Does MSGE’s Cisco Partnership Rethink Tech Investment Or Simply Refine Its Sponsorship‑Led Strategy?

- Earlier this week, Madison Square Garden Entertainment Corp. announced a new multi-year partnership with Cisco, naming Cisco an Official Partner of Madison Square Garden to provide networking infrastructure and connected solutions that support more scalable, technology‑driven fan experiences.

- This collaboration highlights how MSG Entertainment is seeking to deepen high-margin sponsorship relationships while upgrading venue technology that could reinforce its premium in-person entertainment positioning.

- Next, we’ll examine how this expanded Cisco technology partnership fits into MSG Entertainment’s sponsorship-led growth narrative and venue enhancement plans.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Madison Square Garden Entertainment Investment Narrative Recap

To own MSG Entertainment, you have to believe in the durability of premium, in‑person experiences at its flagship venues and the company’s ability to convert that demand into higher-margin sponsorship and hospitality revenue, despite earnings volatility and high leverage. The expanded Cisco partnership fits neatly into that story by reinforcing technology‑led, sponsorship-rich fan experiences, but it does not materially change the near term reliance on strong event calendars or the risk from any slowdown in discretionary spending.

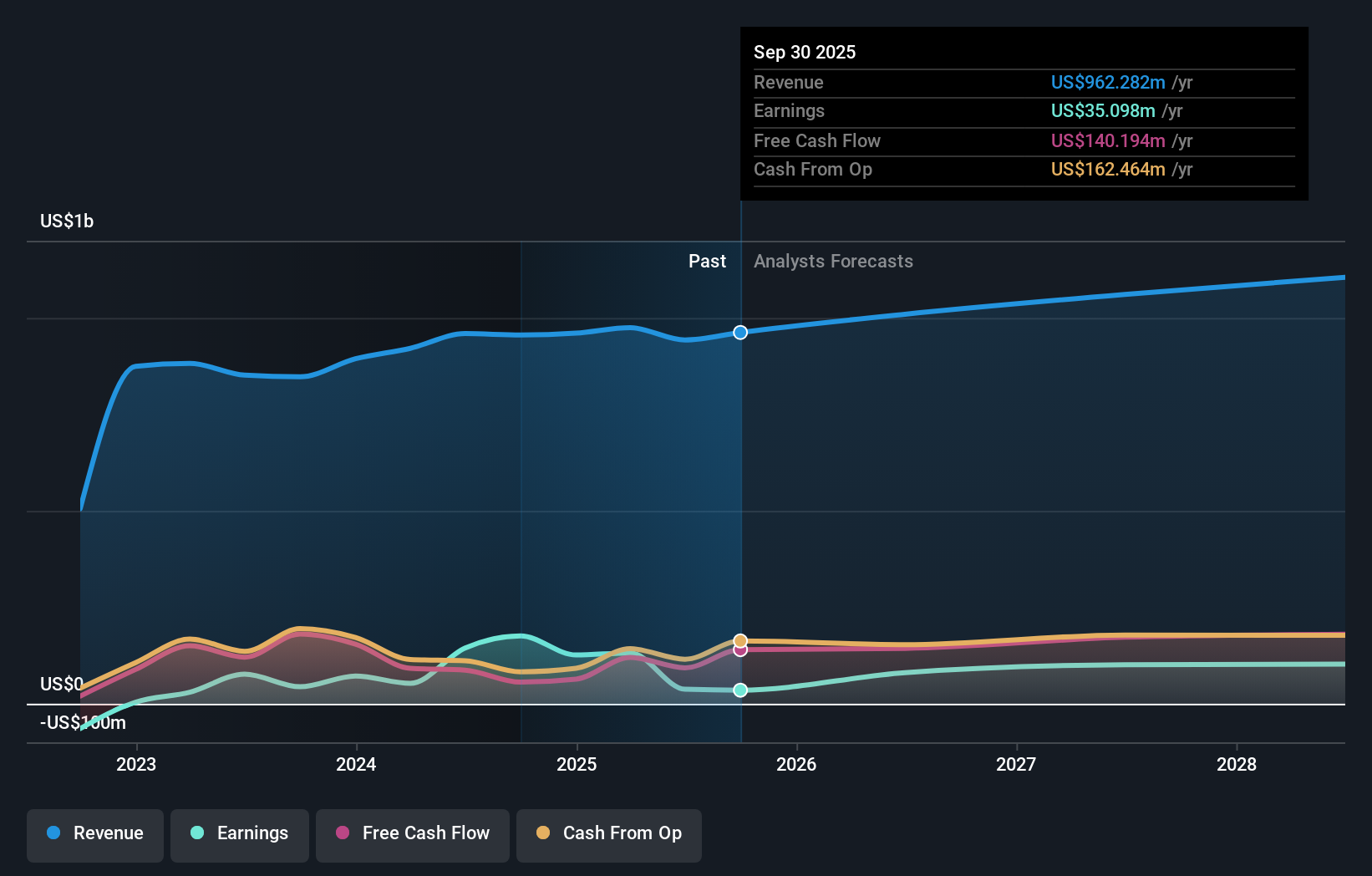

Recent earnings highlight this tension: in Q1 FY2026, revenue grew year on year to US$158.26 million, yet the company still posted a net loss of US$21.65 million, reflecting the sensitivity of profits to event mix and cost levels. Against that backdrop, the Cisco deal looks most relevant to the existing catalyst around building higher-margin sponsorship and partnership income, potentially helping MSG Entertainment lean more on corporate relationships to smooth out some of the lumpiness that comes with marquee shows and residencies.

However, while the Cisco partnership may support fan experience and sponsorship goals, investors should be aware of the company’s heavy concentration in a small number of core venues and what that means if...

Read the full narrative on Madison Square Garden Entertainment (it's free!)

Madison Square Garden Entertainment's narrative projects $1.1 billion revenue and $131.3 million earnings by 2028. This requires 5.5% yearly revenue growth and about a $93.9 million earnings increase from $37.4 million today.

Uncover how Madison Square Garden Entertainment's forecasts yield a $51.50 fair value, in line with its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member has submitted a fair value estimate, clustering tightly at about US$48.81 per share. Readers should weigh this single viewpoint against the company’s concentrated venue exposure and consider how different event and sponsorship outcomes could affect MSG Entertainment’s longer term earnings profile.

Explore another fair value estimate on Madison Square Garden Entertainment - why the stock might be worth 6% less than the current price!

Build Your Own Madison Square Garden Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Madison Square Garden Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madison Square Garden Entertainment's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal