Blue Owl Capital (OWL): Valuation Check After Insider Buying, Fundraising Success and Ongoing Class Action Lawsuits

Blue Owl Capital (OWL) is back in the spotlight after insiders bought heavily into the stock while the firm closed a new $1.7 billion digital infrastructure fund, even as class action lawsuits swirl.

See our latest analysis for Blue Owl Capital.

Those heavy insider purchases and the $1.7 billion digital infrastructure fund are landing against a mixed backdrop, with a recent 7 day share price return of 8.27% but a year to date share price return of negative 31.16%. At the same time, the 3 year total shareholder return of 65.96% hints that long term momentum, though dented, is not broken.

If Blue Owl’s rebound has you rethinking where management conviction matters most, now is a good moment to explore fast growing stocks with high insider ownership as potential next ideas.

With shares still trading at a steep discount to analyst targets despite brisk fundraising and insider conviction, is Blue Owl quietly undervalued, or is the market already bracing for weaker earnings and slower growth ahead?

Most Popular Narrative Narrative: 24.1% Undervalued

With Blue Owl Capital last closing at $16.24 against a narrative fair value of $21.40, the story hinges on powerful growth and margin assumptions.

Significant ongoing growth in permanent capital vehicles, particularly through expansion in private credit, real assets, and evergreen/interval fund strategies, is providing stable and recurring management fee revenue and positioning Blue Owl for higher future earnings and durable margin expansion.

Curious how steady fees could still support aggressive profit expansion and a lower future earnings multiple than many peers? Explore the full narrative playbook behind this valuation.

Result: Fair Value of $21.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained fundraising slowdowns or tougher competition squeezing fees could easily derail those ambitious growth and margin assumptions that are embedded in today’s valuation.

Find out about the key risks to this Blue Owl Capital narrative.

Another Angle on Valuation

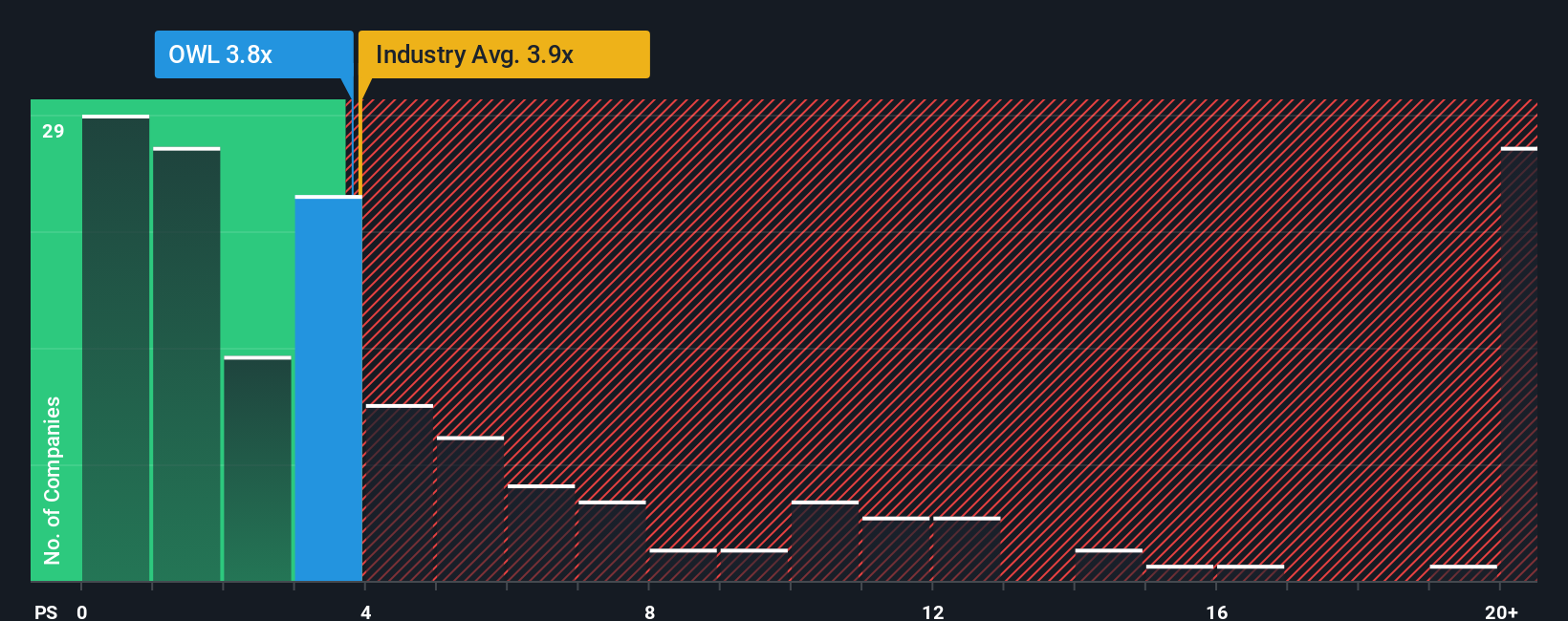

While the community fair value suggests upside, a simple price to sales lens paints Blue Owl as fully priced. The stock trades on 3.9 times sales, roughly in line with both its 3.9 times fair ratio and the 4 times industry average, leaving limited clear margin of safety.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blue Owl Capital Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view of Blue Owl in just minutes. Do it your way.

A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunity by using our powerful screeners to pinpoint focused themes, strong fundamentals, and income friendly portfolios.

- Identify potential bargains early by targeting companies that our models flag as attractively priced through these 906 undervalued stocks based on cash flows.

- Find opportunities in the next wave of innovation by focusing on fast moving companies across these 26 AI penny stocks.

- Build your passive income stream by filtering for dependable payers among these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal