Does Extended EBITDA Outlook And Balance Sheet Tweaks Change The Bull Case For TC Energy (TSX:TRP)?

- In the past quarter, TC Energy reported resilient third-quarter 2025 results with double-digit EBITDA growth led by its natural gas pipelines, extended its 5–7% annual EBITDA growth outlook through 2028, declared another quarterly dividend in a 25-year growth streak, and issued US$350 million of fixed-for-life junior subordinated notes to redeem preferred shares and trim debt.

- This combination of stronger earnings, longer-term growth guidance, and balance sheet refinement highlights how TC Energy is leaning on core gas infrastructure to underpin both expansion plans and continued dividend growth.

- Now, we'll explore how the extended 5–7% EBITDA growth outlook through 2028 could reshape TC Energy's existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TC Energy Investment Narrative Recap

To own TC Energy, you need to believe in steady, infrastructure-style cash flows from regulated and long-term contracted gas pipelines, with enough growth to support an elevated dividend and balance sheet repair. The latest quarter’s double-digit EBITDA growth and extension of 5–7% annual EBITDA guidance through 2028 reinforce that growth pillar, while the biggest near term risk, its stretched leverage and interest coverage, is only modestly eased by the recent financing moves.

The US$350 million fixed-for-life junior subordinated notes issue, used to redeem preferred shares and trim debt, ties directly into that balance sheet risk and dividend sustainability story. For investors focused on catalysts, this step supports TC Energy’s effort to align its capital structure with its long-term EBITDA outlook and 25-year dividend growth record, even as earnings and interest coverage metrics remain under pressure.

However, investors should also be aware that concentration in long-lived gas infrastructure could become a problem if...

Read the full narrative on TC Energy (it's free!)

TC Energy's narrative projects CA$17.2 billion revenue and CA$4.0 billion earnings by 2028.

Uncover how TC Energy's forecasts yield a CA$77.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

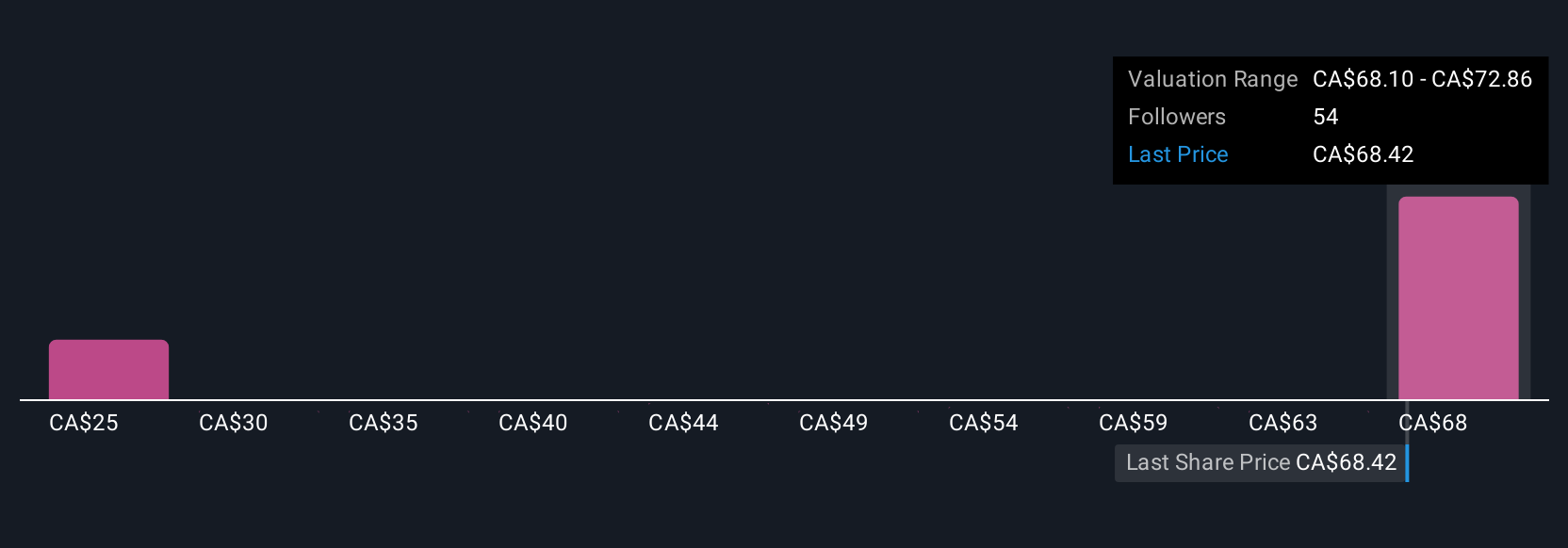

Four Simply Wall St Community members put TC Energy’s fair value between CA$46.88 and CA$77.50, underlining how far apart individual views can sit. When you set that against the company’s extended 5–7% annual EBITDA growth outlook through 2028, it becomes clear why you might want to compare several independent takes on what could drive future returns.

Explore 4 other fair value estimates on TC Energy - why the stock might be worth as much as CA$77.50!

Build Your Own TC Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TC Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TC Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TC Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal