Taking Stock of Telephone and Data Systems’ Valuation After Q3 Profit Return and New $500 Million Buyback

Telephone and Data Systems (TDS) is back in the black after a $40 million third quarter profit, powered by asset sales and fiber expansion, along with a new $500 million share repurchase plan.

See our latest analysis for Telephone and Data Systems.

Investors have taken notice, with the latest share price at $39.40 and a solid year to date share price return of 14.27%, while the three year total shareholder return of 334.59% signals strong, longer term momentum despite recent position trimming by Silver Point Capital.

If this shift in sentiment has you rethinking your playbook, it could be a good moment to see how other telecoms and infrastructure names stack up against broader markets using fast growing stocks with high insider ownership.

With profitability returning, a hefty buyback in place, and shares still trading below analyst targets, should investors treat TDS as an undervalued turnaround story or assume the market is already baking in its fiber driven growth?

Most Popular Narrative Narrative: 19% Undervalued

With Telephone and Data Systems last closing at $39.40 versus a narrative fair value near $48.67, the story hinges on how its transformation plays out.

The divestiture of UScellular and major spectrum assets has substantially deleveraged TDS's balance sheet, freeing up capital for aggressive expansion in fiber infrastructure and providing flexibility for opportunistic M&A, both of which are positioned to drive long-term revenue and earnings growth as broadband demand intensifies.

Want to see why shrinking revenue projections still line up with richer profits and a higher future earnings multiple than today? Unlock the full narrative math behind that disconnect, including the margin reset, growth path, and discount rate that support this fair value call.

Result: Fair Value of $48.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in the wireless divestiture or slower than expected fiber uptake could pressure margins and delay the anticipated re rating in TDS shares.

Find out about the key risks to this Telephone and Data Systems narrative.

Another View: Rich on Earnings Today

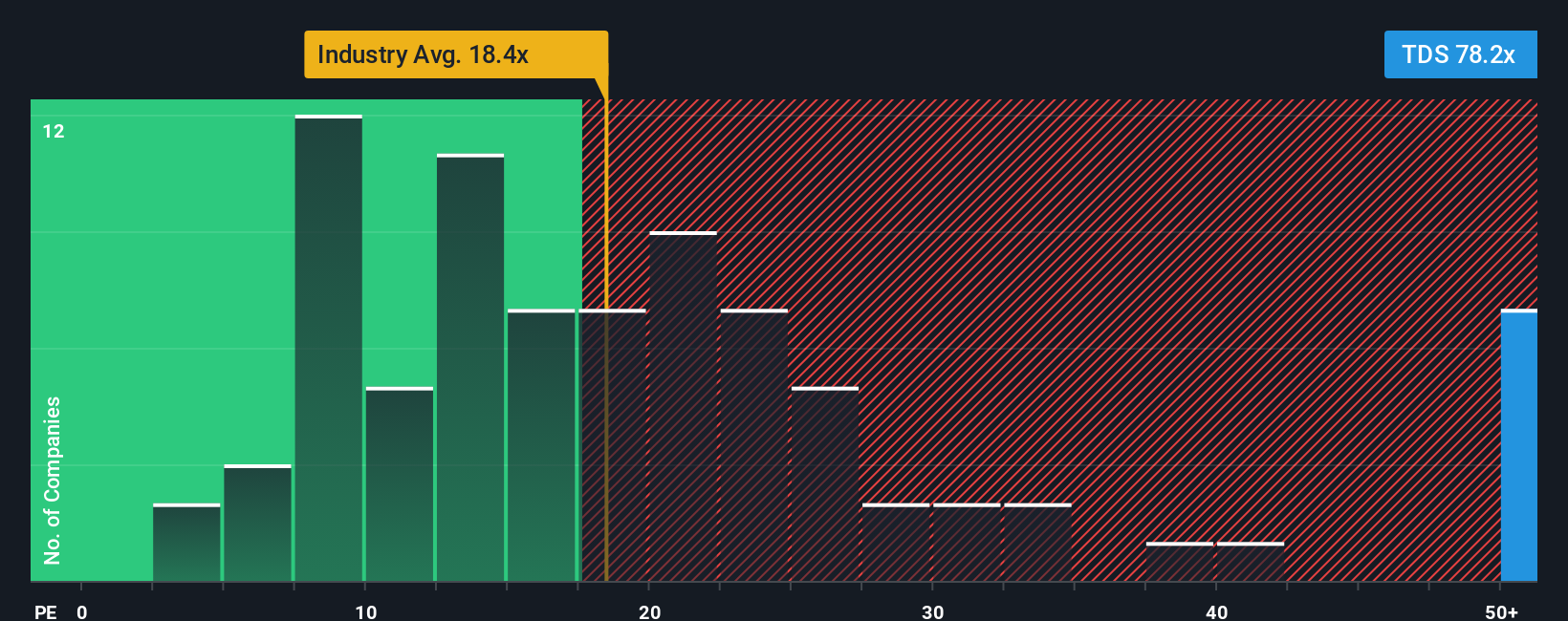

While the narrative fair value suggests upside, the earnings based lens points the other way. TDS trades on a price to earnings ratio of about 80.8 times, far above the global wireless telecom average of 17.6 times and its own fair ratio of 37.4 times. This signals meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telephone and Data Systems Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in just a few minutes: Do it your way.

A great starting point for your Telephone and Data Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity, use the Simply Wall Street Screener to uncover fresh stocks tailored to your style before the market moves without you.

- Capture mispriced quality by scanning these 906 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations.

- Supercharge your growth hunt by targeting innovation focused names through these 26 AI penny stocks at the forefront of artificial intelligence.

- Strengthen your income strategy by pinpointing reliable payers using these 15 dividend stocks with yields > 3% that can help support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal