Is It Too Late To Consider Luckin Coffee After Its 49.3% One Year Surge?

- If you are wondering whether Luckin Coffee’s latest price still leaves room for upside or if most of the gains are already reflected, you are not alone. This breakdown is for investors in exactly that position.

- Despite slipping 1.4% over the last week and 5.9% over the last month, Luckin is still up 33.4% year to date and 49.3% over the past year, which keeps it firmly on growth investors’ radar.

- Those moves follow a string of expansion updates in China and abroad that have highlighted Luckin’s aggressive store rollout and product experimentation. They have also reignited debate about how sustainable its growth model really is. At the same time, the stock’s long-term gain of 788.6% over five years has shifted market sentiment from “speculative recovery story” toward “maturing growth compounder,” which changes how investors may think about valuation and risk.

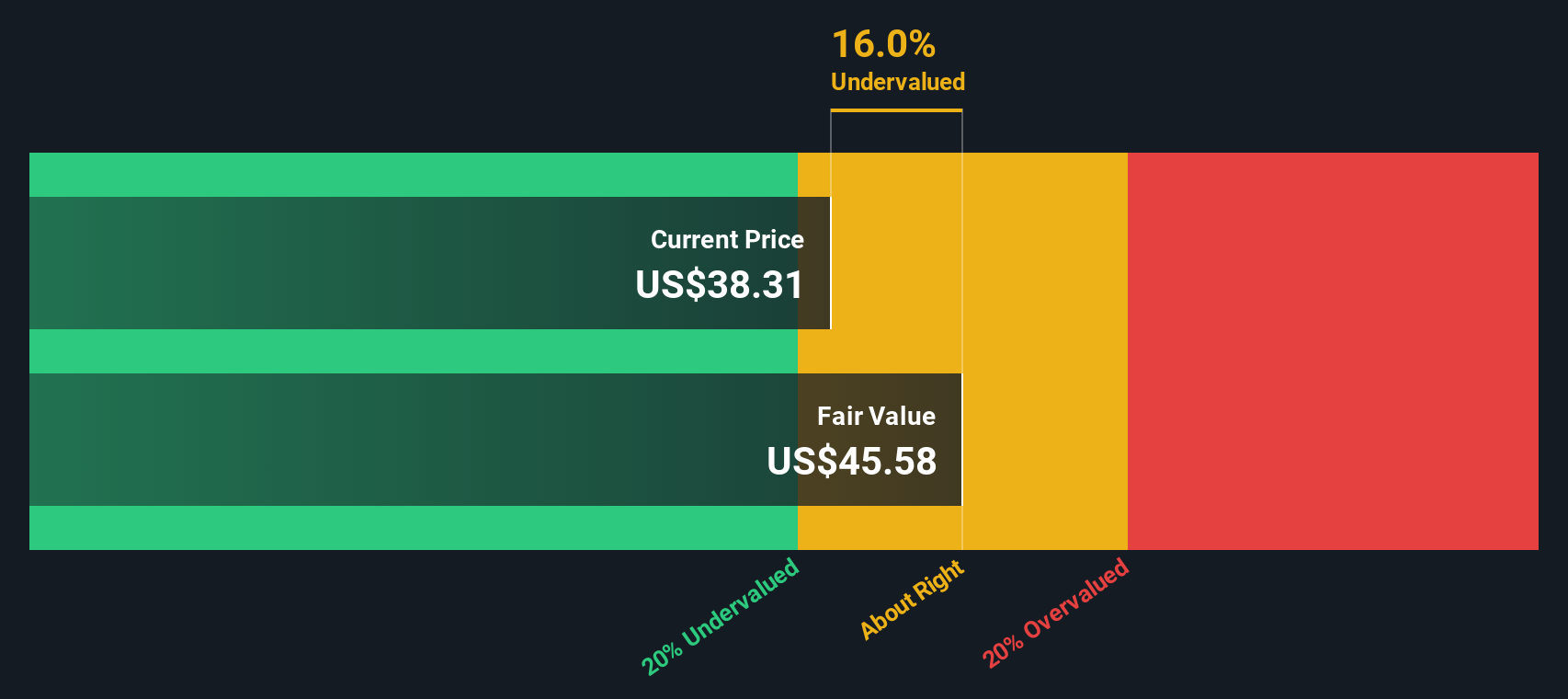

- Right now, our framework gives Luckin Coffee a 4/6 valuation score, suggesting it appears undervalued on several fronts, though not all. In the sections ahead we unpack what that score means using multiple valuation lenses, and then finish with a more holistic way to think about what the market might be overlooking.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth today by extrapolating future cash flow projections and discounting them back to their present value. For Luckin Coffee, the 2 Stage Free Cash Flow to Equity model starts from last twelve months free cash flow of about CN¥4.39 billion and then projects how this might evolve as the business matures.

Analysts provide detailed forecasts for the next few years. Beyond that point, Simply Wall St extrapolates growth, leading to an estimated free cash flow of roughly CN¥5.39 billion by 2035. Each of these projected cash flows is discounted back to today in CN¥ terms, and then summed to arrive at an equity value per share.

This process produces an intrinsic value estimate of $29.73 per share, compared with a current share price that implies the stock is about 20.8% above this DCF value. On this basis, the cash flow outlook suggests the market is already pricing in optimistic growth assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luckin Coffee may be overvalued by 20.8%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Luckin Coffee Price vs Earnings

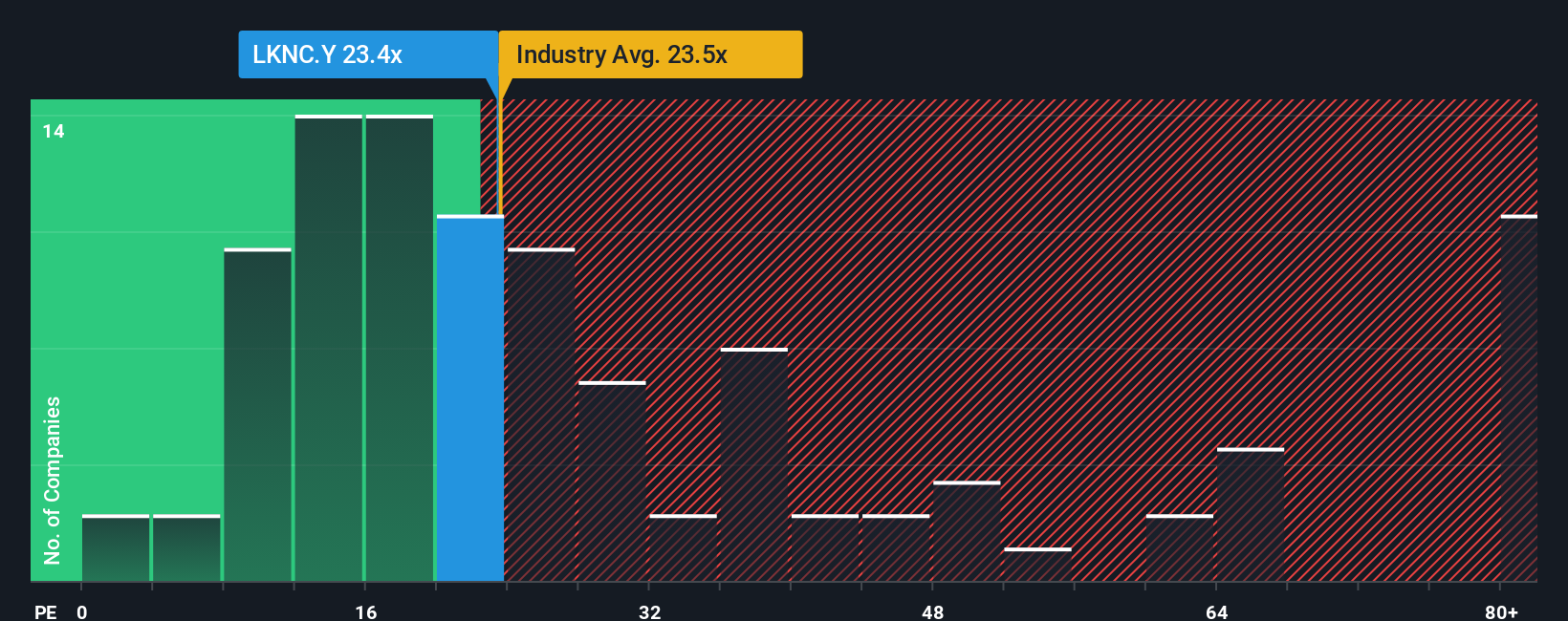

For profitable businesses like Luckin Coffee, the price to earnings ratio is a straightforward way to connect what the company earns today with what investors are willing to pay for each dollar of profit. In general, faster growth and lower perceived risk justify a higher PE ratio, while slower or shakier companies tend to trade on lower multiples.

Luckin currently trades on a PE of about 20.8x, broadly in line with the Hospitality industry average of roughly 21.2x, but well below the peer group average of around 54.1x. To move beyond these blunt comparisons, Simply Wall St calculates a Fair Ratio of 26.8x. This reflects what a typical PE might be for a business with Luckin’s earnings growth profile, margins, industry, size and risk factors.

This Fair Ratio is more informative than simple peer or sector averages because it explicitly adjusts for company specific strengths and weaknesses, rather than assuming all hospitality stocks deserve similar valuations. With Luckin’s current 20.8x multiple sitting meaningfully below the 26.8x Fair Ratio, the preferred multiple view points to upside from today’s level.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

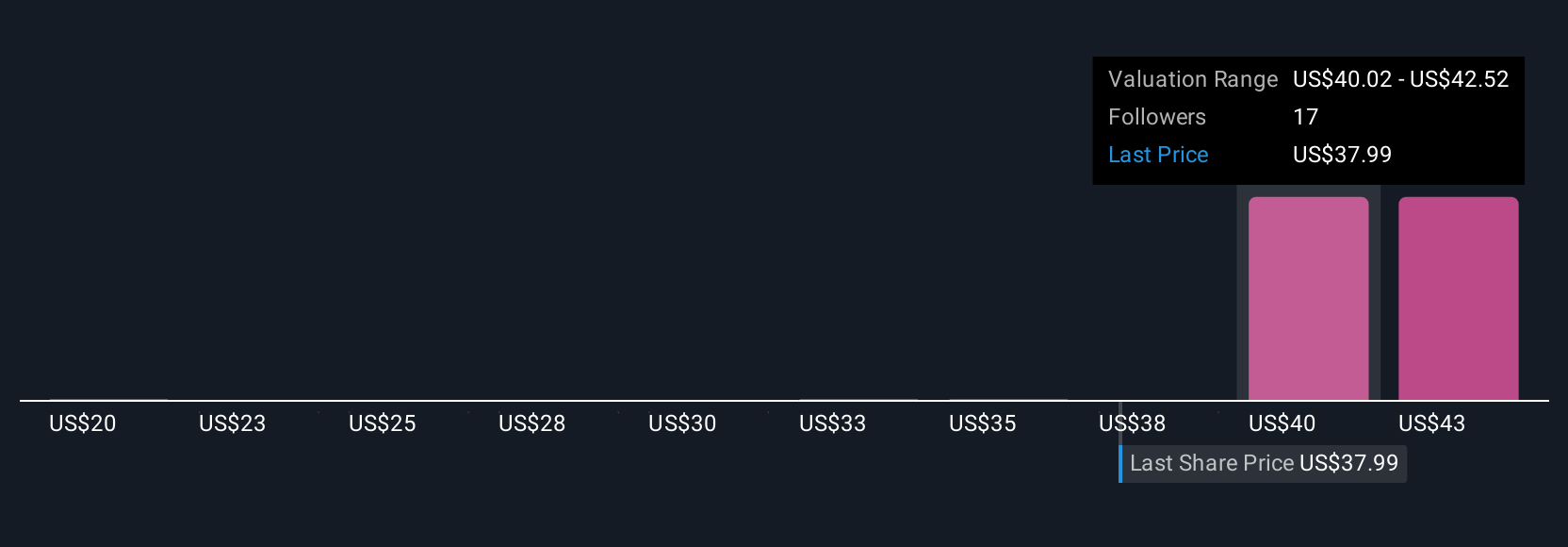

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about a company with the numbers behind its future.

A Narrative on Simply Wall St lets you spell out your view on a business, link it to a specific forecast for revenue, earnings and margins, and then see the fair value that drops out of that story.

Because Narratives live inside the Community page on Simply Wall St, used by millions of investors, they are easy to access, compare and tweak. They also continuously update as new information such as earnings, news or guidance changes the outlook.

For Luckin Coffee, one investor might build a Narrative that assumes strong execution and a fair value near the high end of community estimates around $50. A more cautious investor could instead plug in slower growth and more margin pressure and arrive at a much lower fair value. Each can then compare their fair value to today’s price to decide whether Luckin looks like a buy, hold or sell for them right now.

Do you think there's more to the story for Luckin Coffee? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal