Is Buckle’s 5.9% YTD Comp Sales Growth Reshaping the Investment Case For Buckle (BKE)?

- The Buckle, Inc. recently reported that for the 4-week period ended November 29, 2025, comparable store net sales rose 2.5%, while total net sales increased 3.9% to US$122.1 million compared with the same period a year earlier.

- Over the longer 43-week period, the retailer’s net sales crossed the US$1.02 billion mark with 5.9% comparable store growth, underscoring ongoing momentum in its core business.

- We’ll now examine how this recent 5.9% year-to-date comparable store sales growth might influence Buckle’s broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Buckle Investment Narrative Recap

Buckle’s investment case rests on consistent specialty apparel demand, disciplined merchandising and a balance sheet that supports dividends and reinvestment. The latest 5.9% year to date comparable sales growth reinforces the near term same store sales catalyst, but does little to ease concerns around mall exposure and rising occupancy costs, which remain key risks.

The recent Q3 2025 earnings release is particularly relevant here, as it showed higher sales and earnings alongside this sales update, suggesting Buckle has so far been able to translate store level momentum into bottom line growth. Together, the quarterly results and November sales data give investors a clearer view of how current trading strength interacts with longer term questions about digital adoption and store productivity.

However, investors should keep in mind the risk that Buckle’s heavy mall footprint could limit the benefits of...

Read the full narrative on Buckle (it's free!)

Buckle's narrative projects $1.4 billion revenue and $226.1 million earnings by 2028. This requires 4.0% yearly revenue growth and about a $24.5 million earnings increase from $201.6 million today.

Uncover how Buckle's forecasts yield a $54.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

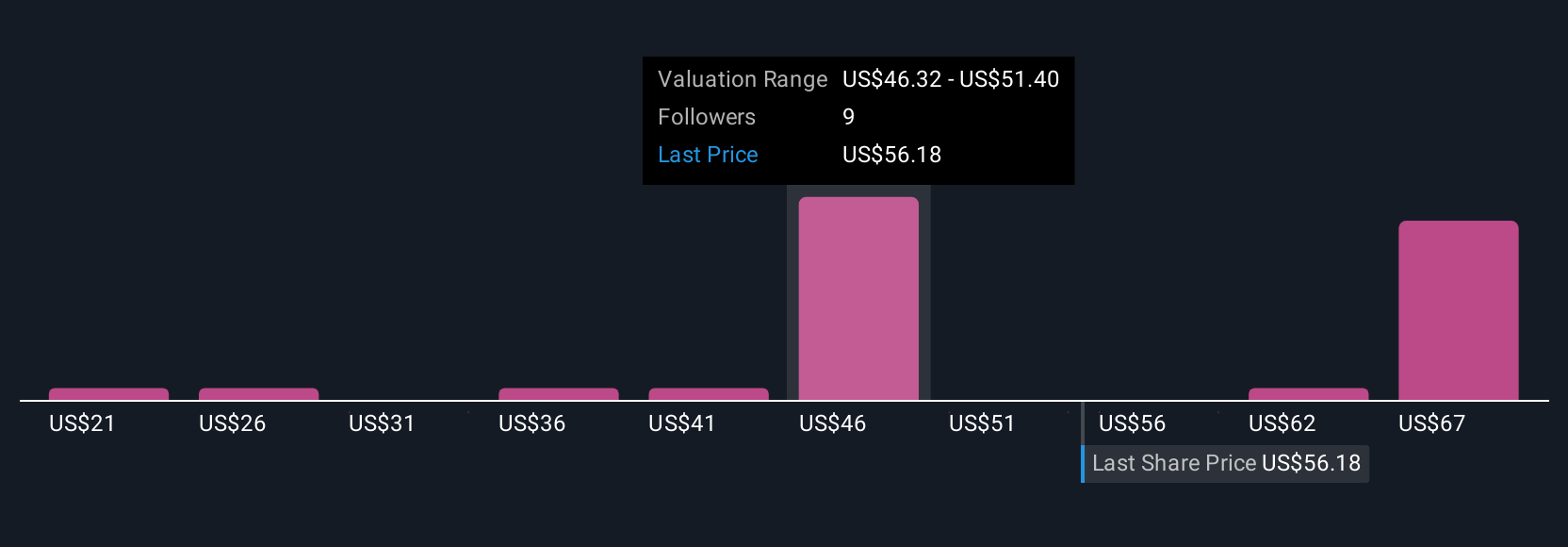

Eight Simply Wall St Community fair value estimates for Buckle span roughly US$21 to US$88 per share, highlighting sharply different expectations. You can compare these views against the recent 5.9% year to date comparable sales growth and consider how ongoing mall exposure might affect the company’s ability to sustain that performance.

Explore 8 other fair value estimates on Buckle - why the stock might be worth as much as 57% more than the current price!

Build Your Own Buckle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Buckle research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Buckle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Buckle's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal