Why fuboTV (FUBO) Is Down 6.2% After Another Revenue Drop And Rising Reliance On Hulu Deal

- In Q3 2025, fuboTV reported its second straight quarterly revenue decline, lower average revenue per user, and continued negative free cash flow, underscoring rising costs amid weakening advertising trends and modest subscriber growth.

- The company’s future now appears closely tied to the outcome of the Hulu + Live merger, raising questions about its influence and long-term position in a market increasingly shaped by larger streaming bundles.

- We’ll now examine how fuboTV’s deepening reliance on the Hulu + Live merger reshapes its investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

fuboTV Investment Narrative Recap

To own fuboTV today, you need to believe it can carve out a durable role in live sports streaming despite bigger bundle competitors. The latest quarter’s second straight revenue decline, falling ARPU and ongoing cash burn make the near term hinge on how much real scale and cost benefit the Hulu + Live merger delivers, while intensifying the key risk that fuboTV becomes a marginal player within a larger bundle ecosystem.

Against this backdrop, the closing of the Hulu + Live TV transaction and the new combined board may be the most important recent development to watch. It directly connects fuboTV’s content access, pricing power and ad inventory potential to decisions made in a much larger organization, which could either support its existing catalysts around sports-focused bundles and ad tech, or constrain them if priorities diverge.

Yet investors should also be aware that if cash burn persists and fuboTV’s influence within the merged entity remains limited, then...

Read the full narrative on fuboTV (it's free!)

fuboTV’s narrative projects $1.8 billion revenue and $200.4 million earnings by 2028. This requires 3.8% yearly revenue growth and about a $112.7 million earnings increase from $87.7 million today.

Uncover how fuboTV's forecasts yield a $4.50 fair value, a 58% upside to its current price.

Exploring Other Perspectives

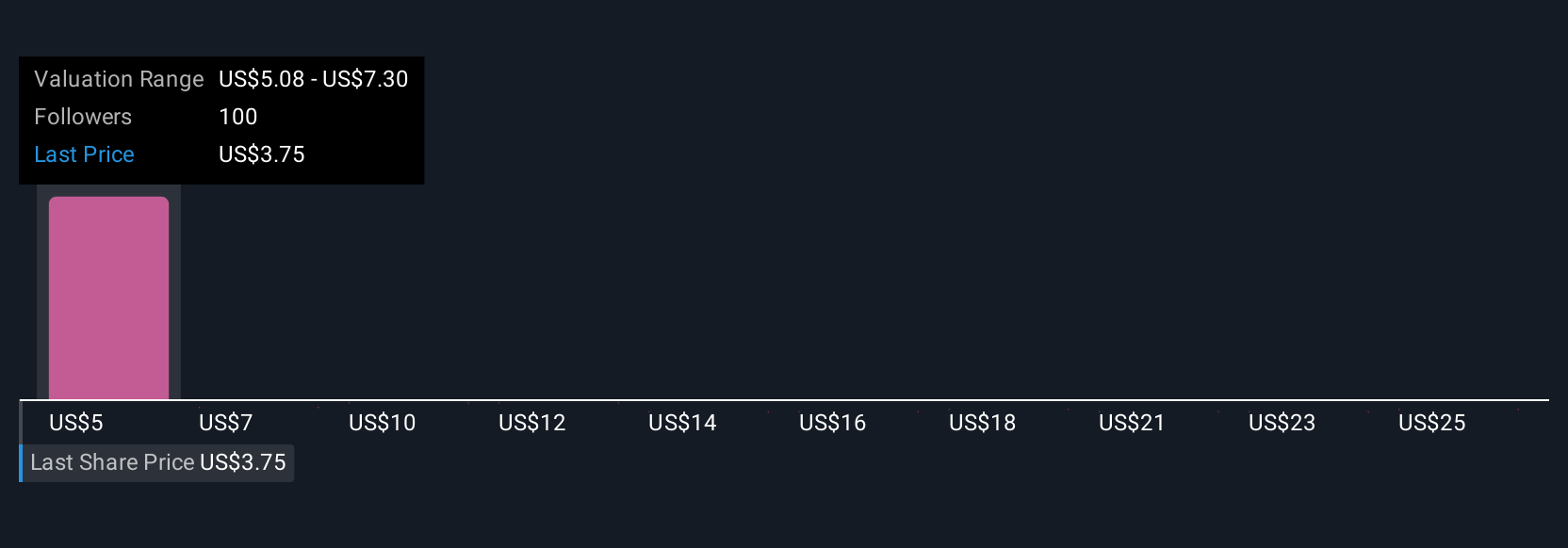

Eighteen fair value estimates from the Simply Wall St Community cluster between US$4.25 and US$18.62, highlighting how far apart individual views can be. As you weigh those opinions, remember that recent revenue declines, weaker ARPU and reliance on the Hulu + Live merger could all shape how sustainable any future improvement in fuboTV’s performance proves to be.

Explore 18 other fair value estimates on fuboTV - why the stock might be worth over 6x more than the current price!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal