Can SolarEdge (SEDG) Turn European Storage Momentum Into an Offset for U.S. Policy Risk?

- Recently, SolarEdge Technologies reported the successful installation of its CSS-OD storage system in Germany, supported by over 150 orders totaling 15 MWh, while investors reacted to the planned expiration of U.S. residential clean energy tax credits at the end of 2025 under the One Big Beautiful Bill Act.

- This combination highlights how policy uncertainty in SolarEdge’s largest market contrasts with early traction for its commercial and industrial storage solutions in Europe.

- Next, we’ll examine how concerns over expiring U.S. residential tax credits could reshape SolarEdge’s investment narrative and growth mix.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

SolarEdge Technologies Investment Narrative Recap

To own SolarEdge today, you need to believe it can transition from a pressured U.S. residential market into a broader solar and storage platform, while returning to profitability. The latest selloff on tax credit fears sharpens the biggest near term risk: a potential demand air pocket in its core U.S. residential business. At the same time, that news does not materially change the key catalyst, which is whether new products and geographies can offset U.S. policy uncertainty.

The early momentum of SolarEdge’s CSS-OD commercial storage rollout in Germany, with over 150 orders totaling 15 MWh, is one of the most relevant announcements here. It illustrates how the company is already leaning into C&I and European storage demand as an alternative growth pillar while U.S. residential incentives are under debate, making execution in these newer segments an increasingly important part of the story.

Yet while Europe shows promise, investors should be aware that expiring U.S. residential tax credits could still...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' narrative projects $1.6 billion revenue and $11.8 million earnings by 2028. This requires 20.6% yearly revenue growth and an earnings increase of about $1.7 billion from current earnings of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $33.22 fair value, a 13% upside to its current price.

Exploring Other Perspectives

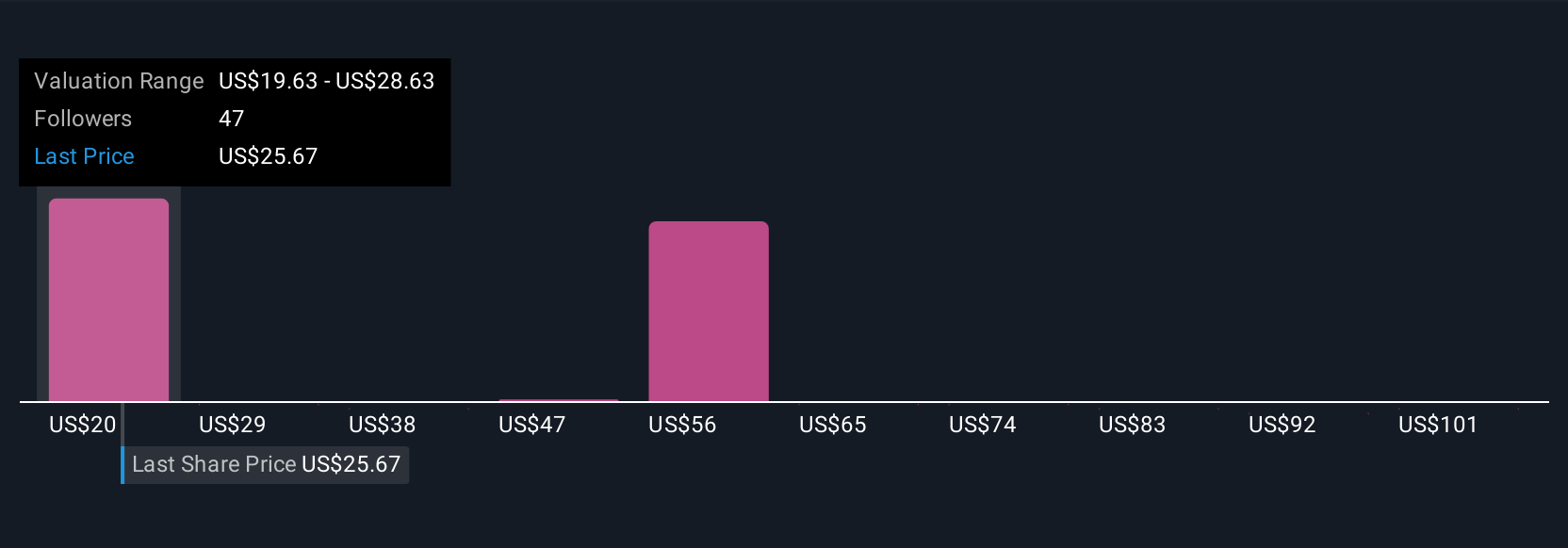

Sixteen fair value estimates from the Simply Wall St Community span about US$33 to over US$90 per share, showing just how far opinions can stretch. You are weighing these views against the risk that U.S. residential tax credits lapse in 2025, which could materially influence SolarEdge’s earnings path and the balance between its U.S. and European businesses.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth just $33.22!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal