Assessing Agnico Eagle Mines (NYSE:AEM) Valuation After Record Profits, Strong Cash Flows and Growth Project Progress

Agnico Eagle Mines (NYSE:AEM) is back in the spotlight as investors digest record profits, hefty free cash flow, and a net cash balance sheet, all while management reiterates steady gold output through 2027.

See our latest analysis for Agnico Eagle Mines.

The stock’s recent cooling, with a 1 day share price return of minus 1.52 percent and 7 day share price return of minus 3.21 percent to 168.83 dollars, comes after a powerful year to date share price return of 105.92 percent and a standout three year total shareholder return of 255.25 percent. This suggests momentum is pausing rather than breaking as management showcases its growth story across high profile mining conferences.

If Agnico’s surge has you rethinking your exposure to resource names, it could be worth broadening your watchlist and exploring fast growing stocks with high insider ownership.

With shares already more than doubling this year and trading below, but not far from, analyst targets, the key question now is whether Agnico Eagle still offers mispriced upside or if the market is already factoring in its next growth leg.

Most Popular Narrative Narrative: 13.1% Undervalued

With Agnico Eagle last closing at 168.83 dollars against a narrative fair value near 194 dollars, the story leans toward upside still being on the table.

Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth; this supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.

Curious how steady but unspectacular growth assumptions can still justify a premium style earnings multiple and higher fair value than today’s price? The narrative leans heavily on margin resilience and multi asset expansion, but the real twist is how future profits are capitalized. Want to see the specific revenue, earnings, and valuation bridge that underpins this upside case?

Result: Fair Value of $194.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view hinges on gold remaining elevated and major projects staying on budget, with weaker prices or cost overruns quickly eroding today’s optimism.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another View on Valuation

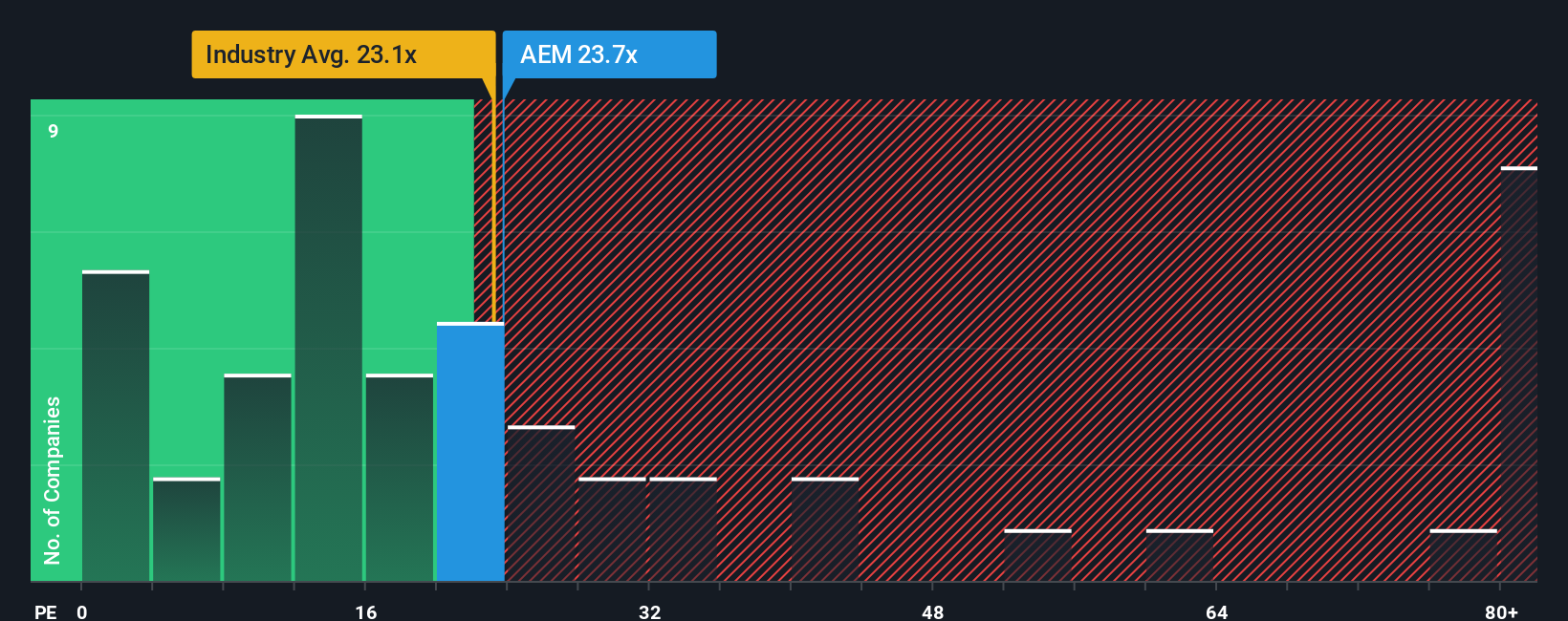

While the narrative fair value points to upside, Simply Wall St’s valuation using a single price to earnings yardstick is more cautious. AEM trades at 24.6 times earnings, richer than the US Metals and Mining industry at 22.2 times and its 23.9 times fair ratio, implying limited margin of safety if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agnico Eagle Mines Narrative

If this perspective does not quite match your own, or you prefer to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you can use the Simply Wall St Screener to uncover fresh opportunities that many investors may be overlooking.

- Target potential income by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio with regular cash returns.

- Explore long term growth potential through these 26 AI penny stocks at the forefront of artificial intelligence innovation.

- Look for possible market mispricing by scanning these 906 undervalued stocks based on cash flows that may offer attractive value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal