Assessing Resideo Technologies After 2025 Run Up and Recent Portfolio Transformation

- If you are trying to figure out whether Resideo Technologies is still a smart buy after its recent run, you are in the right place to unpack what the current price is really telling us.

- The stock trades around $33.81, and while it is up 48.4% year to date and 112.9% over three years, the last month’s slide of 17.7% after a 2.5% gain in the past week suggests sentiment is getting more nuanced.

- Recent headlines have focused on Resideo’s ongoing transformation of its smart home and security portfolio and continued portfolio streamlining, which are reshaping how investors think about its long term earnings power. At the same time, sector wide attention on building technologies and smart energy management has pulled more eyes onto names like Resideo, amplifying both optimism and scrutiny around the stock.

- On our framework, Resideo scores a 4/6 valuation check, suggesting the market may still be underestimating parts of the story. Next, we will break that down across different valuation methods, before finishing with a more powerful way to think about the company’s value altogether.

Approach 1: Resideo Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

For Resideo Technologies, the 2 Stage Free Cash Flow to Equity model starts from last twelve months free cash flow of about $1.35 billion (negative), reflecting a period of heavy investment or working capital swings. Analysts then expect cash flows to recover, with projections reaching about $394 million by 2027 and rising to roughly $598 million by 2035, with the later years extrapolated rather than based on direct analyst forecasts.

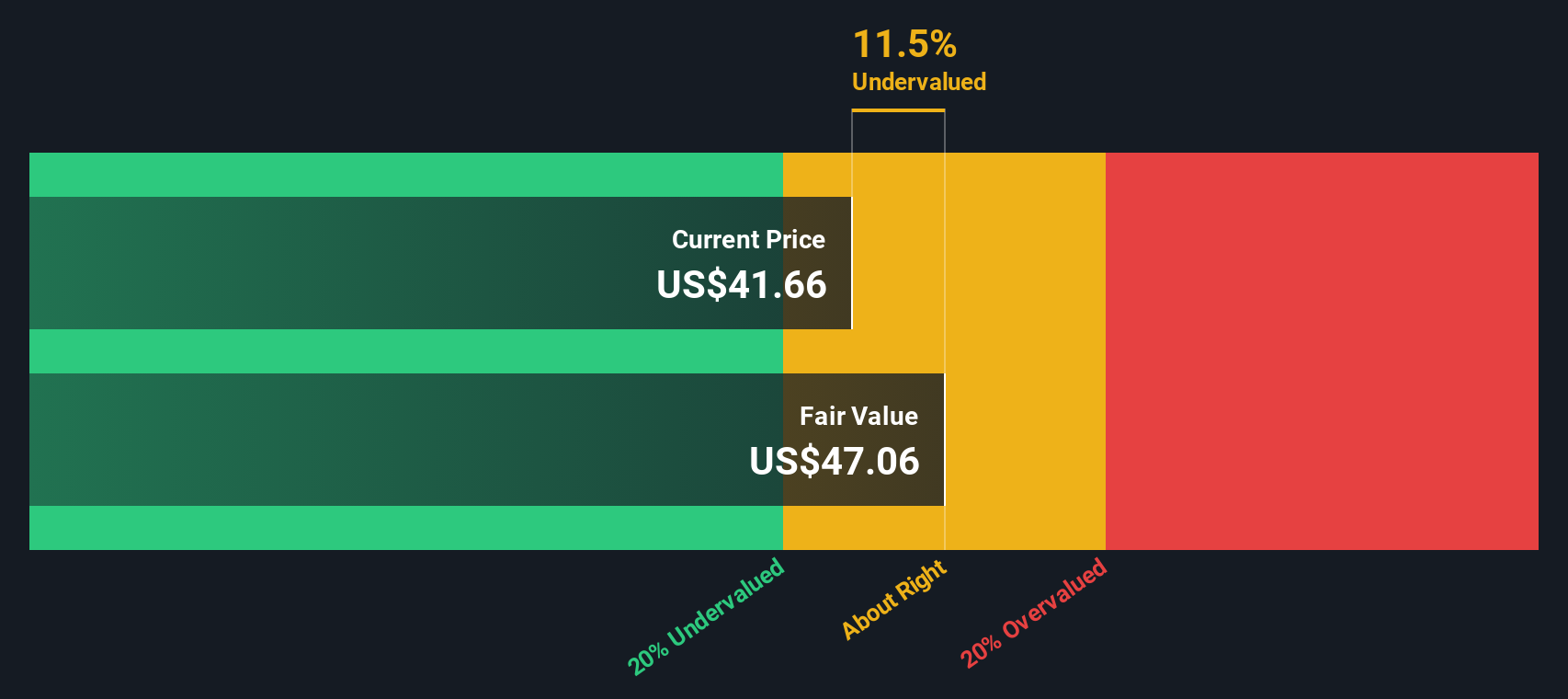

When all projected cash flows over the next decade and beyond are discounted back, the model indicates an intrinsic value of about $41.42 per share. Compared with the recent share price around $33.81, the DCF output suggests Resideo is valued about 18.4% below this estimate, indicating a potential gap between the market price and the modeled cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Resideo Technologies is undervalued by 18.4%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Resideo Technologies Price vs Sales

For companies where earnings are still normalizing, the price to sales ratio can be a cleaner way to value the business, because it focuses on revenue, which tends to be less volatile than profits during periods of investment or margin pressure.

In general, higher growth and lower risk justify a higher normal or fair multiple, while slower growth, thinner margins or greater uncertainty usually mean investors should demand a lower multiple to compensate. That is why comparing a stock’s multiple with a few simple benchmarks can be helpful, but not sufficient on its own.

Resideo currently trades on a price to sales ratio of about 0.68x, which is well below the Building industry average of roughly 1.66x and also below the peer group average of around 3.20x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what multiple a company should trade on, given its growth outlook, profit margins, risk profile, industry and market cap. For Resideo, this Fair Ratio is 1.55x, comfortably above the current 0.68x, which indicates the market is still pricing the stock at a discount to what its fundamentals would typically warrant.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

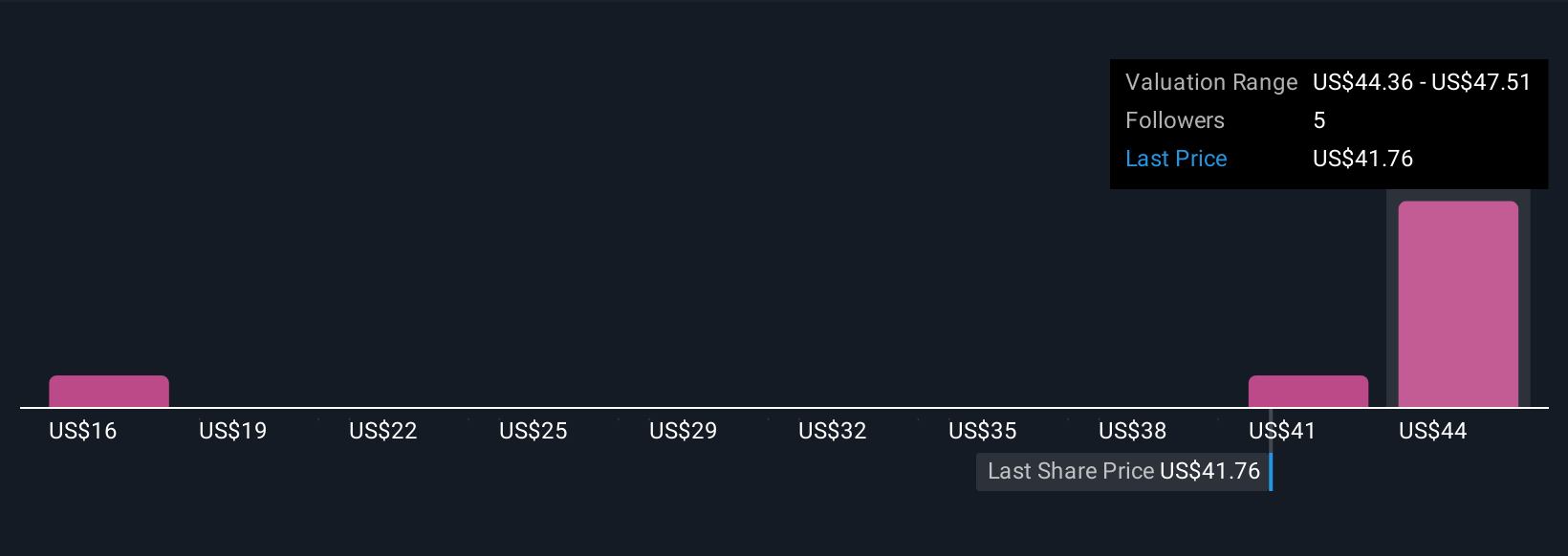

Upgrade Your Decision Making: Choose your Resideo Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which let you attach a clear story and set of assumptions about future revenue, earnings, margins and fair value to a company. You can then connect that story directly to a forecast and a fair value estimate that you can easily compare with today’s share price to help decide whether to buy, hold or sell, all inside Simply Wall St’s Community page where millions of investors share perspectives that automatically update as new news, earnings or guidance arrive. For Resideo Technologies, for example, one optimistic Narrative might assume its smart home pipeline, ADI spinoff and cash flows support a fair value close to $41.50 per share. A more cautious Narrative might focus on competition, reliance on legacy products and housing cyclicality to support a lower fair value closer to the low 30s. By seeing these side by side and updating them over time, you can quickly anchor your own view to the numbers and decide how to respond when the market price diverges from the fair value in the Narrative you find most reasonable.

Do you think there's more to the story for Resideo Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal