Ashland (ASH): Reassessing Valuation After Major Investor Discloses 5.7% Stake and Fuels Bullish Sentiment

Ashland (ASH) just caught investors attention after a major investment firm disclosed a 5.7% stake, a clear vote of confidence that sent the stock sharply higher and ignited fresh debate around its outlook.

See our latest analysis for Ashland.

That stake disclosure lands on top of a surprisingly strong near term run, with a 7 day share price return of 10.76 percent and 30 day share price return of 15.47 percent, even though the year to date share price return and 1 year total shareholder return remain clearly negative. This suggests momentum is rebuilding after a tough stretch.

If this kind of turnaround story has your attention, you might also want to explore fast growing stocks with high insider ownership as another way to spot where confident shareholders are already leaning in.

With the shares still trading below analyst targets and at a hefty intrinsic value discount, yet facing weak long-term returns and recent earnings pressure, are investors being offered a genuine mispricing, or is the market already discounting a sharper earnings rebound ahead?

Most Popular Narrative: 7.3% Undervalued

Ashland's widely followed narrative pegs fair value modestly above the last close, framing today's discount as a bet on earnings recovery and margin repair.

Ongoing strategic cost reductions and manufacturing network optimization are set to deliver meaningful incremental savings ($55–60 million year over year expected in FY26), underpinning structurally higher EBITDA margins and improved free cash flow conversion as the benefits phase into the P&L.

Curious how modest top line growth, sharply higher margins, and a future earnings multiple come together to justify this uplifted fair value? The full narrative reveals the exact profit runway, valuation math, and capital allocation assumptions sitting behind that seemingly conservative discount. Want to see which numbers have to fall into place to make this pricing story work?

Result: Fair Value of $63.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing demand softness in key export markets and limited remaining cost levers could cap margin gains and undermine the current recovery narrative.

Find out about the key risks to this Ashland narrative.

Another Angle on Value

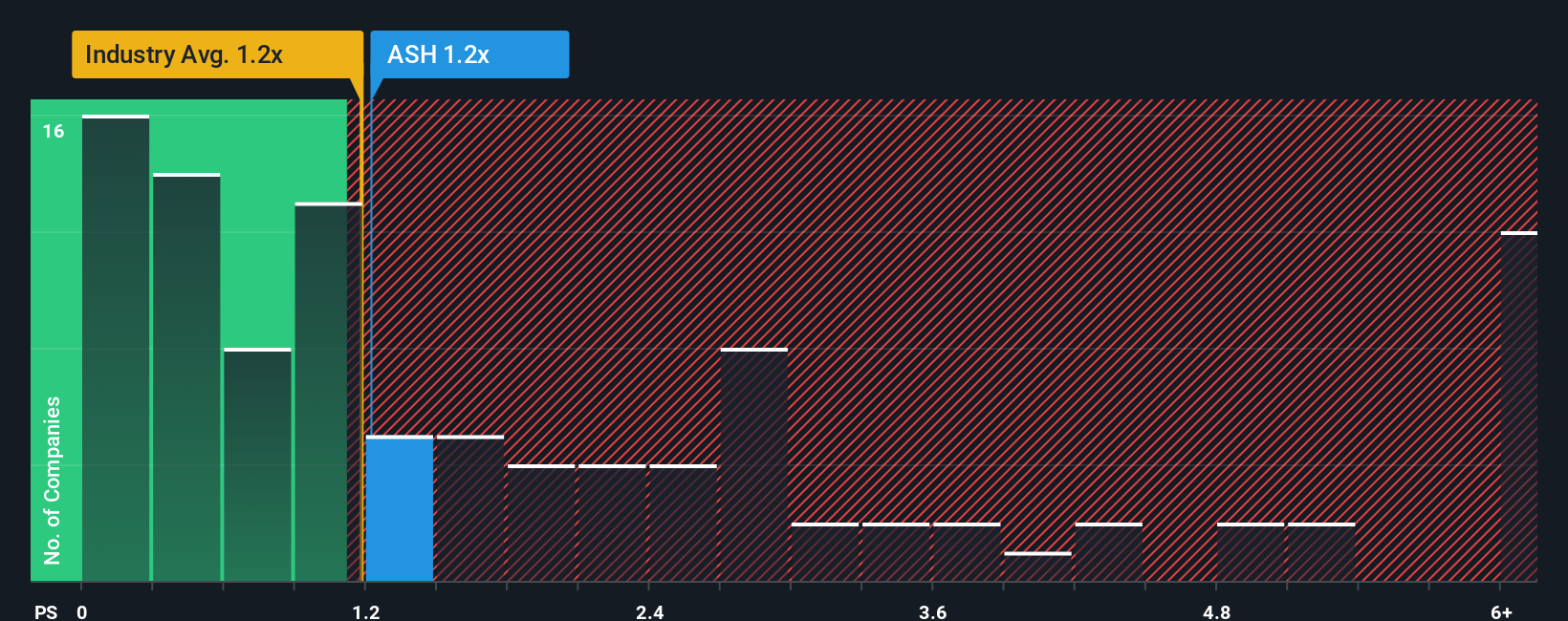

While the prevailing narrative leans on future earnings power, the current price tells a different story when stacked against sales. Ashland trades on a 1.5x price to sales ratio, richer than both the US Chemicals industry and peer average of 1.1x, and above its own 1.3x fair ratio. That premium hints at less margin for error if the turnaround stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ashland Narrative

If you are not entirely sold on this view or simply prefer to dig into the numbers yourself, you can build a custom thesis in just a few minutes, Do it your way.

A great starting point for your Ashland research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Once you have formed your view on Ashland, do not stop there. Use the Simply Wall Street Screener to uncover fresh, data driven opportunities before others react.

- Target income potential with these 15 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals and help you build a more resilient cash generating portfolio.

- Accelerate your growth watchlist by scanning these 26 AI penny stocks positioned at the heart of the AI boom, where rapid innovation can quickly reshape long term returns.

- Strengthen your value hunting by filtering for these 906 undervalued stocks based on cash flows that may be mispriced today, giving you a head start before sentiment and multiples catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal