Investors Still Waiting For A Pull Back In Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (BMV:OMAB)

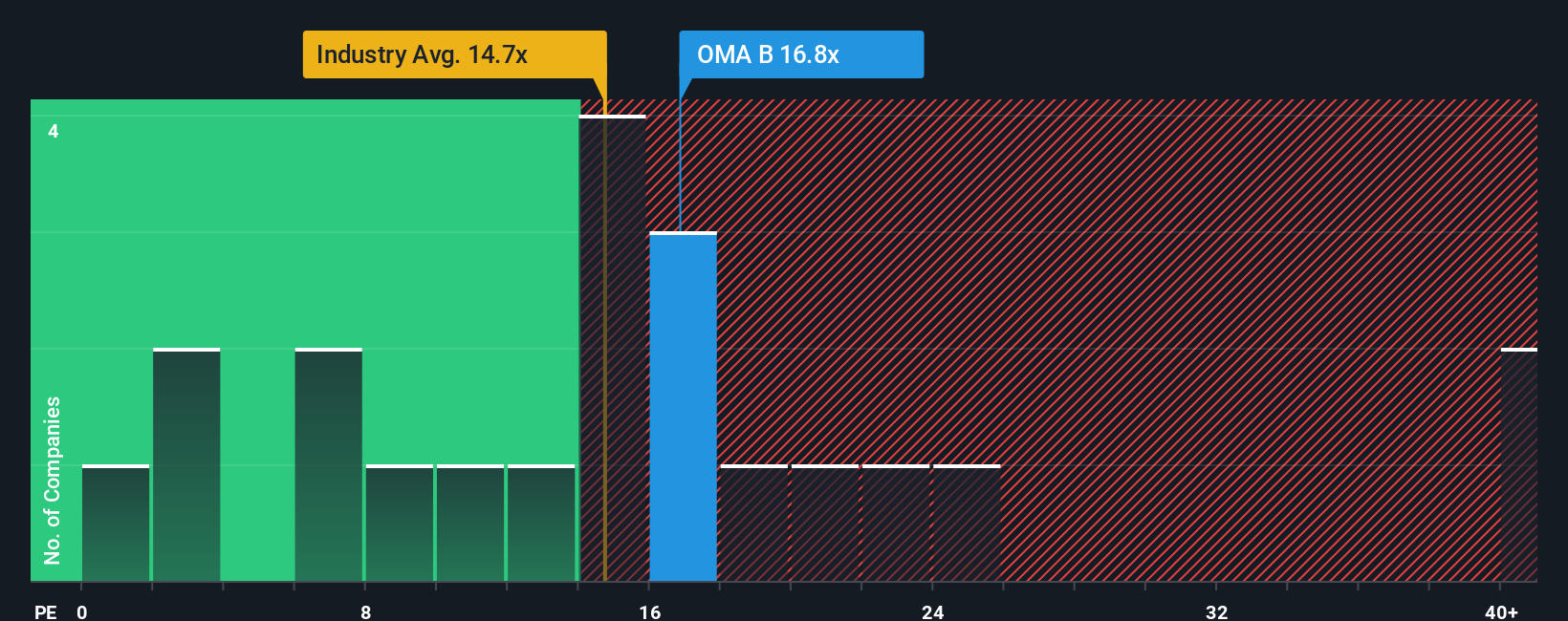

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V.'s (BMV:OMAB) price-to-earnings (or "P/E") ratio of 16.8x might make it look like a sell right now compared to the market in Mexico, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Grupo Aeroportuario del Centro Norte. de's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Grupo Aeroportuario del Centro Norte. de

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Grupo Aeroportuario del Centro Norte. de's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 6.4%. This was backed up an excellent period prior to see EPS up by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 18% per annum over the next three years. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader market.

In light of this, it's understandable that Grupo Aeroportuario del Centro Norte. de's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Grupo Aeroportuario del Centro Norte. de's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Grupo Aeroportuario del Centro Norte. de maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Grupo Aeroportuario del Centro Norte. de that we have uncovered.

If these risks are making you reconsider your opinion on Grupo Aeroportuario del Centro Norte. de, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal