How Investors Are Reacting To Stock Yards Bancorp (SYBT) Sm-All Star Nod and New Market President

- Stock Yards Bancorp recently announced that Stock Yards Bank & Trust has appointed veteran banker Rick Seadler as Bowling Green Market President, while the company was also named to Piper Sandler’s elite 2025 “Sm-All Stars” list for top-performing small-cap banks.

- This combination of fresh local leadership and third-party recognition for growth, profitability, credit quality, and capital strength reinforces Stock Yards Bancorp’s franchise quality among regional peers.

- With that backdrop, we’ll explore how Piper Sandler’s Sm-All Star recognition shapes Stock Yards Bancorp’s investment narrative and competitive positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Stock Yards Bancorp's Investment Narrative?

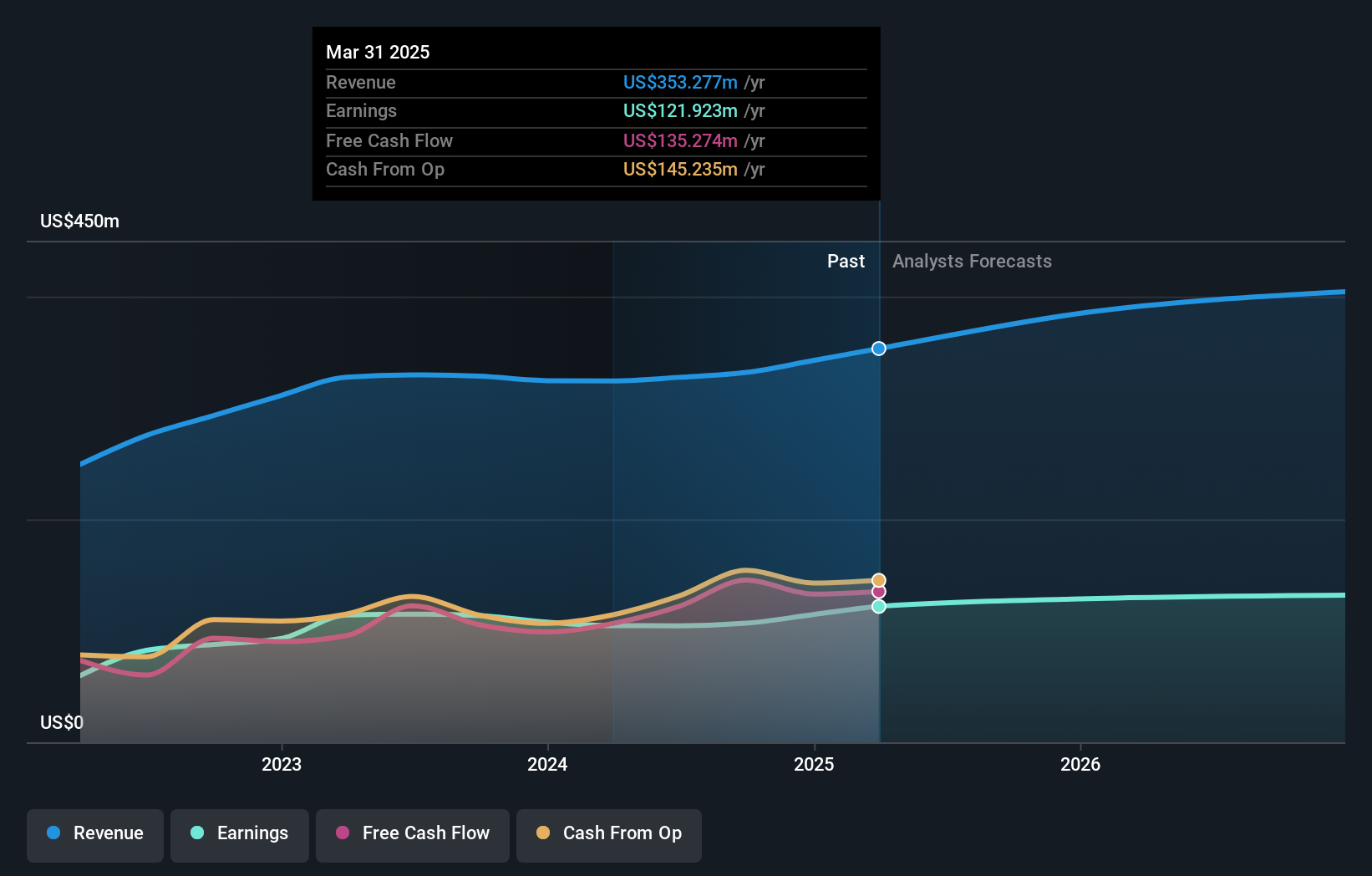

To own Stock Yards Bancorp, you need to be comfortable with a straightforward regional banking story: steady, mid‑single‑digit growth in revenue and earnings, a long record of profitability, and a dividend that has inched higher over time, offset by a relatively low return on equity and recent share price underperformance versus both the market and bank peers. The key near term catalysts still revolve around how effectively the bank can translate its above‑peer net interest income growth into stronger margins and returns, while keeping credit quality intact. The Piper Sandler Sm‑All Stars recognition and the appointment of Rick Seadler in Bowling Green both support the franchise and could incrementally help growth, but they are unlikely to materially change the near term earnings trajectory or risk profile by themselves. The bigger swing factors remain margin pressure, loan growth, and any credit surprises.

However, one risk in particular may catch shareholders off guard if conditions turn. Stock Yards Bancorp's shares have been on the rise but are still potentially undervalued by 35%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Stock Yards Bancorp - why the stock might be worth just $69.89!

Build Your Own Stock Yards Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stock Yards Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stock Yards Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal