Is Netskope (NTSK) Turning MCP Security Into a Durable Edge in Enterprise AI Governance?

- Netskope recently introduced new security capabilities for Model Context Protocol (MCP) communications within its Netskope One platform, aiming to give enterprises better visibility, access control, and data protection for AI agents, with general availability planned for the first half of 2026.

- By extending its Cloud Confidence Index risk scoring and granular policy controls to MCP servers, Netskope is positioning itself as an early specialist in securing the fast-emerging ecosystem of autonomous AI tools inside large organizations.

- We’ll examine how Netskope’s focus on securing MCP-enabled AI interactions could reshape the company’s investment narrative for long-term investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Netskope's Investment Narrative?

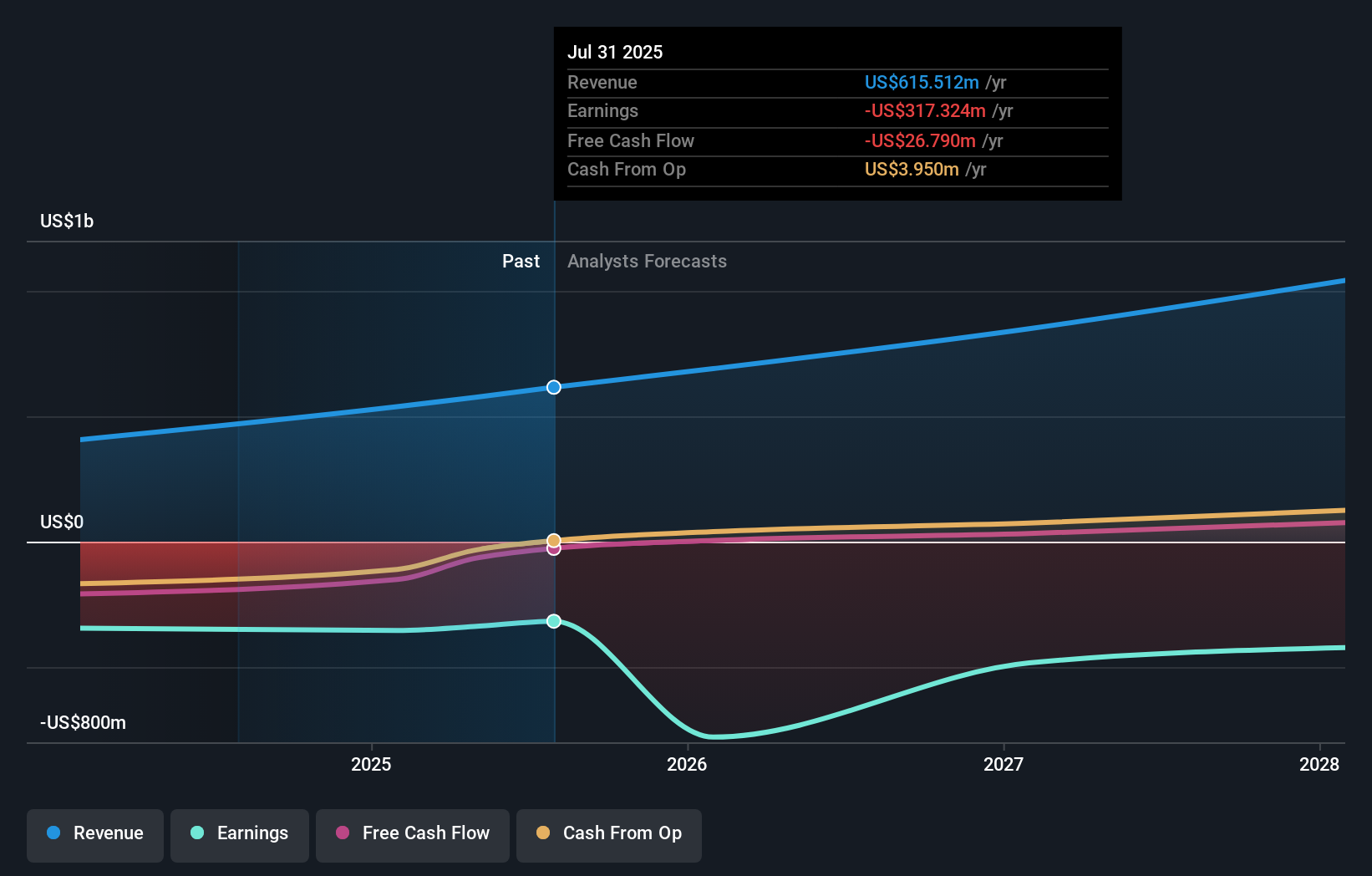

To own Netskope, you really have to believe that securing AI-heavy, cloud-first enterprises can support premium pricing even while the company remains unprofitable and trades on a rich sales multiple. The new MCP protections and recent Microsoft integrations strengthen the story around Netskope One as a control plane for AI agents, which could matter for near-term adoption and ARR growth, but probably do not remove the key short-term swing factors: execution around its first post-IPO earnings, sales efficiency, and progress toward narrowing losses from US$317,324,000. At the same time, the rapidly expanding AI feature set raises the execution risk of doing a lot at once, especially with negative equity, high valuation, and lock-up expiries still ahead. For now, the MCP news looks more like a supportive catalyst than a thesis changer.

However, one risk in particular may surprise investors who only focus on the AI upside.Netskope's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.

Exploring Other Perspectives

Explore 5 other fair value estimates on Netskope - why the stock might be worth as much as 30% more than the current price!

Build Your Own Netskope Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netskope research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Netskope research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netskope's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal