How Twin FDA Breakthrough Therapy Wins Could Impact Ionis Pharmaceuticals (IONS) Investors

- In early December 2025, Ionis Pharmaceuticals announced that the FDA granted Breakthrough Therapy designation to zilganersen for Alexander disease and to olezarsen for severe hypertriglyceridemia, both supported by pivotal trials showing clinically meaningful benefits and favorable safety.

- These twin Breakthrough Therapy designations underscore Ionis’ RNA-targeted platform as a potential source of first-in-class treatments across both ultra-rare neurology and broader cardiometabolic disease.

- We’ll now examine how olezarsen’s Breakthrough Therapy status in severe hypertriglyceridemia may influence Ionis’ investment narrative around larger patient populations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ionis Pharmaceuticals Investment Narrative Recap

To own Ionis, you need to believe its RNA platform can convert multiple late stage programs into durable, commercially successful drugs while moving toward profitability. The twin Breakthrough Therapy designations strengthen the near term regulatory story, but they also concentrate attention on the biggest current risk: execution around U.S. approvals, pricing and uptake for olezarsen in broader severe hypertriglyceridemia, where a larger audience may come with lower net pricing and more complex reimbursement.

The olezarsen Breakthrough Therapy designation in severe hypertriglyceridemia is the clearest link to the next major catalyst, given Ionis plans a supplemental FDA filing by year end. Positive CORE and CORE2 data in a sizable, high risk population could help underpin volume driven growth, while still leaving open questions about long term margins, payer responses and how far pricing may need to adjust as the drug moves beyond ultra rare use cases.

Yet investors should also weigh how payer pushback and pricing negotiations in larger sHTG populations could affect the economics they are counting on...

Read the full narrative on Ionis Pharmaceuticals (it's free!)

Ionis Pharmaceuticals’ narrative projects $1.5 billion revenue and $241.3 million earnings by 2028.

Uncover how Ionis Pharmaceuticals' forecasts yield a $85.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

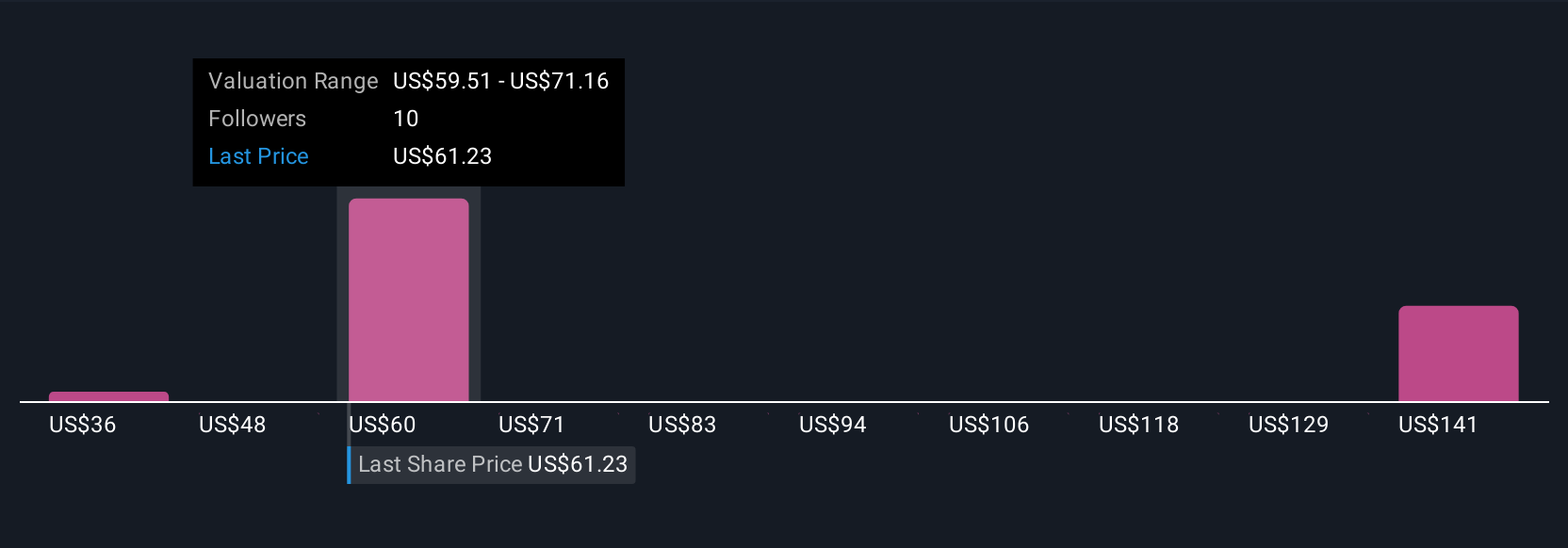

Simply Wall St Community members have published four fair value estimates for Ionis, ranging from US$36.19 to US$222.96 per share, reflecting very different expectations. You can weigh those views against the risk that large scale pricing negotiations in expanded olezarsen indications may curb margin expansion and influence how Ionis converts clinical success into sustainable business performance.

Explore 4 other fair value estimates on Ionis Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Ionis Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ionis Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ionis Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal