Bank of N.T. Butterfield & Son (NTB) Is Up 5.7% After Aggressive Buybacks Amid Analyst Downgrade – Has The Bull Case Changed?

- In recent months, Bank of N.T. Butterfield & Son reached a 52-week high as management accelerated share repurchases, while Wells Fargo shifted its rating from Overweight to Equal Weight due to concerns about the impact of prospective interest rate cuts on the bank’s performance.

- This combination of insider confidence via buybacks and external caution from an analyst downgrade highlights the tension between capital return ambitions and sensitivity to changing rate conditions.

- We’ll now examine how management’s aggressive share buybacks may influence Butterfield’s existing investment narrative and its outlook on earnings resilience.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bank of N.T. Butterfield & Son Investment Narrative Recap

To own Bank of N.T. Butterfield & Son, you need to be comfortable with a fairly concentrated offshore banking and wealth franchise, and the trade off between income today and interest rate sensitivity. The recent 52 week high and buyback acceleration help the near term capital return story, while Wells Fargo’s downgrade underscores that potential rate cuts and net interest margin pressure remain the key short term risk, alongside existing concerns around less sticky deposits.

Among recent announcements, the July 2025 decision to lift the quarterly dividend to US$0.50 per share ties directly into this tension between robust capital returns and interest rate risk. A higher cash payout, on top of buybacks, can be appealing if earnings stay resilient, but it may also limit flexibility should deposit outflows or a weaker margin backdrop weigh on future results.

Yet beneath the rising dividend and buoyant share price, the concentration in large, potentially flighty deposits is something investors should be aware of...

Read the full narrative on Bank of N.T. Butterfield & Son (it's free!)

Bank of N.T. Butterfield & Son's narrative projects $594.7 million revenue and $194.4 million earnings by 2028. This implies a 0.3% yearly revenue decline and a $25.0 million earnings decrease from $219.4 million today.

Uncover how Bank of N.T. Butterfield & Son's forecasts yield a $51.50 fair value, a 5% upside to its current price.

Exploring Other Perspectives

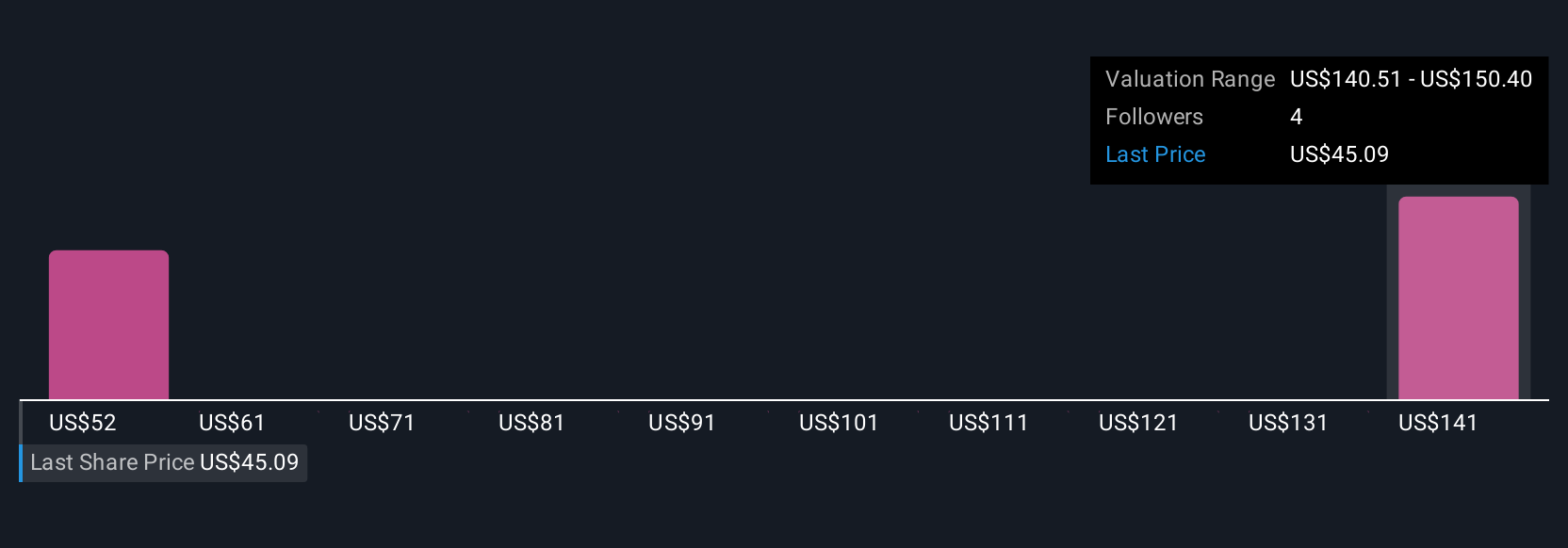

Three members of the Simply Wall St Community see fair value for Butterfield between about US$51.50 and US$156.34, showing how far opinions can stretch. When you set these views against risks like interest rate driven margin pressure, it underlines why comparing several perspectives can be useful before deciding how Butterfield might fit into your portfolio.

Explore 3 other fair value estimates on Bank of N.T. Butterfield & Son - why the stock might be worth just $51.50!

Build Your Own Bank of N.T. Butterfield & Son Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of N.T. Butterfield & Son research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bank of N.T. Butterfield & Son research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of N.T. Butterfield & Son's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal