Assessing NIQ Global Intelligence After a 30.6% Surge and DCF Implied Upside

- Wondering if NIQ Global Intelligence is quietly becoming a bargain, or if the recent buzz is already priced in? Let us unpack what the numbers say about where the value might really be.

- The stock has bounced around lately, with a modest 0.1% move over the last week, a sharp 30.6% jump in the last month, but still sitting at a -17.3% return year to date, hinting at shifting sentiment and possibly rising expectations.

- Those swings have come alongside a steady stream of updates about NIQ Global Intelligence's role in data and analytics, which has kept investors focused on how durable its competitive edge really is. At the same time, broader market chatter around digital transformation has added extra fuel to any company seen as a potential long term winner in insight driven decision making.

- On our checks, NIQ Global Intelligence currently scores 4 out of 6 for valuation, suggesting it looks undervalued on several key measures but not all. Next, we will walk through the main valuation approaches behind that score, and then finish with a more nuanced way to think about what the market might be missing.

Approach 1: NIQ Global Intelligence Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash NIQ Global Intelligence is expected to generate in the future and discounts those projections back to what they are worth in $ today.

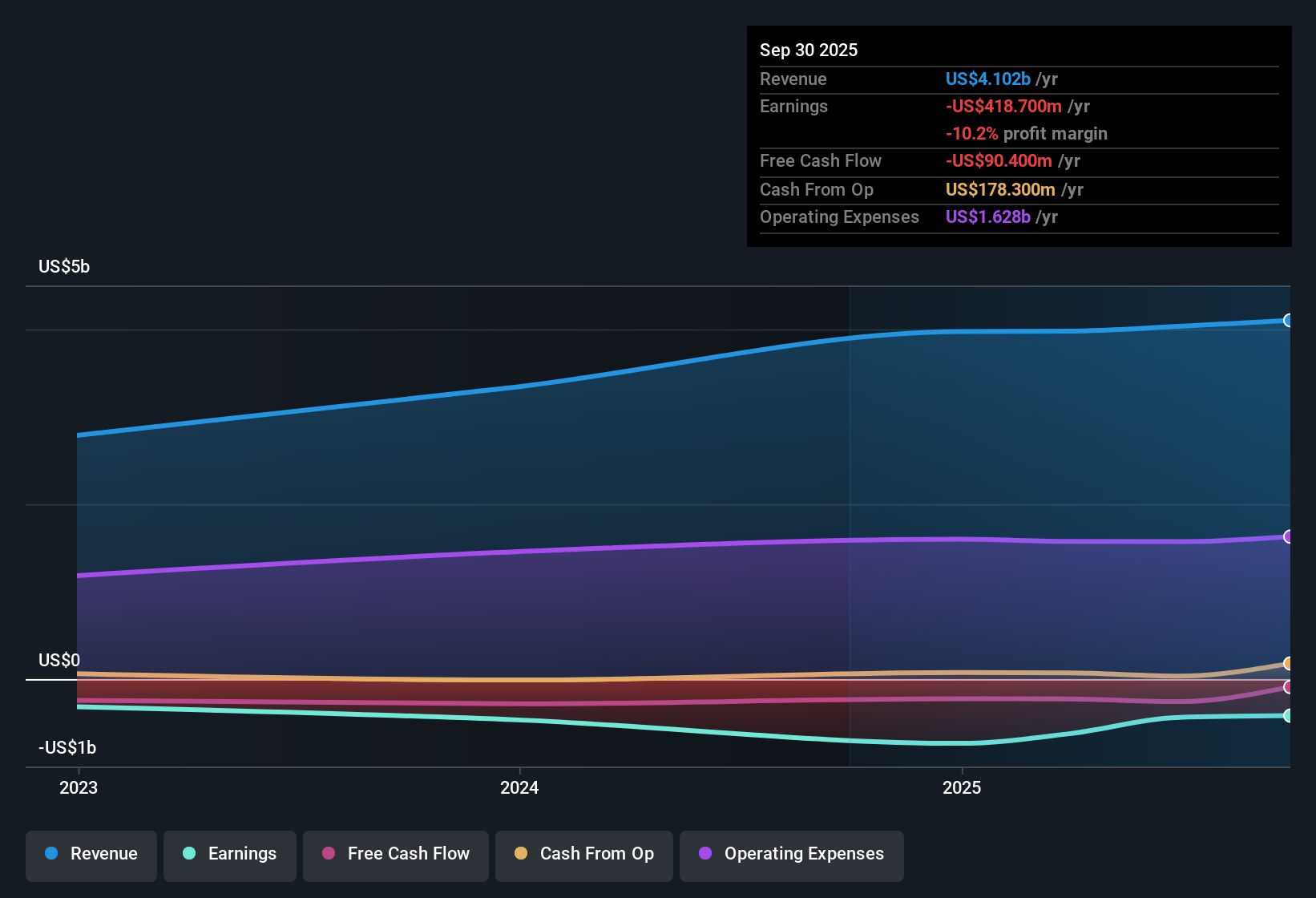

Right now, the company is burning cash, with last twelve month free cash flow of about $132 million in the red. Analysts, however, expect a sharp swing into positive territory, with free cash flow projected to reach roughly $219 million in 2026 and $326 million by 2027. Beyond those formal estimates, cash flows are extrapolated further out, rising to around $815 million by 2035 as growth gradually slows.

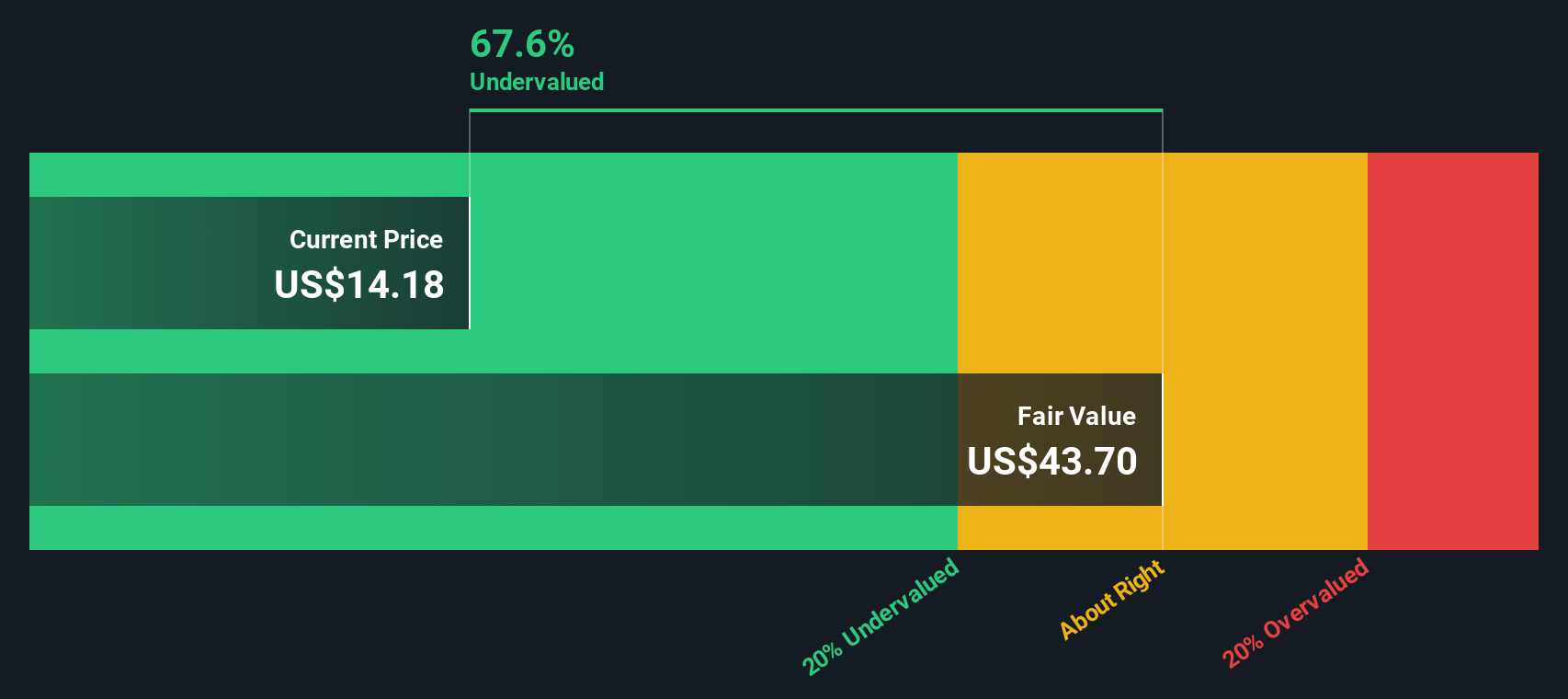

When all those future $ cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, Simply Wall St arrives at an intrinsic value of about $41.48 per share. In this framework, the stock is presented as trading at roughly a 62.1% discount to this estimate, indicating potential upside if the anticipated cash flow improvement occurs.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIQ Global Intelligence is undervalued by 62.1%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: NIQ Global Intelligence Price vs Sales

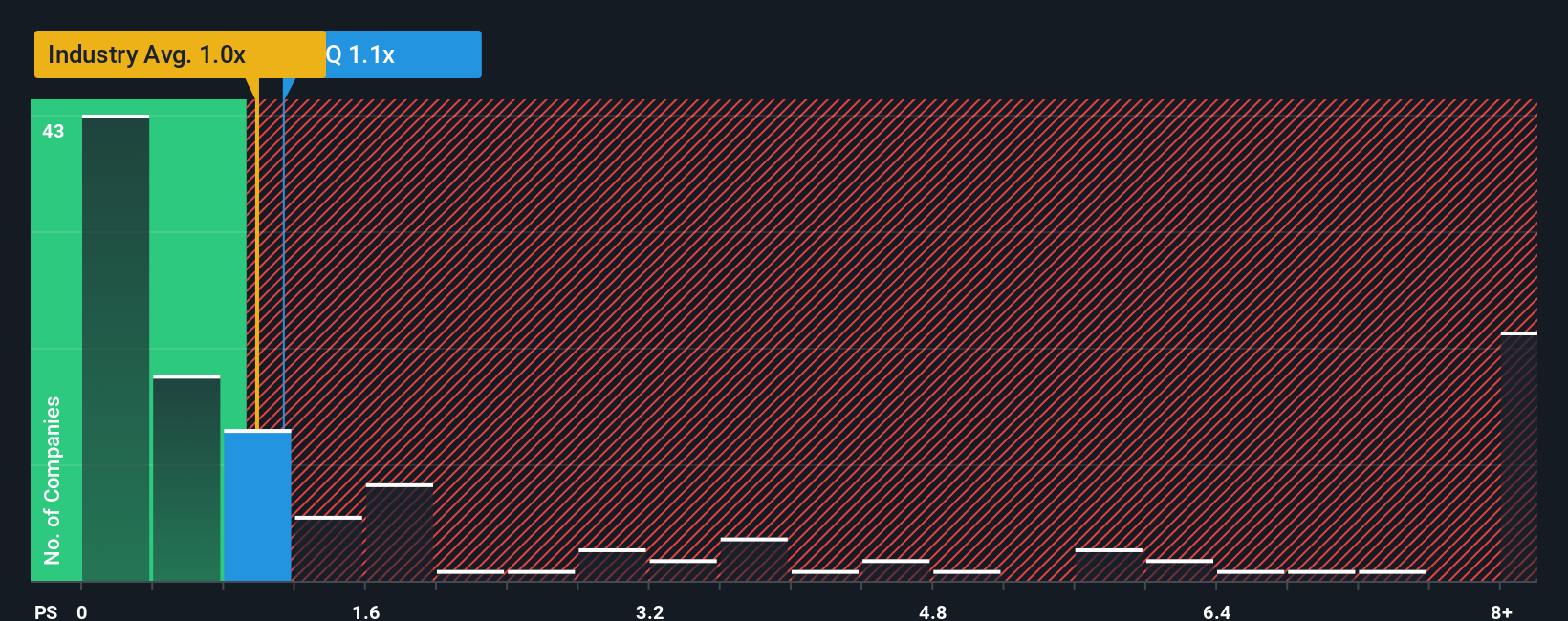

For a business like NIQ Global Intelligence that is still working toward consistent profitability, the price to sales multiple is a useful way to anchor valuation, since it focuses on how the market values each dollar of current revenue rather than near term earnings volatility.

In broad terms, higher growth and lower risk can justify a richer price to sales multiple. Slower growth, thinner margins, or higher uncertainty usually pull that multiple down toward a more conservative range. Against that backdrop, NIQ Global Intelligence currently trades at about 1.13x sales, only slightly above the Media industry average of roughly 0.98x but notably below the peer group average of around 2.31x, which indicates that the market is more cautious on NIQ than on some close comparables.

Simply Wall St goes a step further with its Fair Ratio, a proprietary estimate of what NIQ Global Intelligence’s price to sales multiple could be once you factor in its growth outlook, profitability profile, risk, industry positioning, and market cap. Because this Fair Ratio is tailored to NIQ’s specific fundamentals rather than broad group averages, it provides a more nuanced yardstick than simple peer or industry comparisons.

Result: Potential Undervaluation on a Price to Sales Basis

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIQ Global Intelligence Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of NIQ Global Intelligence’s story with the numbers behind it. A Narrative is your personal, structured perspective on a company, where you spell out how you think revenue, earnings, and margins will evolve, and what that implies for fair value. Instead of treating forecasts as abstract spreadsheets, Narratives link three pieces together: the business story, a concrete financial forecast, and a resulting estimate of fair value. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making the tool both accessible and easy to use. Narratives then help you decide when to buy or sell by comparing your Fair Value to the current share price, and they automatically update as new information, like earnings reports or major news, flows in. For NIQ Global Intelligence, one investor might create a Narrative with conservative growth and a low fair value while another assumes faster adoption and higher margins, resulting in a much higher fair value.

Do you think there's more to the story for NIQ Global Intelligence? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal