BTV Vier Länder Bank (WBAG:BTS): Valuation Check After Weaker Nine‑Month 2025 Earnings Results

BTV Vier Länder Bank (WBAG:BTS) just posted weaker nine month 2025 earnings, with lower net interest income, net income, and earnings per share. This is raising fresh questions about how much profit pressure is now baked into the share price.

See our latest analysis for BTV Vier Länder Bank.

Even with today’s softer earnings, the market seems to be looking past the dip in profits. A year to date share price return of 17.86 percent and a 5 year total shareholder return of 136.74 percent suggest momentum is still broadly positive.

If these results have you rethinking where you take bank style risk, it could be worth scanning fast growing stocks with high insider ownership as a way to spot fresher opportunities.

With earnings under pressure but the shares still riding a strong multi year rally, the key question now is whether BTV Vier Länder Bank trades at a quiet discount, or if the market is already pricing in its next leg of growth?

Price-to-Earnings of 14.9x: Is it justified?

BTV Vier Länder Bank trades on a 14.9x price-to-earnings multiple at a last close of €66, which looks expensive against most European banking peers.

The price-to-earnings ratio compares what investors pay today with the bank's current earnings, making it a key yardstick for mature, profit-generating lenders like BTS.

In this case, the valuation sends a mixed message: the shares look slightly cheaper than the broader Austrian market at 15.5x earnings, yet meaningfully richer than both the European banks average on 10.3x and BTS's closer peer group on 12.2x. That premium implies the market is still willing to pay up for BTV Vier Länder Bank's track record of high-quality earnings and strong five-year profit growth, even after a recent year of negative earnings growth and margin compression.

Stacked against the European banks industry in particular, a 14.9x multiple versus 10.3x signals investors are pricing BTV Vier Länder Bank as a higher-quality, higher-visibility franchise rather than a typical cyclical lender operating in a more volatile rate and credit environment.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.9x (OVERVALUED)

However, persistent profit compression or a sharper economic slowdown across its core regions could quickly challenge the premium rating that investors currently accept.

Find out about the key risks to this BTV Vier Länder Bank narrative.

Another View on Value

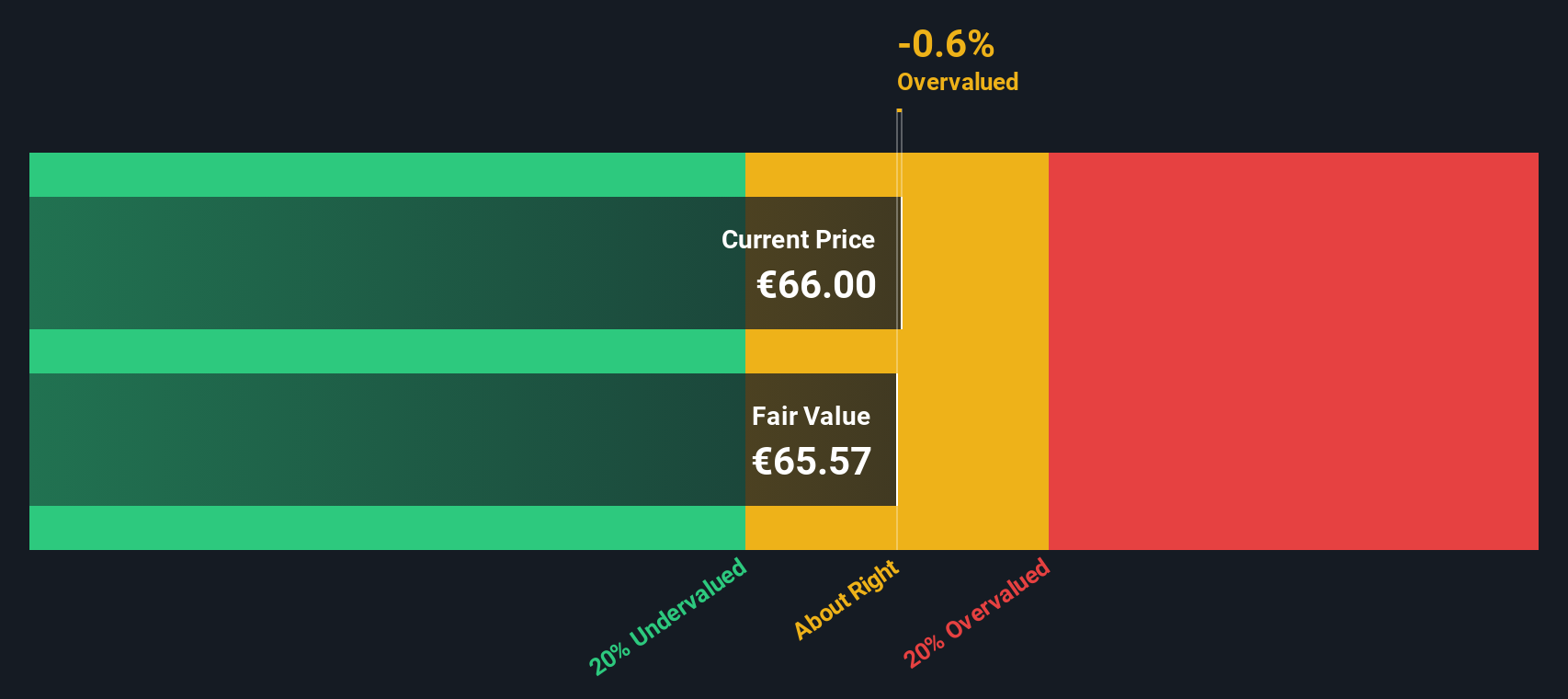

Our DCF model puts fair value for BTV Vier Länder Bank at roughly €65.57 per share, just below the current €66 price, which points to a slightly overvalued stock rather than a bargain. With so little margin of safety, how much upside is really left for new buyers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BTV Vier Länder Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BTV Vier Länder Bank Narrative

If you see the story differently or simply prefer to work from your own assumptions, you can build a personalised view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BTV Vier Länder Bank.

Ready for your next investing move?

Before you stop at one bank, give yourself an edge by lining up fresh ideas from focused stock lists that many investors still overlook.

- Target long term wealth by steering capital toward these 15 dividend stocks with yields > 3% that can steadily reinforce your income stream through changing markets.

- Capitalize on structural growth by backing these 30 healthcare AI stocks positioned at the intersection of medicine, data, and automation.

- Seize mispriced opportunities by scanning these 906 undervalued stocks based on cash flows where market pessimism may already be overdone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal