Is Zillow (ZG) Undervalued After Recent Share Price Weakness? A Fresh Look at Its Valuation

Zillow Group (ZG) has quietly slipped about 2 % in the past day and is down roughly 15 % over the past 3 months, even as revenue and net income have grown solidly year over year.

See our latest analysis for Zillow Group.

Zooming out, Zillow’s 1 year total shareholder return of negative 9.3 % sits in stark contrast to its roughly 111 % 3 year total shareholder return. This suggests momentum has cooled as investors reassess execution risks against improving fundamentals.

If Zillow has you rethinking where growth could come from next, this might be a good moment to explore fast growing stocks with high insider ownership.

With shares lagging despite double digit revenue growth and a sizable discount to Wall Street targets, the key question now is whether Zillow is quietly undervalued or if the market already reflects its next leg of growth.

Most Popular Narrative Narrative: 18.7% Undervalued

Based on the most followed narrative, Zillow Group’s fair value of $88.46 sits well above the last close at $71.89. This frames an upside story driven by digital scale and margin expansion rather than a quick sentiment rebound.

The shift toward integrated, end to end digital transaction ecosystems (like Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software). This is reducing dependence on advertising and expanding top line growth, as well as supporting EBITDA margin expansion through operational efficiencies.

Want to see why this narrative expects profits to flip from red to firmly positive, while justifying a premium multiple far above industry norms? The full story reveals the growth runway, margin reset, and valuation math behind that conviction, but keeps one crucial profitability bridge hidden in plain sight.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability pressures and commission rule changes could still derail Zillow’s growth trajectory and challenge the bullish valuation narrative.

Find out about the key risks to this Zillow Group narrative.

Another Way to Look at Value

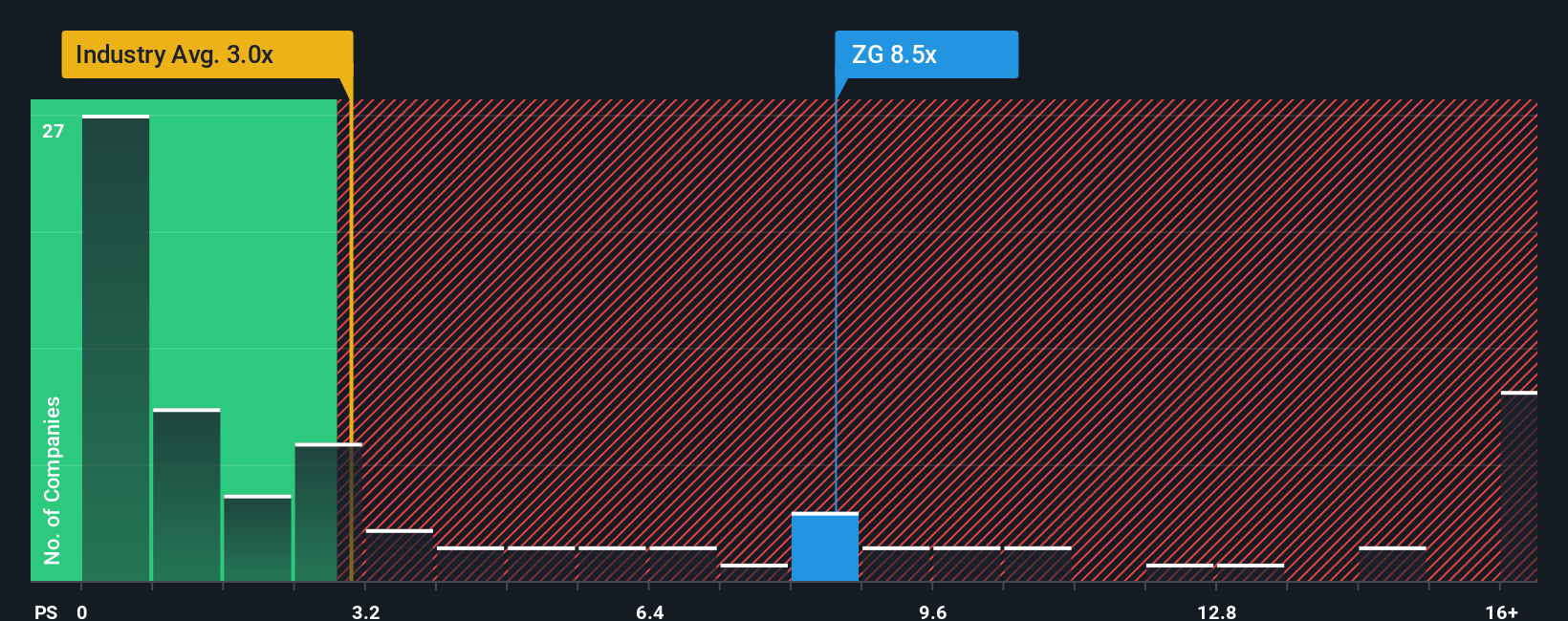

On earnings potential and fair value, Zillow screens as attractive, trading about 28.8% below our estimate of intrinsic value. But on revenue, its 7x price to sales looks rich against peers at 3.2x and a fair ratio of 4.8x, raising the question of which signal the market eventually leans toward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you see the data differently or want to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Ready for your next investing move?

If Zillow is only one piece of your strategy, do not stop here. Use the Simply Wall Street Screener to uncover your next high conviction opportunities.

- Capture long term growth potential with these 906 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Tap into powerful megatrends through these 26 AI penny stocks at the heart of intelligent automation and data driven innovation.

- Secure more predictable income streams by focusing on these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal