Is Reddit’s Rally Justified After Data Licensing Deals and Strong 2025 Price Gains?

- Wondering if Reddit's hype is still backed by real value, or if the stock has already run too far too fast for new investors to step in confidently?

- Over the last week the share price is up 8.1%, roughly 19.3% over the past month, and 41.1% year to date, pushing many investors to reassess both its upside and its risk profile after a 43.8% gain over the past year.

- Recent headlines have focused on Reddit's expanding data licensing deals and deeper integrations with AI partners. This signals that the market sees its user generated content as a monetizable asset rather than just community chatter. At the same time, ongoing conversations about content moderation, platform regulation, and competitive pressure from other social and AI driven platforms are reminding investors that this growth story comes with execution and sentiment risk.

- On our checklist of valuation signals, Reddit currently scores 2 out of 6 for being undervalued. This suggests some metrics hint at an opportunity while others flash caution. In the sections ahead we will walk through each valuation approach in detail before finishing with a more nuanced way to think about what this stock might be worth.

Reddit scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Reddit Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present using a required rate of return.

For Reddit, the latest twelve month Free Cash Flow is about $503.6 Million, and analysts plus Simply Wall St projections see this rising steadily over the next decade. Forecasts in the article show Free Cash Flow climbing past $1 Billion by 2026 and reaching roughly $4.8 Billion by 2035, with earlier years based on analyst estimates and the later years extrapolated from those trends.

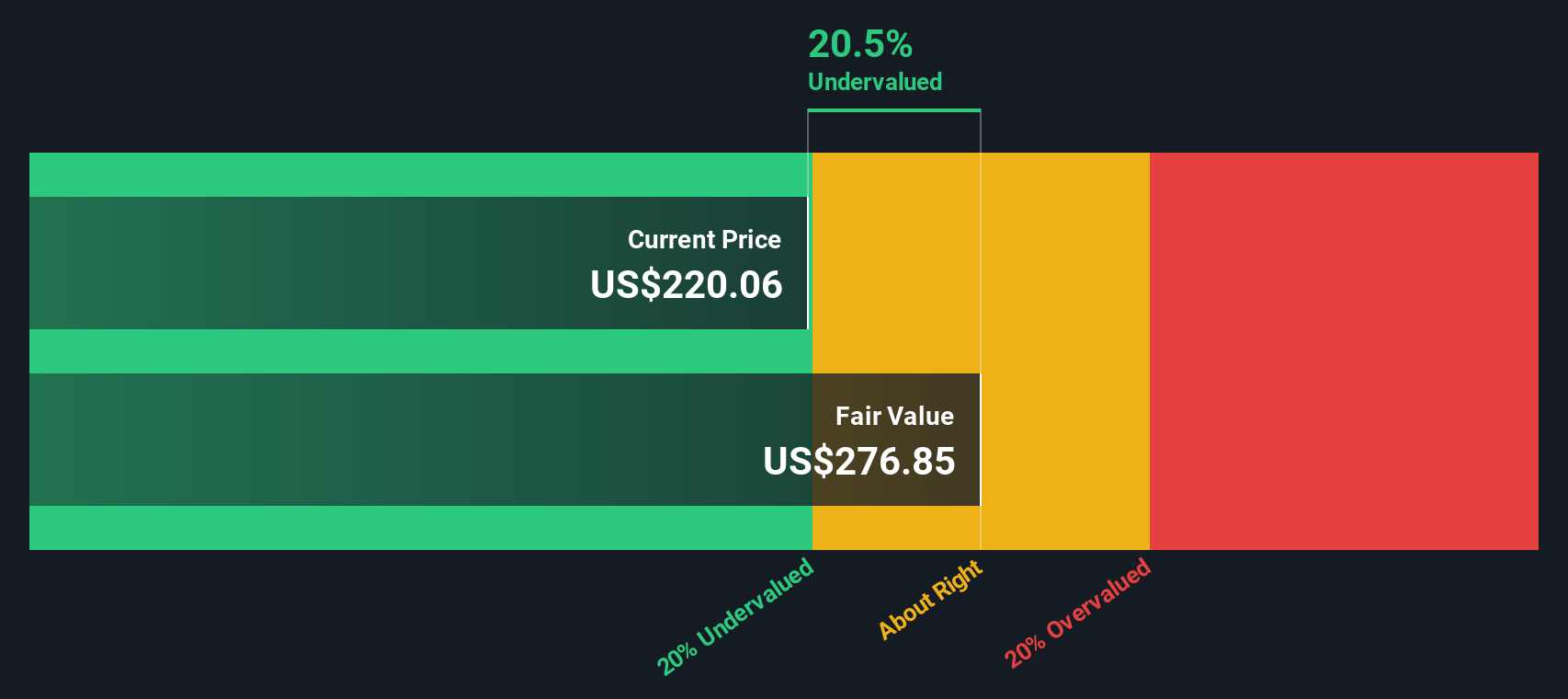

Using this 2 Stage Free Cash Flow to Equity model, Simply Wall St estimates a DCF based intrinsic value of about $338.00 per share. Compared with the current share price, this implies the stock is trading at roughly a 30.7% discount, which in this framework suggests the market is not fully pricing in Reddit's long term cash generation projections.

Result: UNDERVALUED (based on this DCF model)

Our Discounted Cash Flow (DCF) analysis suggests Reddit is undervalued by 30.7%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Reddit Price vs Earnings

For profitable companies, the Price to Earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. It helps link today’s share price to both current profitability and what the market believes those earnings can become over time.

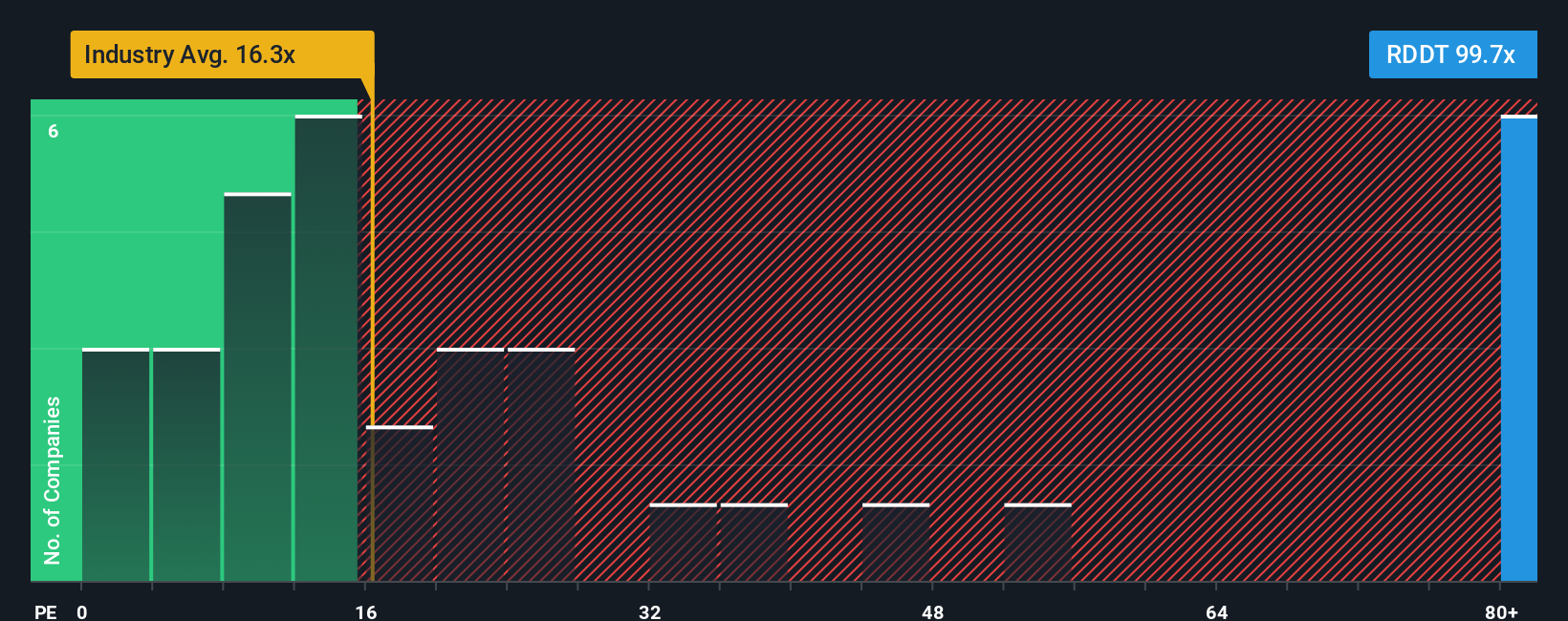

In practice, a higher PE is usually justified when investors expect faster growth or see lower risk, while slower growth or higher uncertainty should result in a lower, more conservative PE. Reddit currently trades on about 127.1x earnings, well above the Interactive Media and Services industry average of roughly 17.8x and the peer group average of around 39.5x. This signals that the market is baking in very strong growth and a premium narrative.

Simply Wall St’s Fair Ratio for Reddit is 37.8x, a proprietary estimate of what its PE should be after accounting for factors such as earnings growth prospects, profit margins, business risks, industry positioning, and market cap. This makes it more tailored than a simple comparison to peers or the broad industry, which can be skewed by outliers or structurally different businesses. With Reddit’s actual PE of 127.1x sitting far above the 37.8x Fair Ratio, the stock screens as materially overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

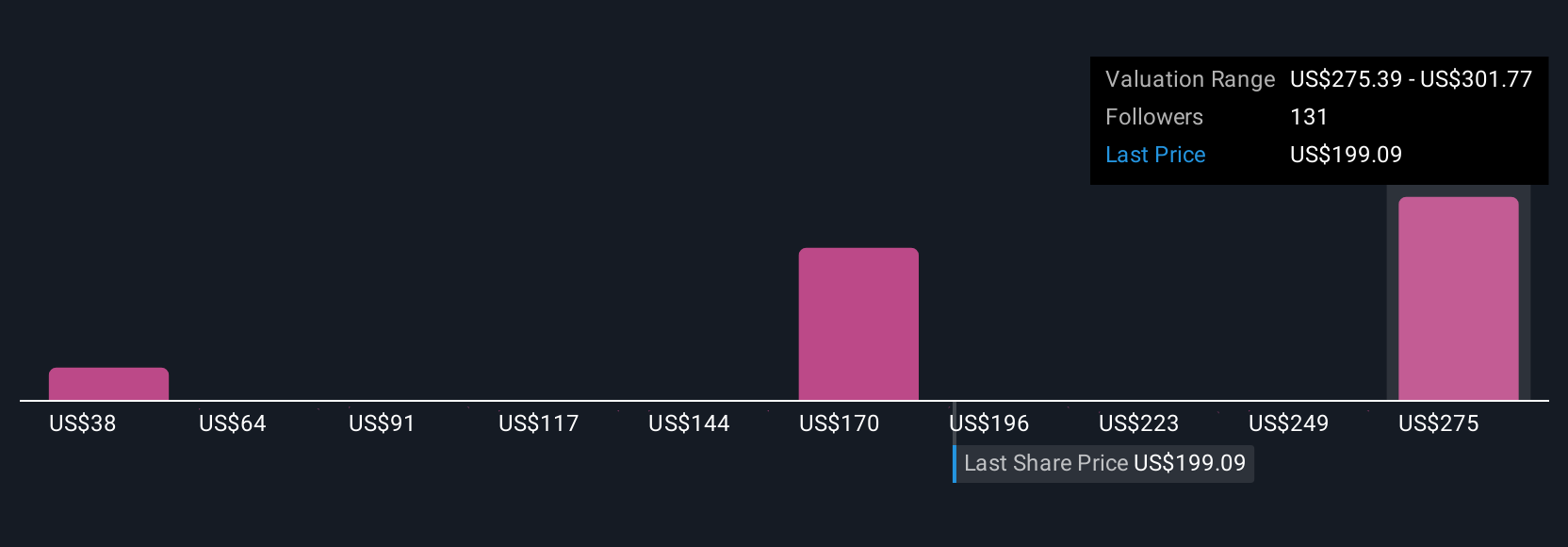

Upgrade Your Decision Making: Choose your Reddit Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Reddit’s business to a concrete forecast and Fair Value estimate. A Narrative is just your story behind the numbers, where you spell out what you believe about future revenue, earnings and margins, and then link that story to a financial model that produces a Fair Value you can compare with today’s share price. On Simply Wall St, millions of investors can build and share Narratives on the Community page, making this approach accessible even if you are not a valuation expert. Narratives can help you think about when to buy or sell by showing whether your Fair Value sits above or below the current price, and they automatically update when new information, like earnings results or major news, changes the outlook. For Reddit, for example, one investor might build a bullish Narrative that assumes strong engagement and successful international expansion, and arrive at a Fair Value well above $240.70. Another might focus on competition, moderation and regulatory risk, land on a Fair Value closer to $75, and then decide to wait for a lower entry point.

Do you think there's more to the story for Reddit? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal