Harrow (HROW): Reassessing Valuation After Vevye’s Tier 1 CVS Formulary Upgrade and Growth Outlook

Harrow (HROW) just scored a major commercial win, with its dry eye drug Vevye moving into the Tier 1 formulary slot at CVS, replacing Xiidra and sharply improving coverage and patient access.

See our latest analysis for Harrow.

The Vevye win comes after a strong run in the stock, with a 30 day share price return of 29.16 percent and a 5 year total shareholder return of 712.61 percent, suggesting momentum is still building.

If this kind of rerating in eyecare has your attention, it could be a good moment to explore other curated healthcare stocks ideas for your watchlist.

With the stock up sharply but still trading at a steep discount to analyst targets, the key question now is whether Harrow remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 35.2% Undervalued

Against a fair value estimate of about $70.63, Harrow’s last close at $45.75 implies the most popular narrative still sees meaningful upside ahead.

Operating leverage is set to improve meaningfully as Harrow's scalable commercial infrastructure, already built out and profitable, absorbs additional high margin revenue from both organic growth (e.g., expanded refill rates, market share gains) and new product launches, likely driving further net margin expansion.

Want to see what kind of growth engine could justify this gap, and how margins and earnings are modeled to reshape Harrow’s entire profit profile? Dive into the full story driving that fair value call.

Result: Fair Value of $70.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on Harrow avoiding slower than expected Vevye uptake and successfully executing its ambitious biosimilars and specialty launch roadmap.

Find out about the key risks to this Harrow narrative.

Another Take on Valuation

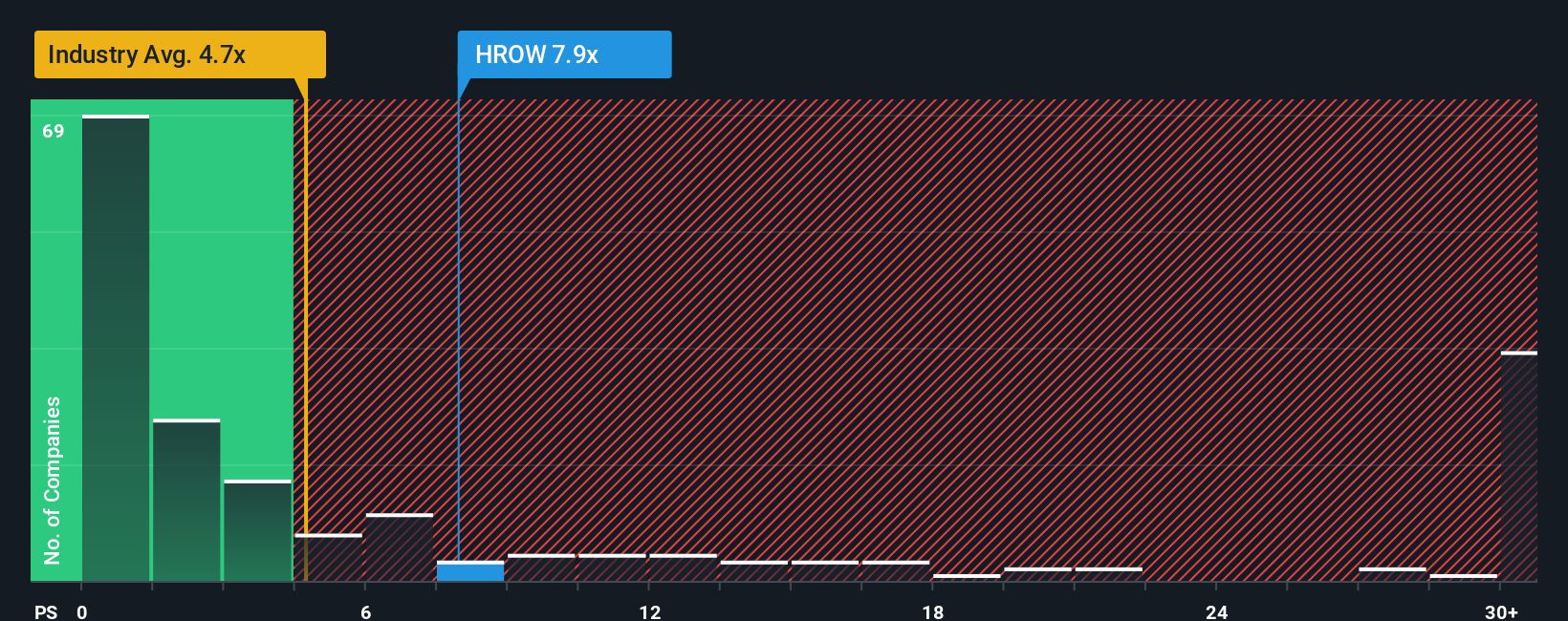

Valuation based on sales paints a more complicated picture. Harrow trades at 6.8 times sales, richer than both peers at 4.9 times and the wider US pharma group at 4 times, yet still below a 8.4 times fair ratio. Is the premium a warning sign or an emerging opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harrow Narrative

If you see the numbers differently or want to pressure test your own thesis from scratch, you can build a complete narrative in minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Harrow.

Looking for your next smart move?

Do not stop at a single stock when the Simply Wall Street Screener can help you quickly surface focused, high conviction ideas tailored to your strategy.

- Lock in income potential by checking companies offering reliable payouts through these 15 dividend stocks with yields > 3%. This can support a long term, cash generative portfolio.

- Ride structural growth by targeting innovators at the frontier of machine learning and automation with these 26 AI penny stocks before the crowd fully catches on.

- Strengthen your diversification and tap into the digital asset ecosystem via these 81 cryptocurrency and blockchain stocks before the next wave of adoption resets valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal