Is W. R. Berkley’s (WRB) Extra US$1 Dividend Clarifying Its Long-Term Capital Allocation Priorities?

- W. R. Berkley Corporation recently declared a regular quarterly cash dividend of US$0.09 per share and a special cash dividend of US$1.00 per share, both paid on December 29, 2025, to shareholders of record as of December 15, 2025.

- Together with a US$0.50 special dividend paid in June, these payouts highlight the insurer’s strong capital position and its willingness to return excess cash to investors while Mitsui Sumitomo builds a 12.5% ownership stake aligned with the Berkley family.

- We’ll now examine how this extra US$1.00 per-share special dividend affects W. R. Berkley’s investment narrative and capital allocation story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

W. R. Berkley Investment Narrative Recap

To own W. R. Berkley, you need to believe in its ability to sustain disciplined underwriting in specialty insurance while managing capital prudently. The latest US$1.00 per-share special dividend reinforces that capital strength but does not materially change the key near term catalyst, which remains operating performance in competitive property and reinsurance lines, or the biggest risk, that pricing discipline in those markets weakens and erodes margins.

The most relevant recent development here is Mitsui Sumitomo Insurance’s move to a 12.5% ownership stake aligned with the Berkley family’s voting. While separate from the dividend news, this new long term shareholder backdrop sits alongside W. R. Berkley’s pattern of meaningful special dividends and could shape how the company balances reinvestment against future cash returns as underwriting conditions evolve.

But while extra dividends are welcome, investors should still be alert to the risk that rising competition in property and reinsurance could...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley’s narrative projects $14.3 billion revenue and $2.0 billion earnings by 2028. This reflects flat (0.0% annually) revenue growth and an earnings increase of about $0.2 billion from $1.8 billion today.

Uncover how W. R. Berkley's forecasts yield a $74.20 fair value, a 11% upside to its current price.

Exploring Other Perspectives

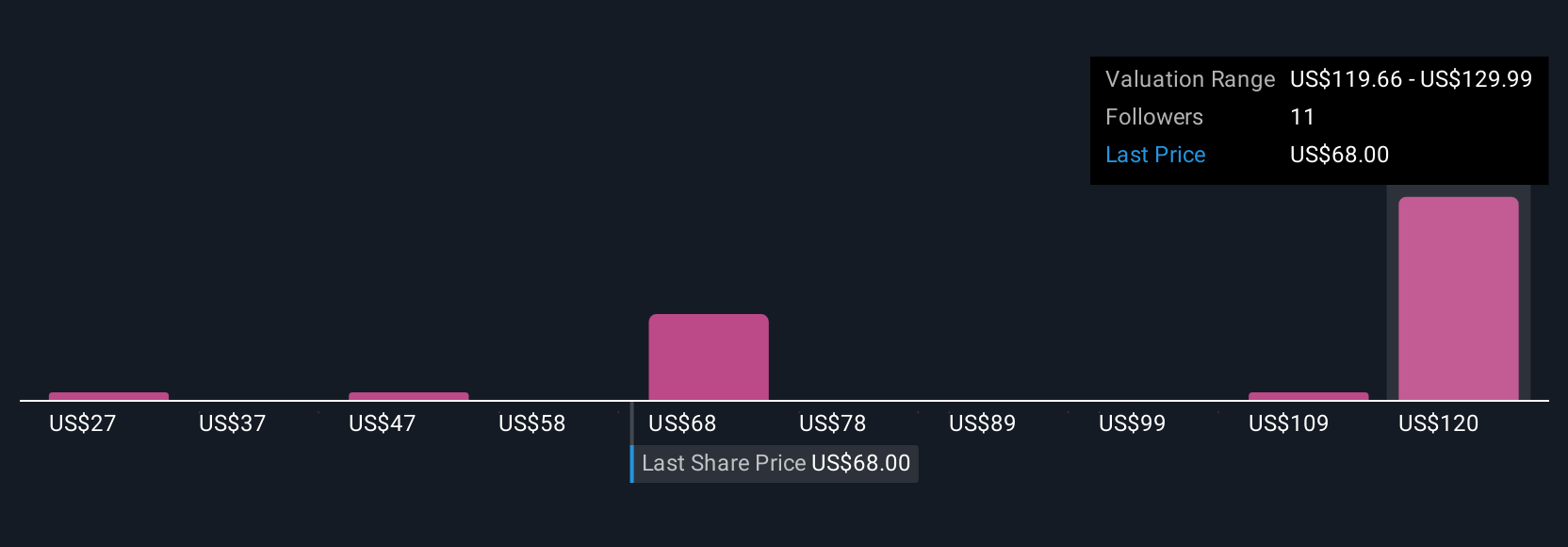

Four members of the Simply Wall St Community now value W. R. Berkley between US$26.69 and US$118.54 per share, underscoring how far opinions can stretch. When you weigh those views against the risk of weakening pricing discipline in property and reinsurance, it becomes even more important to compare several perspectives before forming your own expectations for the business.

Explore 4 other fair value estimates on W. R. Berkley - why the stock might be worth less than half the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal