Kulicke and Soffa (KLIC) Valuation After Earnings Beat and Dividend Affirmation

Kulicke and Soffa Industries (KLIC) just followed up its stronger than expected fiscal fourth quarter with another shareholder friendly move by affirming a quarterly dividend of $0.205 per share alongside the recent earnings surprise.

See our latest analysis for Kulicke and Soffa Industries.

The market seems to be warming back up to Kulicke and Soffa, with a roughly 22.8% 1 month share price return and a 26.9% 3 month share price return supporting the recent earnings surprise. Even so, the 1 year total shareholder return of 2.7% still looks muted and suggests momentum is only just rebuilding.

If Kulicke and Soffa’s rebound has your attention, this could be a good moment to scan other high potential chip names using high growth tech and AI stocks.

With earnings rebounding, a fresh dividend affirmation, and the share price already sprinting ahead of many analyst targets, investors now face a key question: is Kulicke and Soffa still mispriced, or is the market already baking in its next leg of growth?

Price-to-Sales of 3.9x: Is it justified?

Kulicke and Soffa trades at a 3.9x price to sales multiple, which screens as expensive versus peers and still modestly rich against the wider US semiconductor group.

The price to sales ratio compares a company’s market value to its revenue, a common yardstick for capital equipment names where earnings can swing through cycles.

For Kulicke and Soffa, a 3.9x multiple signals that investors are already paying a premium for each dollar of current sales, even as earnings only recently turned positive again and return on equity remains low. That premium looks stretched when stacked against an estimated fair price to sales level of 3.2x, a zone the market could gravitate toward if growth expectations cool.

Relative to the broader US semiconductor industry average of about 5.5x, Kulicke and Soffa still looks cheaper, but the stock is clearly priced richer than its closer peer set on revenue, suggesting the market may be assigning it a higher quality or recovery story than the numbers alone justify.

Explore the SWS fair ratio for Kulicke and Soffa Industries

Result: Price-to-Sales of 3.9x (OVERVALUED)

However, softer than expected capital spending or a slowdown in advanced packaging demand could quickly compress Kulicke and Soffa’s premium revenue multiple.

Find out about the key risks to this Kulicke and Soffa Industries narrative.

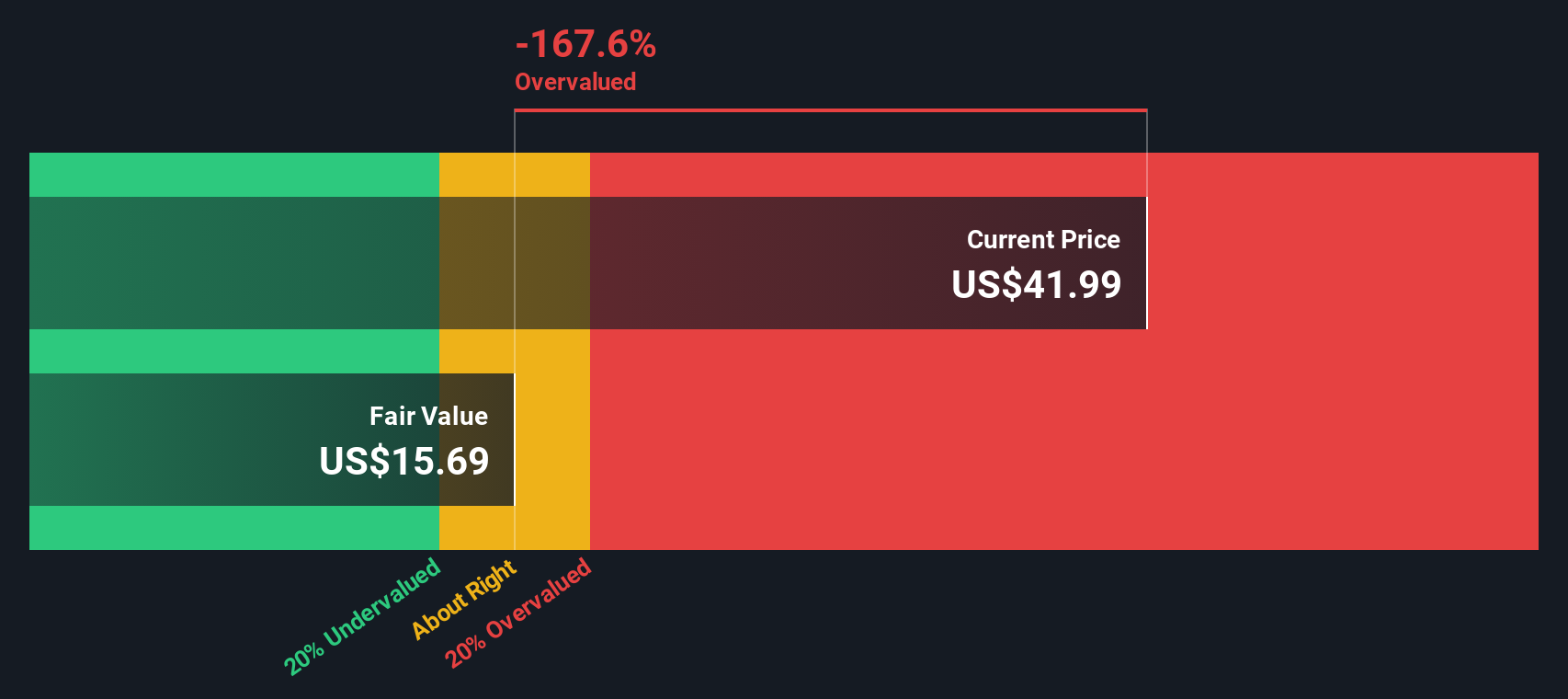

Another View: Our DCF Signals a Very Different Story

While the 3.9x price to sales ratio only looks mildly stretched, our DCF model paints a starker picture, suggesting Kulicke and Soffa is trading well above its fair value of roughly $13.84. If the cash flow outlook proves closer to this view, how much multiple risk are investors really carrying?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kulicke and Soffa Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kulicke and Soffa Industries Narrative

If you see the numbers differently or want to dig into the drivers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next potential opportunity by scanning targeted stock ideas across themes, sectors, and income profiles using the Simply Wall St Screener.

- Capture early-stage potential with these 3576 penny stocks with strong financials that already back their stories with strengthening financials and room for re-rating.

- Explore the next wave of intelligent automation by targeting these 26 AI penny stocks powering advancements across software, hardware, and data infrastructure.

- Identify value opportunities using these 906 undervalued stocks based on cash flows where robust cash flows and compressed valuations may help support attractive long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal