How Dolby’s New Home and In‑Car Atmos Experiences Could Reshape the DLB Competitive Narrative

- Dolby Laboratories and Nebraska Furniture Mart recently opened the first Dolby Home Experience at NFM’s The Colony store, creating an immersive, home-like showroom for Dolby Vision and Dolby Atmos alongside leading TVs, soundbars, and devices.

- Coupled with a new Dolby Atmos partnership for Tata Motors’ upcoming Tata Sierra, Dolby is extending its premium entertainment ecosystem directly into both living rooms and car cabins worldwide.

- We’ll now examine how this push into experience‑led retail and in‑car Dolby Atmos could influence Dolby’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dolby Laboratories Investment Narrative Recap

To own Dolby, you have to believe immersive audio and video standards like Atmos and Vision can offset softer, more commoditized device markets and modest forecast growth. The NFM Dolby Home Experience and Tata Sierra Atmos win modestly support near term catalysts around automotive and premium home adoption, but they do not fundamentally change key risks around unit volatility, competition from royalty free alternatives, or dependence on a concentrated set of OEM partners.

The Dolby Atmos integration in Tata’s upcoming Sierra is most relevant here, because it directly reinforces the auto OEM catalyst: more models carrying Dolby tech into everyday use. It aligns with Dolby’s broader push beyond cyclical consumer electronics into emerging verticals such as automotive, where immersive, branded experiences can help diversify licensing revenue away from slower growth foundational products.

But while these wins help, investors should also be aware of the ongoing risk that major OEMs could pivot to in house or open codecs that...

Read the full narrative on Dolby Laboratories (it's free!)

Dolby Laboratories' narrative projects $1.5 billion revenue and $334.6 million earnings by 2028.

Uncover how Dolby Laboratories' forecasts yield a $90.50 fair value, a 35% upside to its current price.

Exploring Other Perspectives

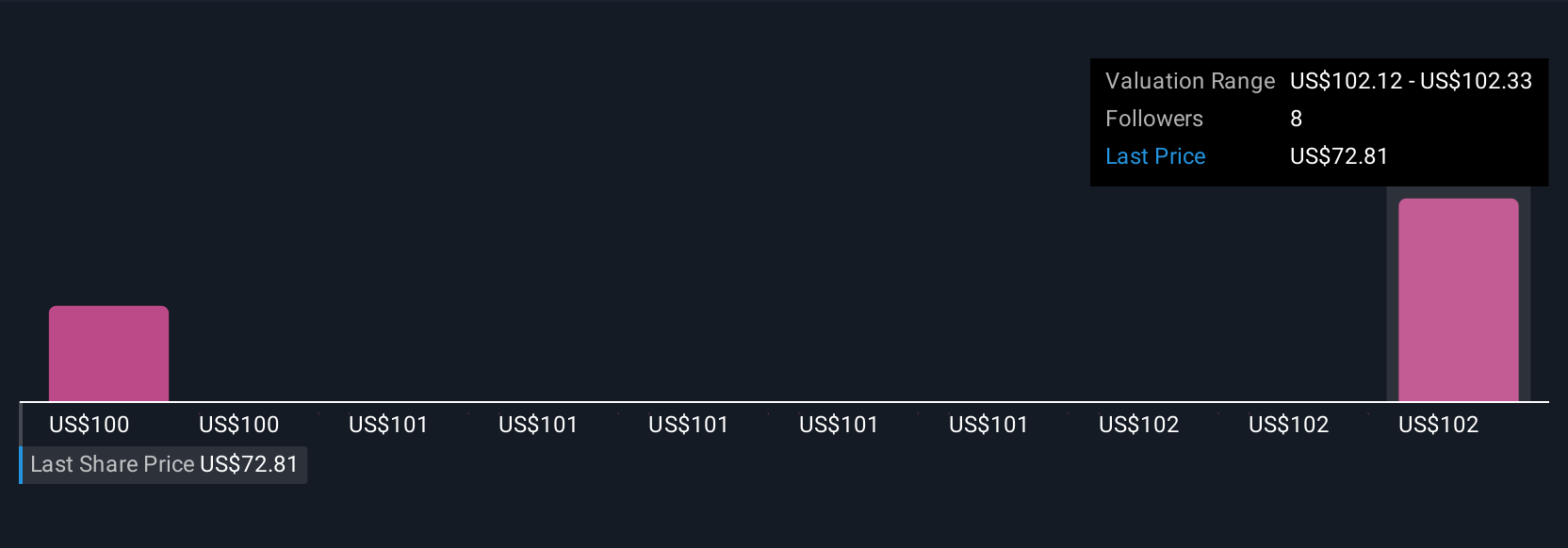

Five fair value estimates from the Simply Wall St Community span roughly US$47 to US$233 per share, reflecting very different expectations. As you weigh these views, keep in mind that Dolby’s growth still leans heavily on broader Atmos and Vision adoption across devices and autos, in markets where commoditization and alternative codecs could materially influence long term licensing power and earnings resilience.

Explore 5 other fair value estimates on Dolby Laboratories - why the stock might be worth 29% less than the current price!

Build Your Own Dolby Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dolby Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dolby Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dolby Laboratories' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal