Assessing Exponent (EXPO) Valuation After a Year-to-Date Share Price Decline

Exponent (EXPO) has been lagging the broader market this year, and that underperformance is grabbing attention. With shares down about 17 % year to date, investors are reassessing what they are really paying for.

See our latest analysis for Exponent.

The recent drift lower in the share price, including a roughly 22% one-year total shareholder return decline, suggests momentum is fading as investors question how much they should pay for Exponent’s steady but unspectacular growth profile.

If this reassessment of risk and reward has you looking beyond Exponent, it might be a good moment to explore fast growing stocks with high insider ownership.

So with Exponent’s shares sliding despite steady high margin growth and analysts still seeing modest upside, is the market unfairly punishing a quality compounder, or simply recognizing that most of its future expansion is already priced in?

Most Popular Narrative: 11.8% Undervalued

With Exponent’s fair value estimate set at $83 against a last close of $73.22, the most followed narrative sees room for upside from here.

Ongoing expansion into high growth, innovation driven domains including artificial intelligence safety, distributed energy systems, and advanced medical technologies broadens Exponent's addressable market and client base, setting up an accelerating revenue trajectory as these industries scale. Strengthening headcount growth, propelled by effective recruiting and a development focused culture, enables Exponent to capture more project volume and maintain its reputation driven pricing power, with positive implications for both top line growth and sustained high net margins.

Curious how modest revenue growth, sticky margins and a punchy future earnings multiple can still justify upside from here? The narrative’s projections might surprise you.

Result: Fair Value of $83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and weaker utilization, particularly in slower regulatory segments, could undercut the premium multiple that this narrative depends on.

Find out about the key risks to this Exponent narrative.

Another Angle on Valuation

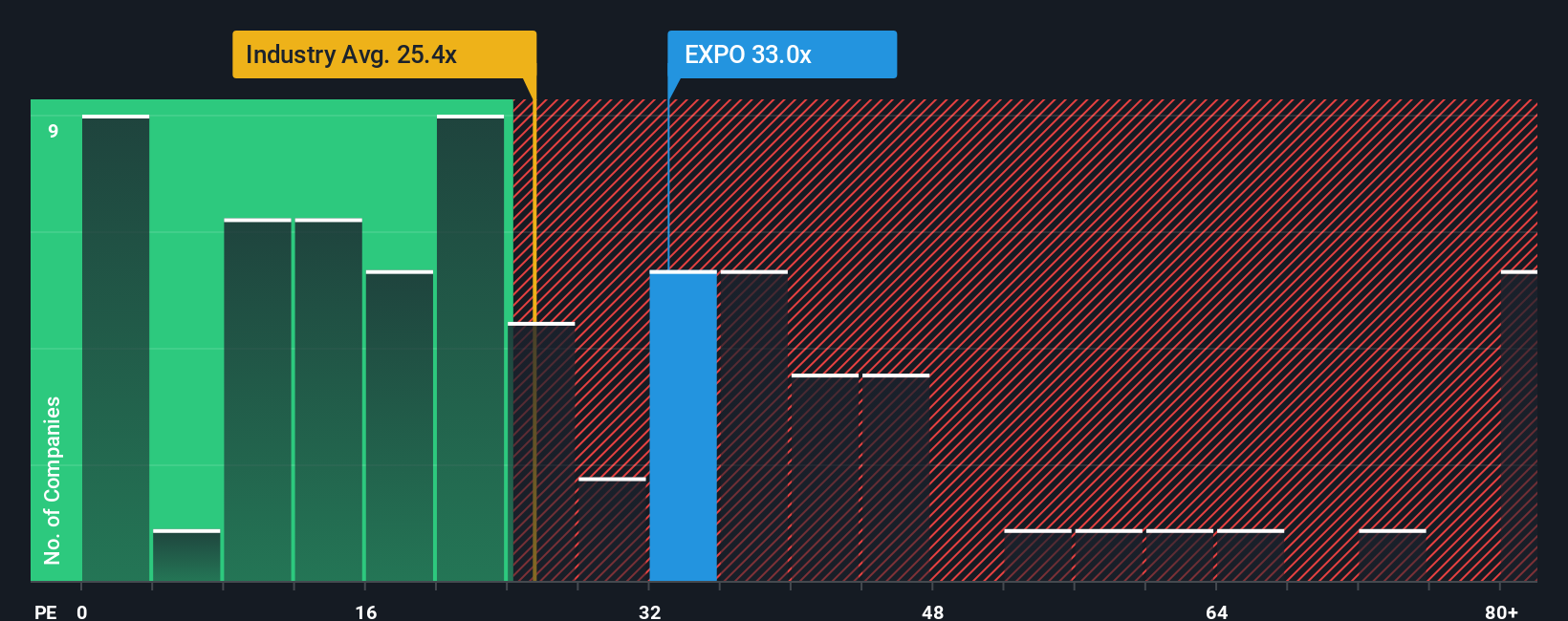

While the narrative framework points to upside, Exponent’s current price to earnings ratio of 34.8 times paints a more demanding picture. It trades well above the US Professional Services industry at 24.9 times and a fair ratio of 21.3 times, implying meaningful de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exponent Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Exponent.

Ready for your next investing move?

Before you move on, lock in your next opportunity by tapping into powerful screeners that surface focused ideas you might otherwise overlook on Simply Wall St.

- Target reliable income streams by checking out these 15 dividend stocks with yields > 3% that have historically rewarded shareholders with attractive cash returns.

- Capitalize on market mispricing by using these 906 undervalued stocks based on cash flows to spot companies where future cash flows may not yet be fully appreciated.

- Get ahead of the next technological shift by reviewing these 26 AI penny stocks shaping productivity, automation, and data driven decision making across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal