Leggett & Platt (LEG) Valuation Check After Recent 27% One-Month Share Price Rebound

What Is Moving Leggett & Platt Stock Right Now

Leggett & Platt (LEG) has quietly climbed about 27% over the past month, even as its one year return is still slightly negative. This setup has bargain hunters wondering if this rebound has more room to run.

See our latest analysis for Leggett & Platt.

At a share price of $11.17, Leggett & Platt has seen momentum improve recently, with a 30 day share price return of roughly 27%. However, the 3 year total shareholder return remains deeply negative, which suggests sentiment is shifting but not fully repaired.

If this rebound has you rethinking where the next opportunity might come from, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other potential turnaround or momentum stories.

With shares trading slightly above analyst targets and intrinsic value estimates, Leggett & Platt does not look obviously cheap on traditional metrics. This raises the question: is this a genuine value opportunity, or is the market already baking in a brighter recovery?

Most Popular Narrative Narrative: 2% Overvalued

With Leggett & Platt closing at $11.17 versus a most-followed fair value of $11, the narrative hints at a narrow valuation premium driven by specific long term assumptions.

The analysts have a consensus price target of $9.667 for Leggett & Platt based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $200.1 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 12.3%.

Curious how modest revenue pressure, margin rebuild and a future earnings multiple all combine to justify that tight fair value band? The narrative spells it out, number by number.

Result: Fair Value of $11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in bedding demand and ongoing competitive discounting in flooring could still derail the margin rebuild that underpins this valuation narrative.

Find out about the key risks to this Leggett & Platt narrative.

Another Angle on Valuation

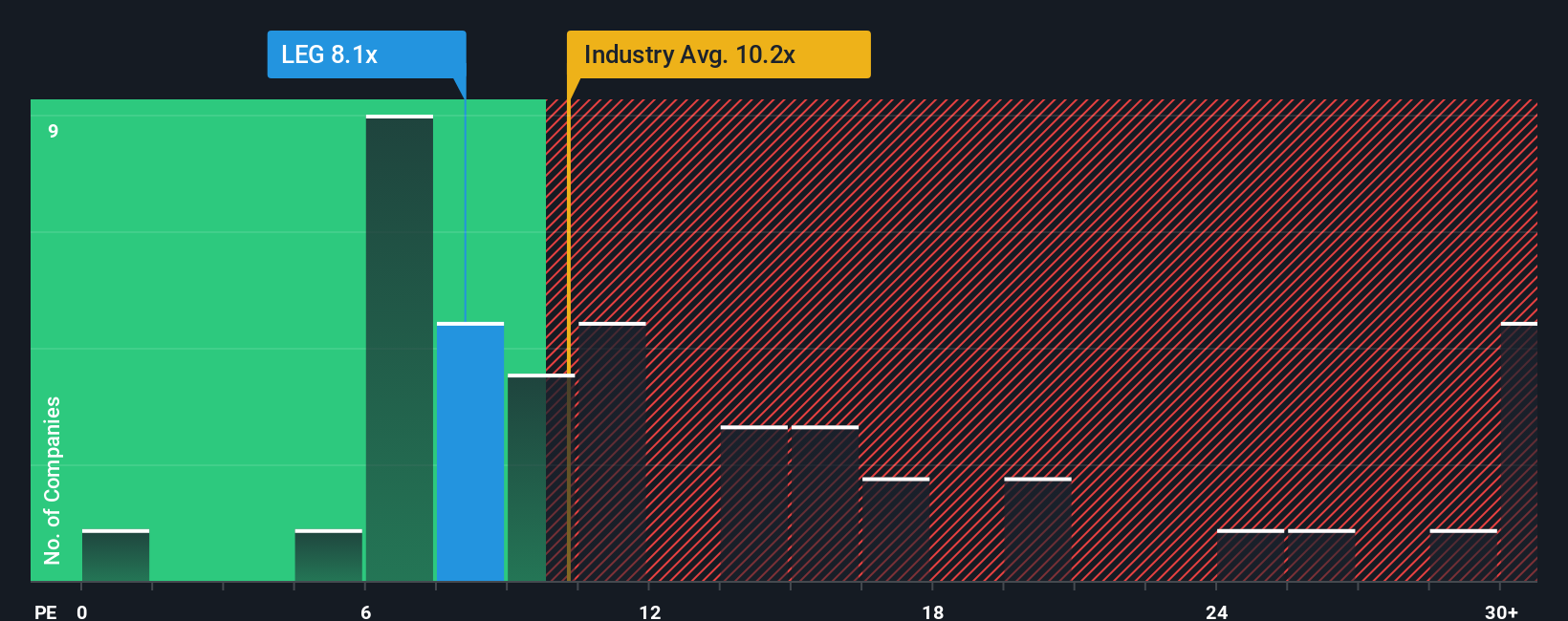

On earnings, Leggett & Platt looks far from expensive, trading on a price to earnings ratio of 6.7x versus 11.4x for the US Consumer Durables industry and 14x for peers, while our fair ratio sits near 12.3x. Is the market underestimating the risk, or the recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leggett & Platt Narrative

If you see things differently or would rather dig into the numbers yourself, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your Leggett & Platt research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking For Your Next Investment Edge?

Before you move on, lock in a few more smart ideas with targeted screeners that surface opportunities many investors overlook, across risk levels, sectors and themes.

- Capture potential mispricings by running these 906 undervalued stocks based on cash flows, which blends solid fundamentals with attractive cash flow valuations.

- Position for the next wave of innovation by scanning these 26 AI penny stocks, which may benefit from accelerating adoption of artificial intelligence.

- Boost your income strategy by reviewing these 15 dividend stocks with yields > 3%, which pairs meaningful yields with the potential for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal