OneStream (OS): Assessing Valuation After Strategic Leadership Changes and AI-Focused Growth Plans

OneStream (OS) just reshuffled its C suite, elevating AI leader Scott Leshinski to president, promoting Pamela McIntyre to chief accounting officer, and outlining a CFO handoff to board veteran John Kinzer.

See our latest analysis for OneStream.

The leadership reshuffle comes after a tough stretch in the market, with a year to date share price return of minus 35.03 percent and a one year total shareholder return of minus 40.18 percent, suggesting sentiment has cooled even as management leans into its AI centric growth story.

If this kind of AI focused pivot has your attention, it could be a good time to explore other high growth tech names using our screener for high growth tech and AI stocks.

With revenue still growing double digits but shares now trading at a steep discount to analyst targets, is OneStream an underappreciated AI platform in transition, or is the market already correctly pricing in its next growth phase?

Most Popular Narrative Narrative: 35% Undervalued

With OneStream last closing at $18.36 against a narrative fair value near the high twenties, the valuation debate now turns on aggressive growth and margin shift assumptions.

Investment in AI-powered features like SensibleAI Forecast, Studio, and Agents is yielding meaningful early traction (60%+ YoY AI bookings growth), speeding time to value for clients, and driving up-sell opportunities within the existing install base, supporting future top-line growth, improved gross margins, and potentially higher net income as scale is achieved.

Curious how sustained double digit revenue growth, rising margins and a premium earnings multiple could still point to upside from here? Unpack the full valuation playbook.

Result: Fair Value of $28.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened public sector budget uncertainty and heavy AI investment needs could delay profitability, which may challenge the bullish rebound and sale speculation embedded in this narrative.

Find out about the key risks to this OneStream narrative.

Another Lens on Valuation

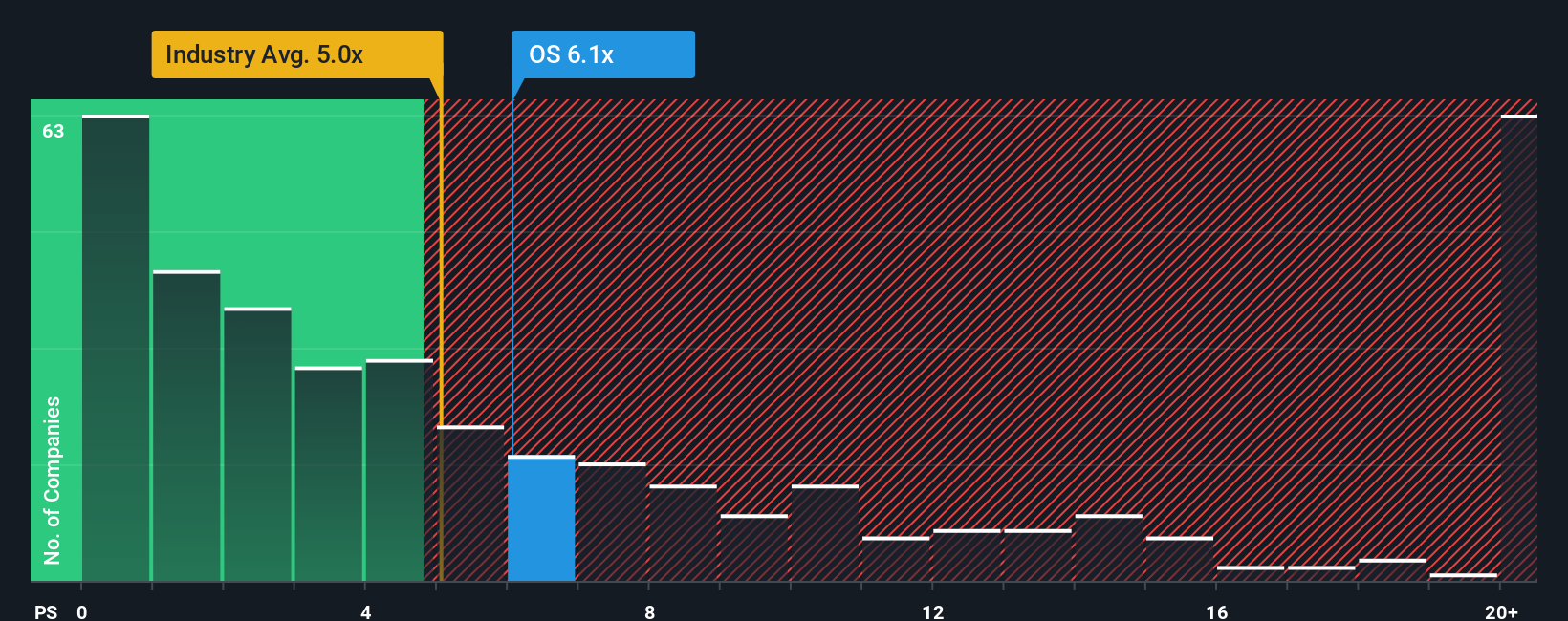

Multiples paint a tighter picture. At around 6 times sales, OneStream screens more expensive than the US software average near 5 times, yet only slightly cheaper than peers at about 6.2 times and above a fair ratio closer to 5.4 times, which hints at limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneStream Narrative

If you see the story differently and want to dive into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your OneStream research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with OneStream. Lock in your next move by using the Simply Wall St screener to uncover fresh, data driven opportunities before others notice.

- Identify potential multi baggers early by scanning these 3576 penny stocks with strong financials, where smaller names show robust balance sheets and real traction, not just hype.

- Explore the automation theme by searching through these 26 AI penny stocks, built around real-world AI adoption and accelerating revenue growth.

- Look for potential bargains with resilient cash flows using these 906 undervalued stocks based on cash flows, focusing on companies that already look cheap on a discounted cash flow basis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal