Is Carvana’s 7,800% Three Year Surge Still Supported by Fundamentals in 2025

- Wondering whether Carvana is still a bargain or if the easy money has already been made? This breakdown will help you decide whether the current price makes sense or is running on hype.

- The stock has rocketed, up 6.7% over the last week, 29.1% over the past month, and 100.3% year to date, stacking on top of a 7,816.2% gain over three years, even though the five-year return is 54.8%.

- Recent headlines have focused on Carvana pushing ahead with its turnaround story, including continued balance sheet improvements and growing investor confidence in its online used car model. At the same time, shifting expectations for interest rates and used car demand have made traders more willing to pay up for future growth, helping fuel the latest leg of the rally.

- Despite that excitement, Carvana currently scores just 0 out of 6 on our valuation checks, suggesting it does not look undervalued by traditional metrics. Next we will walk through the different valuation approaches investors are using today, before finishing with a more holistic way to think about what this stock might be worth.

Carvana scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Carvana Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future, then discounting those cash flows back to today in dollar terms. For Carvana, the 2 Stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $520.3 million and projects that this could grow to roughly $3.4 billion by 2029 as the business scales.

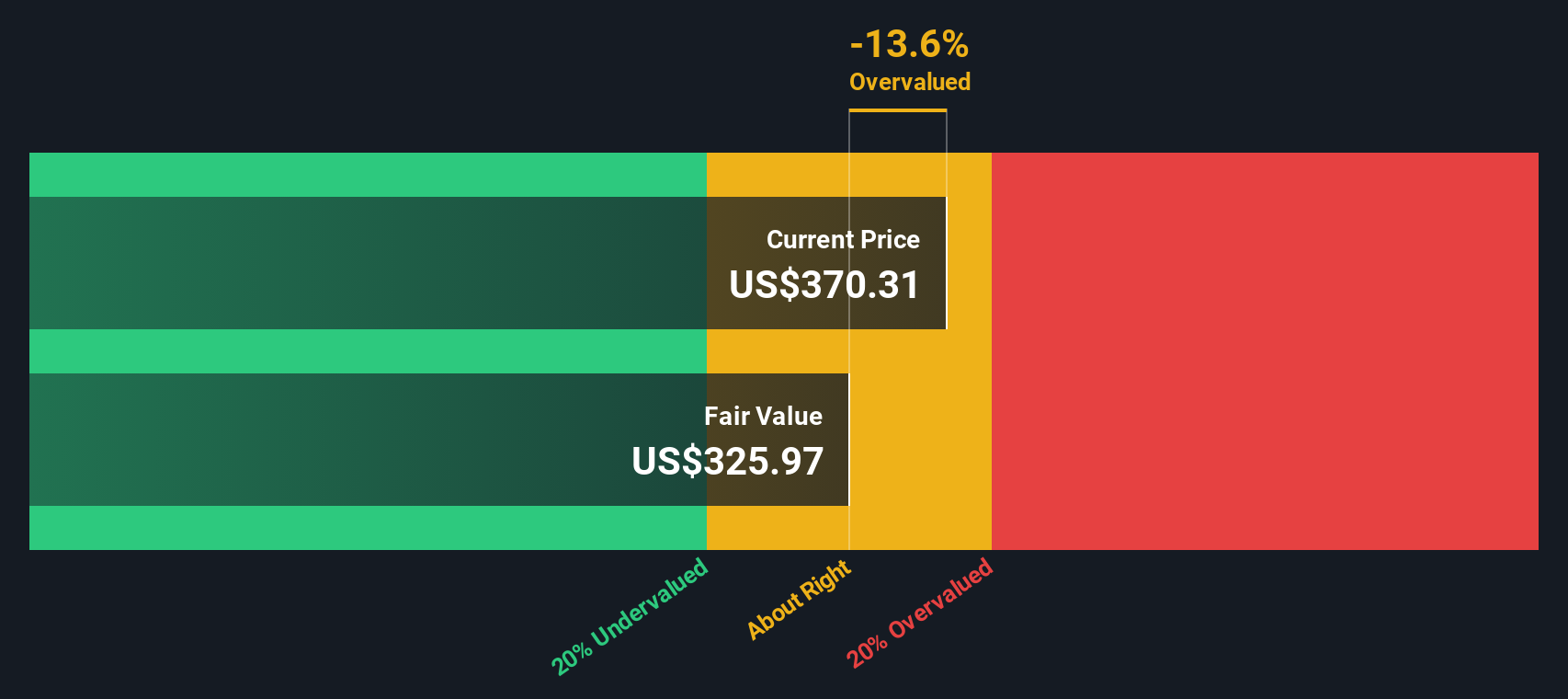

Analysts provide detailed forecasts for the next few years. Beyond that point, Simply Wall St extrapolates growth and gradually slows the pace as Carvana matures. When all of those projected cash flows are discounted back to today, the model arrives at an estimated intrinsic value of about $327.94 per share.

Based on this framework, the DCF suggests Carvana is roughly 21.9% overvalued at the current market price. In other words, investors are paying a premium for future execution and growth to go right.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Carvana may be overvalued by 21.9%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Carvana Price vs Earnings

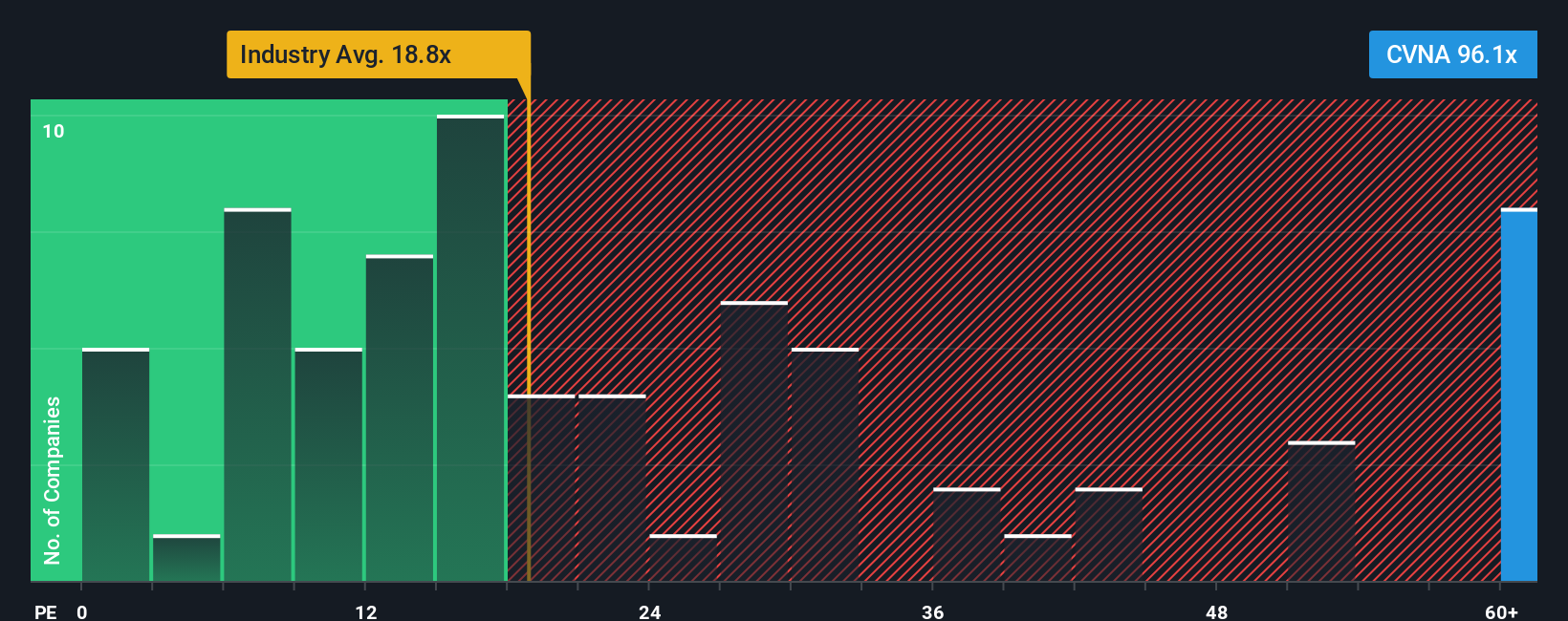

For companies that are generating profits, the price to earnings ratio is often the go to valuation tool because it directly compares what investors are paying with the earnings the business is producing today. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or shakier fundamentals usually mean the multiple should sit closer to, or even below, the market and industry norms.

Carvana is currently trading on a rich PE of about 89.9x, far above both the Specialty Retail industry average of around 18.8x and the broader peer group average of roughly 19.9x. To put that in context, Simply Wall St estimates a Fair Ratio for Carvana of about 41.3x, which reflects the multiple you might expect given its earnings growth profile, margins, industry, market cap, and specific risk factors.

This Fair Ratio is more informative than a simple comparison with peers or the industry, because it adjusts for Carvana’s unique combination of high growth potential and elevated risk. Measured against that 41.3x Fair Ratio, the current 89.9x PE suggests investors are paying a substantial premium for the story.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

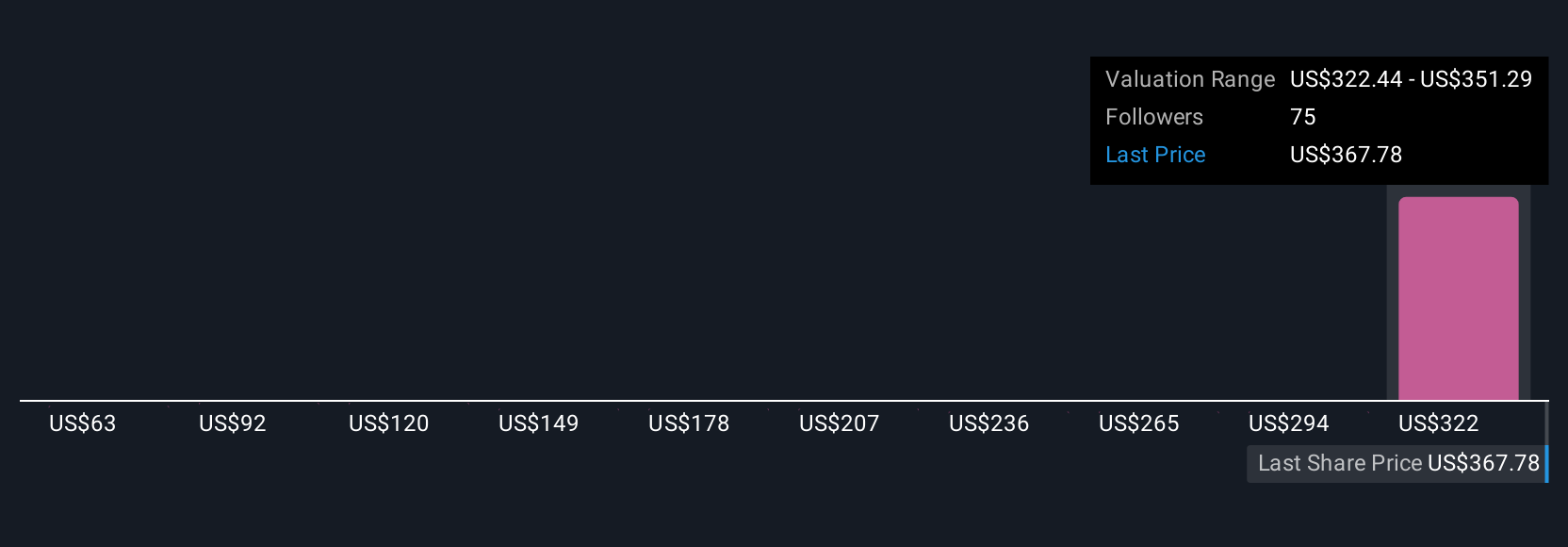

Upgrade Your Decision Making: Choose your Carvana Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you spell out the story you believe about a company and connect it directly to your assumptions for future revenue, earnings, margins and ultimately a fair value estimate. On Simply Wall St, Narratives live in the Community page and are designed to be accessible, even if you are not a valuation expert, because they guide you from a company’s story to a quantified forecast and then to a Fair Value you can compare to the current share price to decide whether you want to buy, hold, or sell. Narratives are dynamic, updating as new information such as earnings releases or major news hits the market, so your fair value view evolves with the facts. For Carvana, for example, one investor might build a bullish Narrative that assumes earnings closer to the high end of analyst expectations and a premium future PE multiple, leading to a Fair Value near $500 per share. In contrast, a more cautious investor could assume earnings nearer the low end with a lower multiple and land closer to $330. This illustrates how different stories lead to different, but transparent, valuations.

Do you think there's more to the story for Carvana? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal