Assessing Alignment Healthcare (ALHC)’s Valuation After Its Profitability Progress and Customer Growth Surge

Alignment Healthcare (ALHC) is drawing fresh attention after a clear financial inflection point, with customer growth accelerating and earnings swinging toward sustained profitability, a combination that often leads investors to revisit their expectations.

See our latest analysis for Alignment Healthcare.

The improving fundamentals seem to be feeding straight into sentiment, with a roughly 69 percent year to date share price return and a 72 percent total shareholder return over the past year signaling that momentum is clearly building rather than fading.

If the shift in Alignment Healthcare has caught your eye, this could be a good moment to explore other potential winners across healthcare stocks that are starting to show similar traction.

With shares hovering just below analyst targets after a powerful rerating, the key question now is whether Alignment Healthcare still trades at a discount to its improving fundamentals or if the market has already priced in the next leg of growth.

Most Popular Narrative: 7.1% Undervalued

With Alignment Healthcare last closing at $19.55 against a narrative fair value of about $21.04, the valuation case leans toward upside if the growth path materialises.

Alignment's robust, technology-enabled care model and investments in administrative automation, workflow standardization, and digital health platforms position the company to significantly lower SG&A expenses and improve scalability, likely powering both margin expansion and earnings growth over the next several years.

Curious how aggressive revenue compounding, margin repair, and a premium future earnings multiple all fit together into one price target story? The answers sit inside the projections driving this fair value, including how fast profits may ramp and what kind of valuation multiple that assumes for a Medicare Advantage specialist.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on Medicare Advantage policy staying supportive. Tighter reimbursement or tougher benefit scrutiny could potentially slow growth and dent future margins.

Find out about the key risks to this Alignment Healthcare narrative.

Another View: Cash Flow Says Something Different

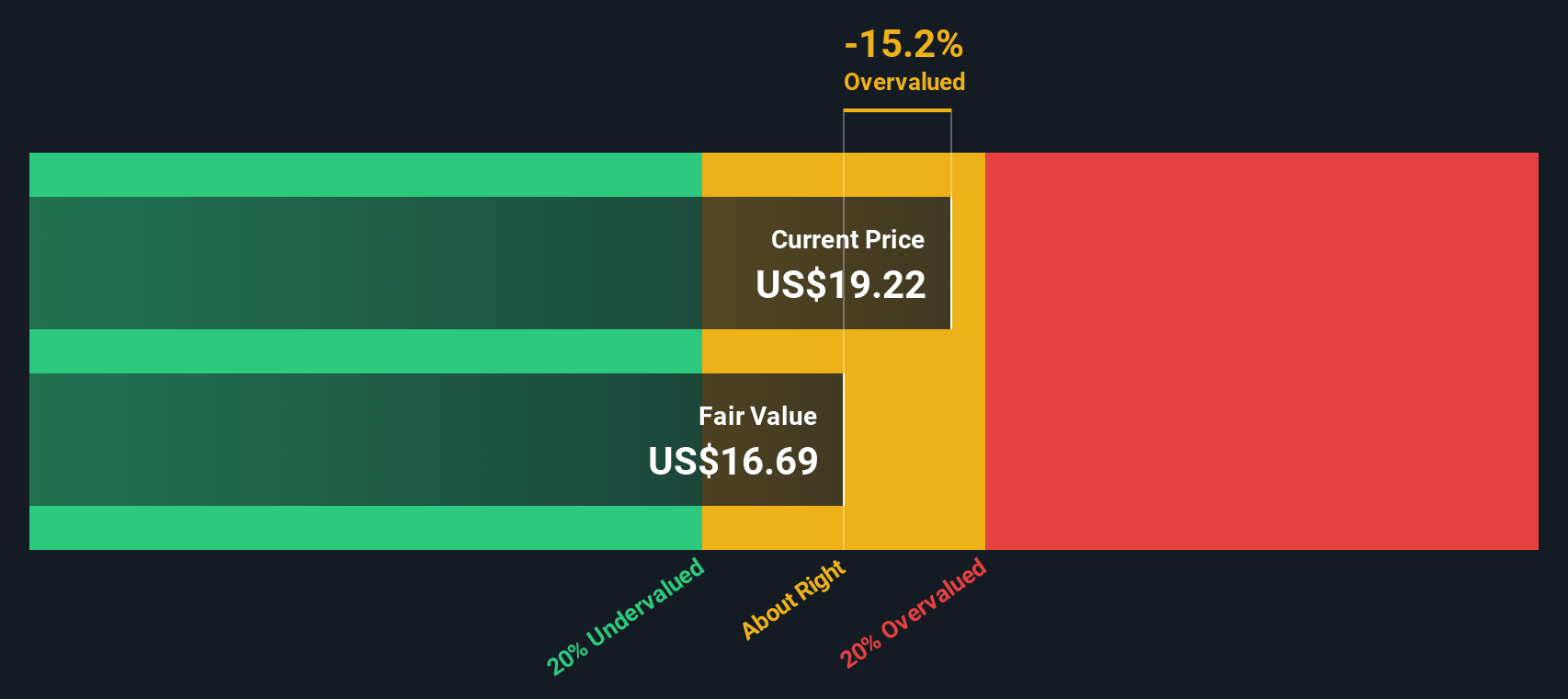

While the narrative fair value points to upside, our DCF model paints a cooler picture, with ALHC trading around $19.55 versus an estimated fair value near $16.69. This implies the shares may be overvalued on cash flow assumptions. Which storyline feels closer to how you see the business playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alignment Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alignment Healthcare Narrative

If you see the numbers differently or simply prefer hands on research, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your Alignment Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your momentum by scanning fresh ideas on Simply Wall Street, where curated stock shortlists can help you find your next opportunity.

- Target cash flow potential using these 906 undervalued stocks based on cash flows to screen for mispriced opportunities supported by stronger fundamentals than their share prices suggest.

- Explore innovation by reviewing these 26 AI penny stocks that may benefit from structural demand for artificial intelligence and automation.

- Support your income strategy with these 15 dividend stocks with yields > 3% that focus on payouts above 3 percent while considering balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal