MongoDB (MDB): Reassessing Valuation After Strong Q3 Beat, Atlas Momentum and Raised Full-Year Guidance

MongoDB (MDB) just turned a strong quarter into a bigger story, with Atlas doing most of the heavy lifting and management lifting guidance. That combination, plus upbeat analyst commentary, is exactly what pushed the stock higher.

See our latest analysis for MongoDB.

Those Q3 numbers and higher guidance have come on top of an already strong run, with a roughly 67% year to date share price return and a three year total shareholder return above 100%. This signals that momentum and confidence are still building at $409.62 a share rather than fading.

If MongoDB's surge has you thinking about what else could benefit from the same AI and cloud tailwinds, it might be worth exploring high growth tech and AI stocks as your next hunting ground.

With shares near record highs, upgraded guidance and bullish analysts are battling eye watering valuation multiples. Is MongoDB still an overlooked compounder in the making, or is the market already paying up for years of growth ahead?

Most Popular Narrative: 4.3% Undervalued

With MongoDB closing at $409.62 and the most followed narrative pointing to fair value near $428, the valuation debate is getting louder.

The fair value estimate has risen from approximately $370 to about $428 per share, reflecting higher expectations for long-term earnings power.

The future P/E multiple has declined from about 3,330x to approximately 388x, suggesting that more of the valuation is now supported by improved earnings rather than multiple expansion alone.

Want to see what kind of revenue ramp, margin shift, and long term profit multiple are now baked into that higher fair value? The full narrative unpacks the assumptions driving this updated target and how they reshape MongoDB's long run earnings power.

Result: Fair Value of $428 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could crack if Atlas growth slows amid intensifying cloud competition, or if stock based compensation driven dilution caps per share upside.

Find out about the key risks to this MongoDB narrative.

Another Angle on Valuation

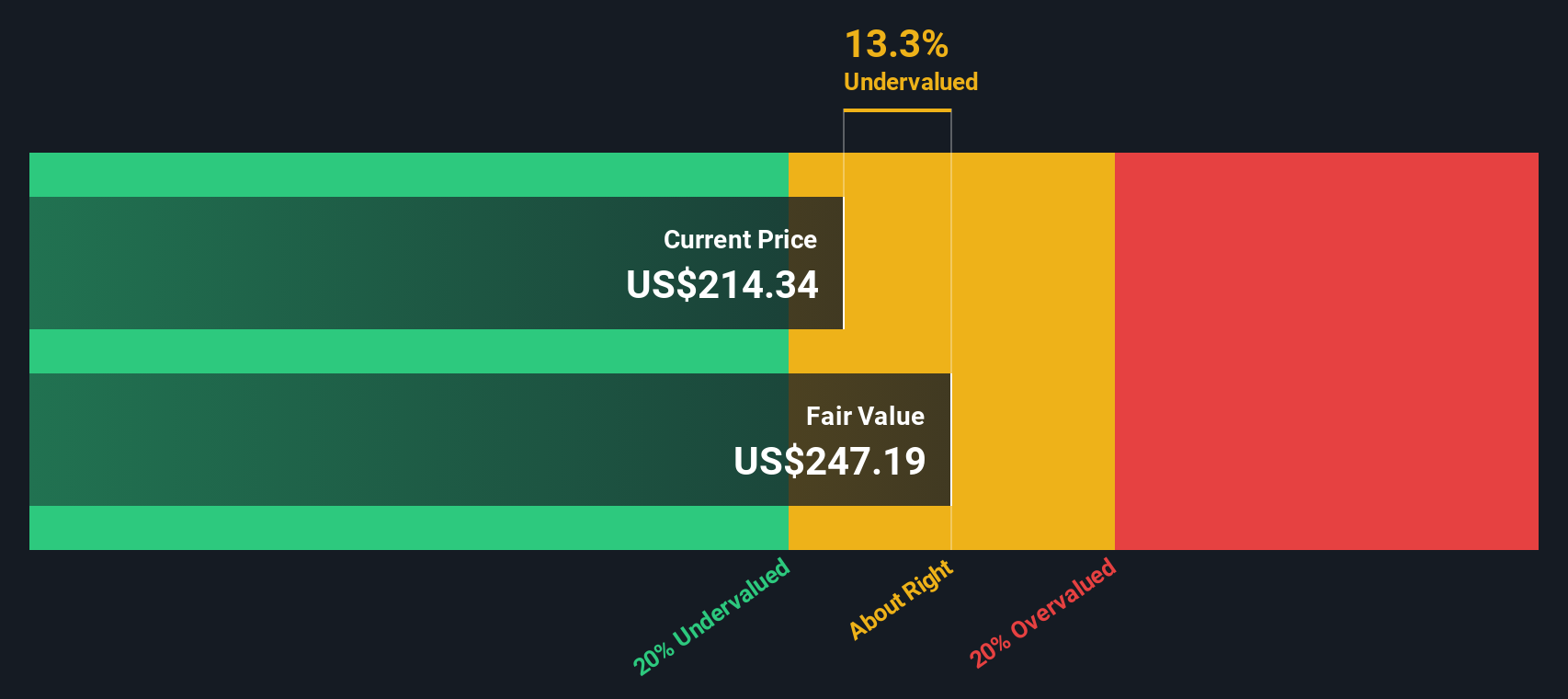

Community narratives see MongoDB as modestly undervalued, but our DCF model paints a very different picture. On those cash flow assumptions, fair value lands closer to $230.64, meaning today’s $409.62 price screens as overvalued, not cheap. Which story do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MongoDB Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MongoDB.

Looking for more investment ideas?

Before you move on, consider exploring your next opportunity by scanning focused stock sets that match your strategy, so you are not chasing yesterday’s winners.

- Explore these 3574 penny stocks with strong financials that pair small size with improving fundamentals and potential for meaningful price moves.

- Align your portfolio with automation and data transformation using these 26 AI penny stocks tied to long term AI adoption themes.

- Support your income objectives by reviewing these 15 dividend stocks with yields > 3% that may continue paying dividends when markets are noisy and unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal