Applied Industrial Technologies (AIT): Exploring Valuation After Recent Sideways Share Price Action

Recent trading action and performance context

Applied Industrial Technologies (AIT) has been drifting slightly lower this week, with the stock easing around 0.4% over the past day and week, while remaining essentially flat over the past month.

See our latest analysis for Applied Industrial Technologies.

Stepping back from the latest dip, the stock still carries a solid year to date share price return of just over 8%, while its three year total shareholder return above 100% shows the longer term momentum story remains very much intact, even if more recently sentiment has cooled a touch.

If AIT has you thinking about where else industrial strength growth might be hiding, now is a good time to scan for fast growing stocks with high insider ownership.

With earnings still growing solidly but the share price treading water this year, is Applied Industrial Technologies quietly slipping into undervalued territory, or is the market already factoring in the next leg of its expansion?

Most Popular Narrative Narrative: 15% Undervalued

With Applied Industrial Technologies last closing at $257.91 versus a narrative fair value near $303, the valuation debate centers on whether earnings power can keep compounding.

The accelerating build out of data center, semiconductor, and advanced manufacturing infrastructure is increasing demand for industrial automation, robotics, and flow control solutions, positioning Applied Industrial Technologies to capture higher margin sales and expand its addressable market, supporting long term revenue and margin growth.

Want to see what happens when modest looking growth meets richer margins and a higher future earnings multiple than the industry standard? The narrative hinges on a carefully layered mix of steady revenue expansion, profit improvement, and shrinking share count that together aim to justify a premium price tag. Curious how those moving parts stack up over the next few years to close the gap to fair value?

Result: Fair Value of $303.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in legacy industrial markets and overreliance on acquisitions could easily cap growth and challenge the case for a higher valuation.

Find out about the key risks to this Applied Industrial Technologies narrative.

Another Angle on Valuation

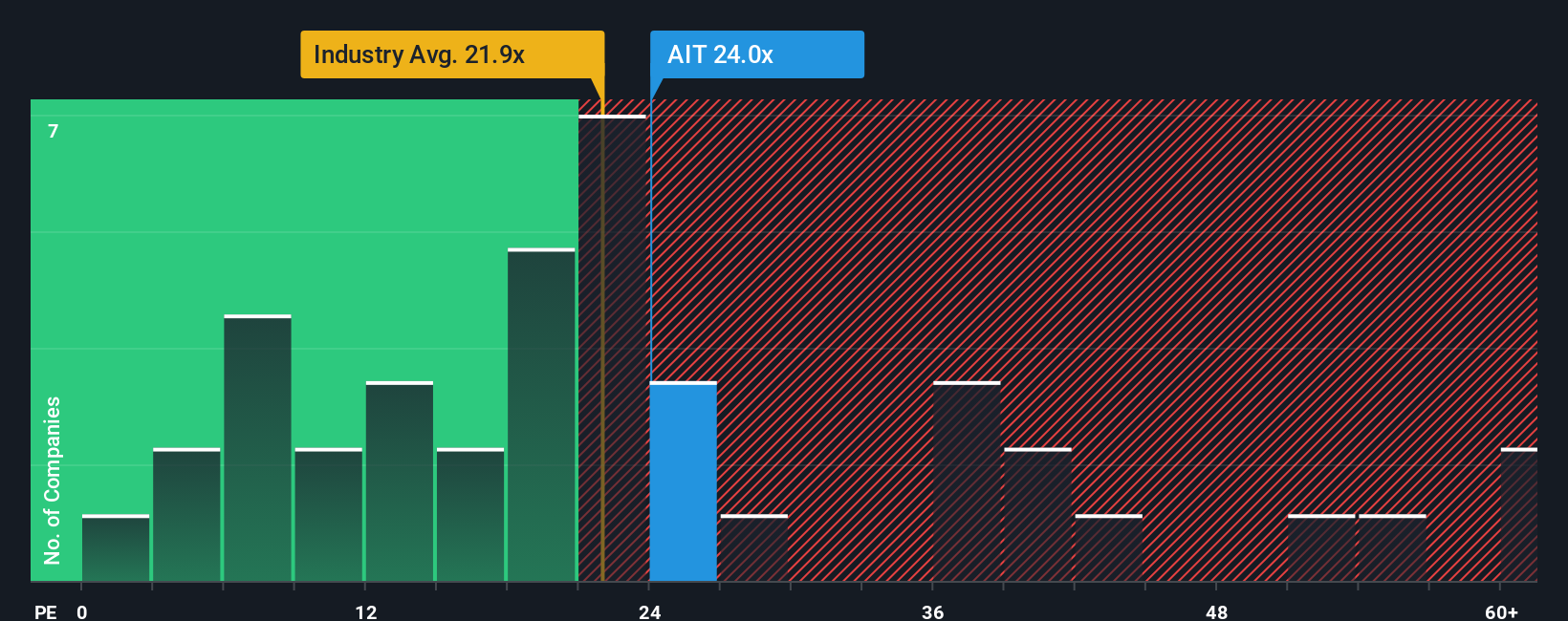

While the narrative view suggests Applied Industrial Technologies is about 15% undervalued, our earnings based comparison paints a tougher picture. AIT trades on roughly 24 times earnings versus a fair ratio near 22 times and about 20 times for both its industry and peers, implying investors are already paying up for quality. Is that premium really as safe as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Industrial Technologies Narrative

If this view does not quite match your own or you prefer to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Applied Industrial Technologies.

Ready for more high conviction ideas?

Before you move on, lock in your next watchlist candidates with targeted screens that surface quality, momentum, and value opportunities you might otherwise miss.

- Target fast moving opportunities with solid financial footing by scanning these 3576 penny stocks with strong financials that are already proving themselves in the numbers.

- Review these 26 AI penny stocks positioned at the intersection of artificial intelligence and scalable business models.

- Evaluate these 15 dividend stocks with yields > 3% as potential candidates for long term core holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal