Assessing APA (APA) Stock Valuation After Its Recent 25% One-Month Rebound

APA (APA) has quietly climbed about 25% over the past month and roughly 19% in the past 3 months, drawing fresh attention to whether the stock still offers value at current levels.

See our latest analysis for APA.

Zooming out, APA’s recent 1 month share price return of around 25% builds on a solid year to date share price gain, even as the 3 year total shareholder return remains negative. This suggests sentiment has only recently swung back in its favor.

If APA’s rebound has you rethinking the energy space, it could be worth scanning other aerospace and defense stocks for fresh ideas beyond traditional oil and gas names.

With the stock now above consensus price targets but still flagged as undervalued on some intrinsic metrics, investors face a key question: is APA a mispriced value play, or is the market already baking in future growth?

Most Popular Narrative: 4.7% Overvalued

With APA closing at $27.10 against a narrative fair value of about $25.89, the current price slightly overshoots the long term intrinsic view.

Progress on Suriname development (GranMorgu), with milestone achievements and early capex outlays signaling timely project delivery, offers a major future uplift to reserves and revenue, aligned with long-term global demand growth in oil and gas.

Curious how a shrinking top line, rising profit margins, and a lower future earnings multiple can still justify today’s price? The full narrative shows the math.

Result: Fair Value of $25.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical risk in Egypt, along with rising decommissioning and compliance costs, could pressure APA’s margins and undermine the current fair value narrative.

Find out about the key risks to this APA narrative.

Another Lens on Valuation

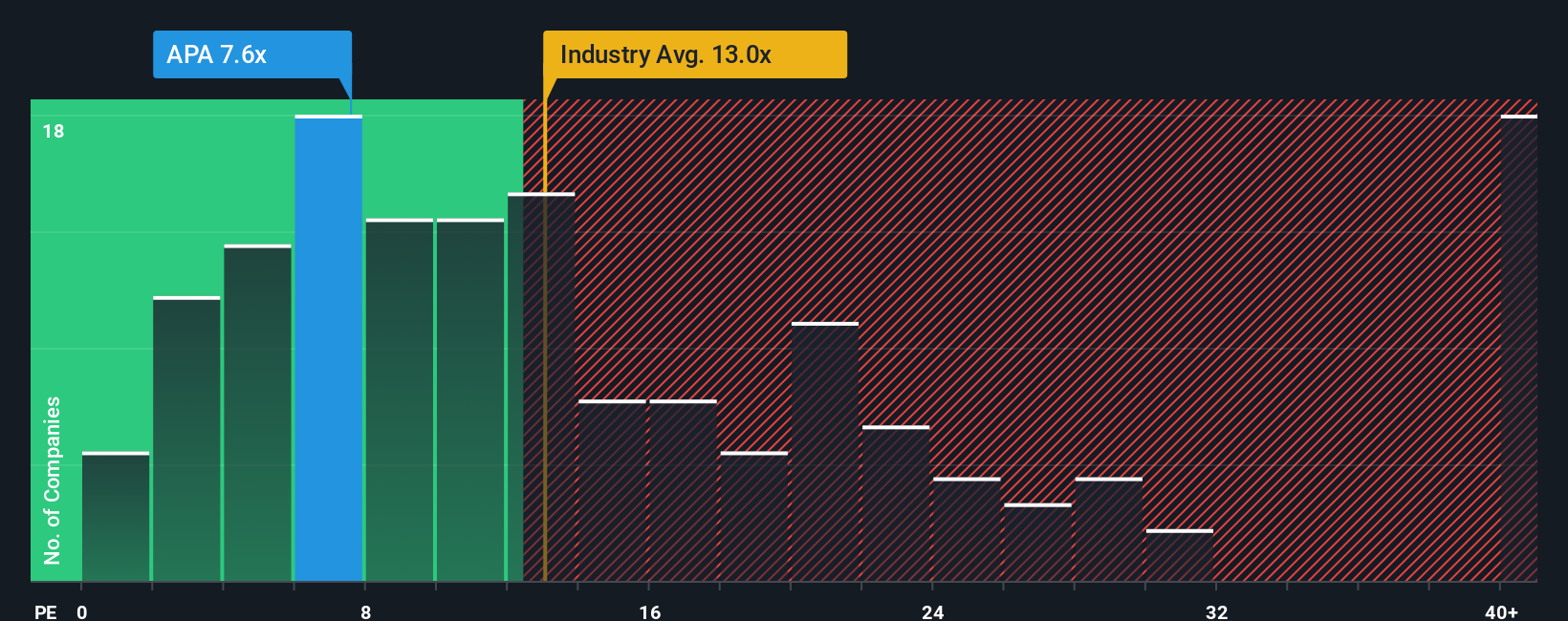

While the narrative fair value suggests APA is about 4.7% overvalued, its price to earnings ratio of 6.4x looks strikingly cheap compared with the industry at 13.8x, peers at 24.2x, and a fair ratio of 14.5x. This hints at meaningful rerating potential if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own APA Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your APA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider using the Simply Wall Street Screener to uncover focused, data driven opportunities beyond APA.

- Target powerful cash generators with these 906 undervalued stocks based on cash flows that the market has not fully appreciated yet, before other investors catch on.

- Explore companies involved in innovation by scanning these 26 AI penny stocks for businesses working on artificial intelligence applications.

- Seek to strengthen your income stream through these 15 dividend stocks with yields > 3%, which is designed to highlight companies with dividend yields that support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal