywhere and Data Security Everywhere momentum, this kind of integration into national security and defense workloads is especially relevant.

Yet even with these wins, investors should be aware that growing integration of security capabilities by hyperscale cloud providers could still...

Read the full narrative on Zscaler (it's free!)

Zscaler's narrative projects $4.7 billion revenue and $139.8 million earnings by 2028. This requires 20.5% yearly revenue growth and a $181.3 million earnings increase from $-41.5 million today.

Uncover how Zscaler's forecasts yield a $328.22 fair value, a 35% upside to its current price.

Exploring Other Perspectives

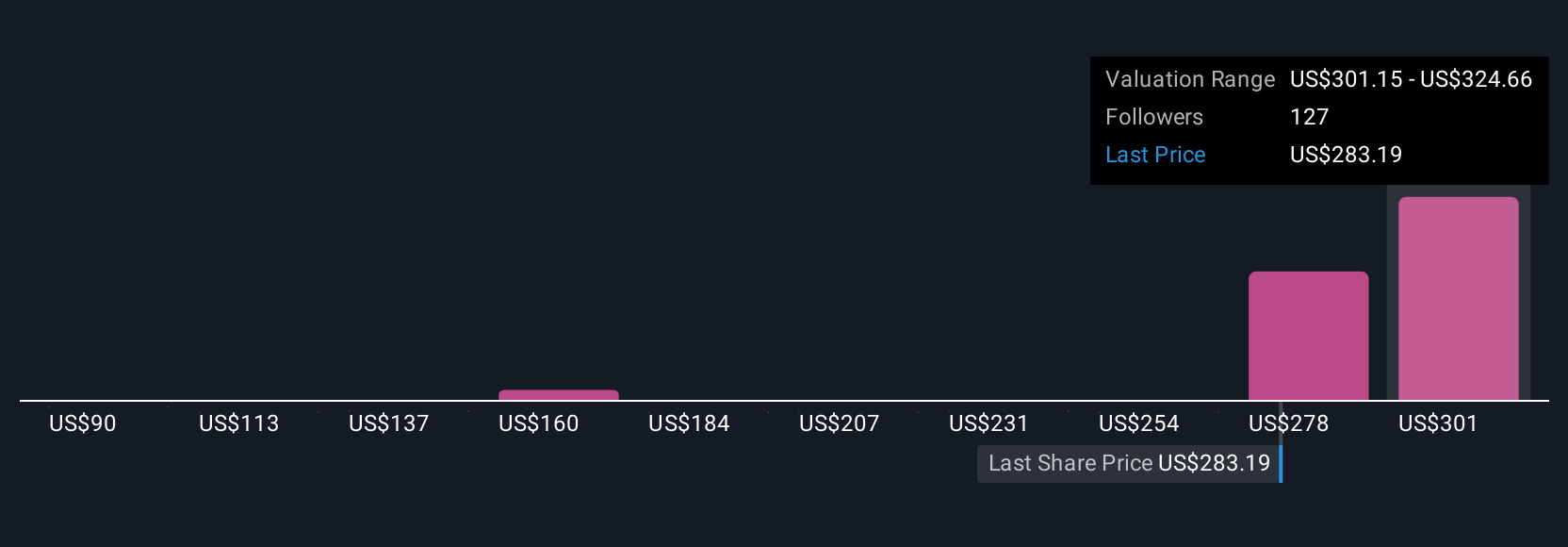

Nine Simply Wall St Community fair value estimates span roughly US$90 to US$328 per share, showing how far apart individual views can be. When you set that against the thesis that public cloud providers might gradually integrate more security in house, it underlines why exploring several independent viewpoints on Zscaler’s long run competitive position matters.

Explore 9 other fair value estimates on Zscaler - why the stock might be worth less than half the current price!

Build Your Own Zscaler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zscaler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zscaler's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal