Is Fiserv (FISV) Quietly Repositioning Portico as a Higher-Value Software Workflow Platform?

- In early December 2025, Business Alliance Financial Services (BAFS) announced it had integrated its BLAST commercial lending platform with Fiserv’s Portico account processing system, giving credit unions using Portico more options to digitize and streamline their commercial loan lifecycles.

- This integration, alongside Fiserv’s appointment of veteran technology-sector analyst Walter Pritchard as Head of Investor Relations, underscores the company’s emphasis on expanding higher-value software workflows while sharpening its communication with the investment community.

- With BAFS’ BLAST now embedded into Portico’s lending workflows, we’ll examine how this development may refine Fiserv’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Fiserv Investment Narrative Recap

To own Fiserv, you need to believe its scale in payments and banking software can translate into steady, if moderate, growth while it manages margin pressure and execution risk. The BAFS integration and new Head of Investor Relations appointment look directionally aligned with the push into higher-value software workflows, but they do not appear to materially change the near term catalyst of improving organic growth or the key risk around slower adoption of newer platforms.

The BAFS BLAST integration into Portico is most relevant here, because it speaks directly to Fiserv’s effort to deepen workflow software in financial institutions and support more automated lending. If credit unions adopt these capabilities at scale, it could help reinforce the broader catalyst of increasing demand for digitized and automated financial services across Fiserv’s platforms, without yet resolving concerns about overall growth decelerating from prior years.

But while these integrations look helpful, investors should still pay close attention to the risk that slower-than-expected adoption of Fiserv’s next generation platforms could...

Read the full narrative on Fiserv (it's free!)

Fiserv's narrative projects $24.7 billion revenue and $5.9 billion earnings by 2028.

Uncover how Fiserv's forecasts yield a $95.48 fair value, a 44% upside to its current price.

Exploring Other Perspectives

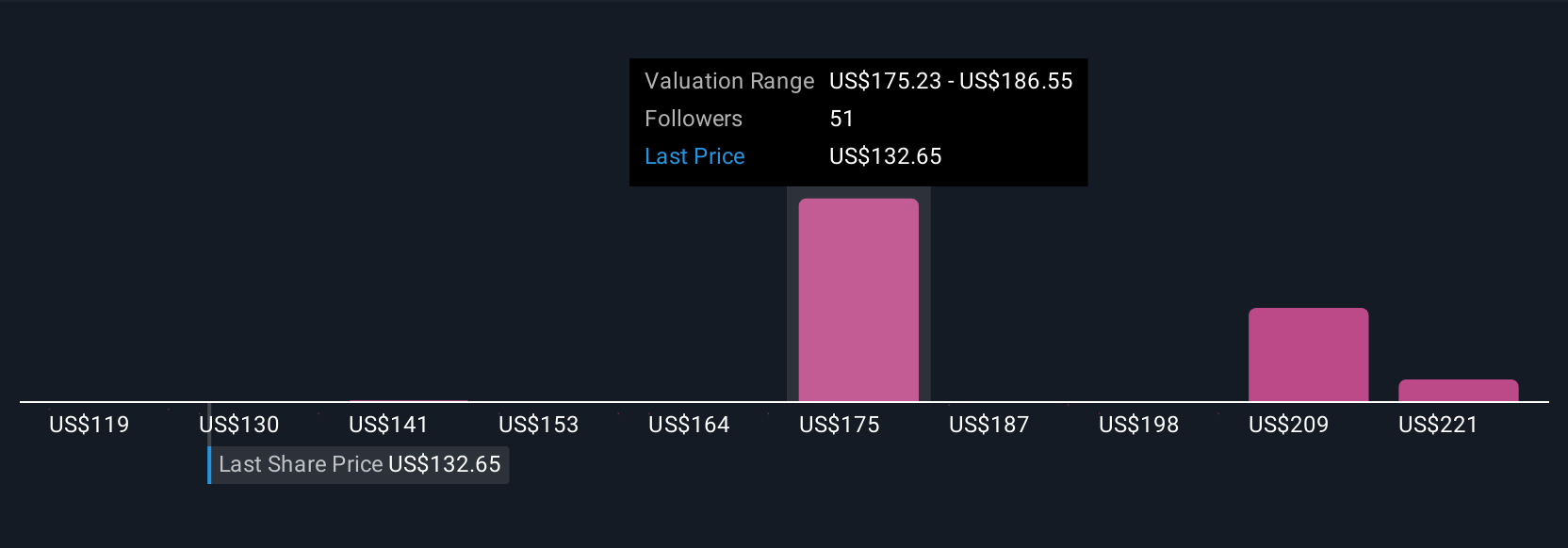

Members of the Simply Wall St Community see Fiserv’s fair value anywhere between US$95.48 and US$231.84, across 18 separate estimates. Against that spread of opinions, the key question is how convincingly Fiserv can translate demand for more digitized financial workflows into sustained growth in its newer platforms, which could influence how those valuations stack up over time.

Explore 18 other fair value estimates on Fiserv - why the stock might be worth just $95.48!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal