Elastic (ESTC) Is Up 5.9% After AI Observability, AWS Milestones And Buyback News - Has The Bull Case Changed?

- Recently, Elastic announced a new integration that brings observability for AI agents and applications running on Amazon Bedrock AgentCore directly into the Elasticsearch platform, alongside a US$500.00 million share repurchase program and stronger fiscal second quarter 2026 results.

- The company is also deepening its AI focus through an investment in investigations software firm Siren and gaining AWS Agentic AI Specialization, underscoring its emphasis on production-grade autonomous AI systems.

- Next, we’ll examine how Elastic’s expanded AI observability with Amazon Bedrock AgentCore may influence its investment narrative and growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Elastic Investment Narrative Recap

For me, the core Elastic thesis is about its ability to turn AI search, observability, and security into a unified, must-have platform as workloads move to the cloud. The Amazon Bedrock AgentCore integration and stronger fiscal 2026 guidance reinforce the near term catalyst around AI driven consumption, while the biggest risk still feels like intensifying competition from hyperscalers’ native tools, which this news does not fully resolve.

The Amazon Bedrock AgentCore observability integration stands out here, because it directly supports Elastic’s AI centric growth catalyst by tying its platform more tightly into AWS agentic AI workloads. If enterprises increasingly want end to end, production grade AI observability on top of their LLM agents, this kind of deep integration could help Elastic stay relevant as those customers weigh hyperscaler native options against specialized platforms.

Yet, despite these AI tailwinds, investors should still be aware of how quickly hyperscaler native services could...

Read the full narrative on Elastic (it's free!)

Elastic's narrative projects $2.3 billion revenue and $50.5 million earnings by 2028. This requires 13.9% yearly revenue growth and a $134.0 million earnings increase from $-83.5 million today.

Uncover how Elastic's forecasts yield a $106.22 fair value, a 42% upside to its current price.

Exploring Other Perspectives

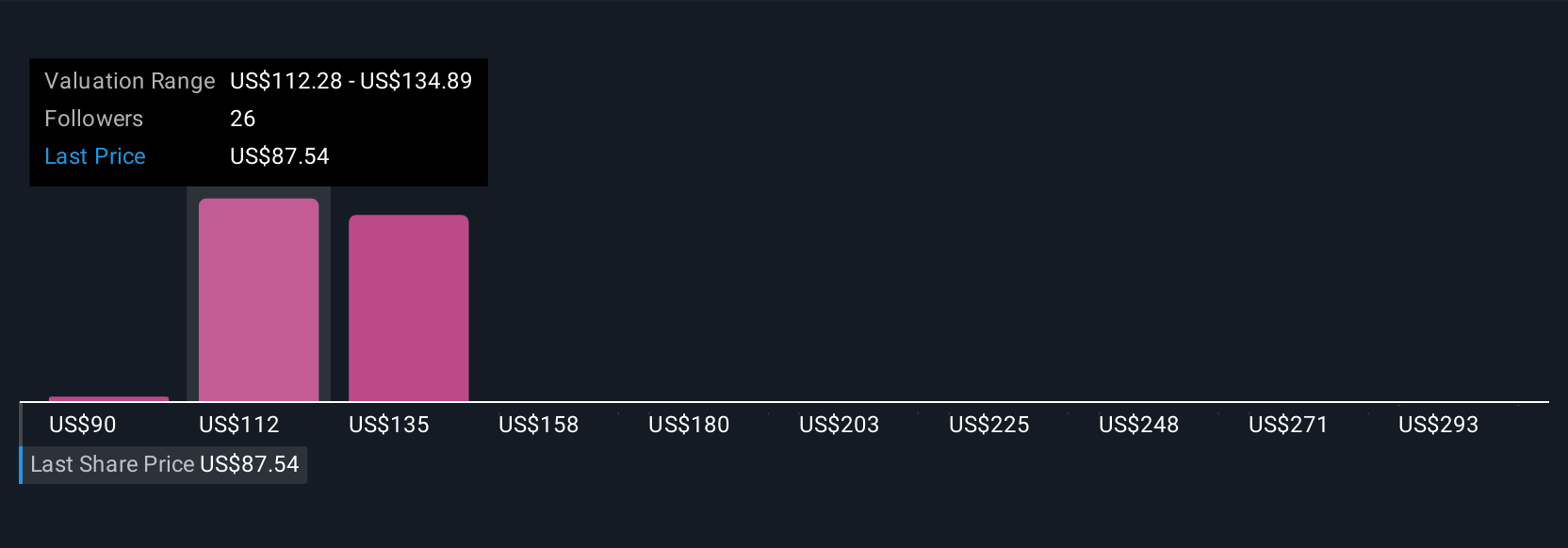

Six members of the Simply Wall St Community currently see Elastic’s fair value between US$89.66 and US$140.57, highlighting a wide spread of expectations. When you set those views against the risk of hyperscalers eroding Elastic’s market share, it underlines why different investors can reach very different conclusions about the company’s long term performance.

Explore 6 other fair value estimates on Elastic - why the stock might be worth just $89.66!

Build Your Own Elastic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elastic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elastic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elastic's overall financial health at a glance.

No Opportunity In Elastic?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal