Taking Another Look at Aspen Insurance Holdings (AHL) Valuation After Its Recent Share Price Climb

Recent performance and valuation context

Aspen Insurance Holdings (AHL) has been quietly grinding higher this year, with the stock up about 14% year to date. This move has prompted investors to revisit how its fundamentals stack up at current levels.

See our latest analysis for Aspen Insurance Holdings.

After a steady climb, the current share price of $37.0 reflects a year to date share price return of nearly 14%. This suggests investors are gradually pricing in improved profitability and a slightly stronger growth profile rather than a sudden shift in risk appetite.

If Aspen’s measured move higher has you thinking about where else disciplined momentum could show up, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential standouts.

With earnings trending higher, a modest uplift to analysts’ price targets, and the shares still trading at a hefty discount to intrinsic value estimates, is Aspen quietly becoming a buying opportunity, or is the market already pricing in future growth?

Price-to-Earnings of 8.5x: Is it justified?

At a last close of $37.0, Aspen Insurance Holdings trades on a price to earnings ratio of 8.5 times, which screens as notably undervalued versus peers.

The price to earnings multiple compares the current share price to the company’s earnings. This makes it a straightforward way to gauge how much investors are paying for each dollar of profit in an insurance and reinsurance business like Aspen.

Relative to similar US insurance names, Aspen’s 8.5 times earnings suggests the market is assigning a clear discount to its profit stream, despite forecasts calling for earnings to keep growing around high single digits each year and the company already having high quality earnings in place.

The gap becomes starker when set against benchmarks, with Aspen trading well below the US Insurance industry average multiple of 12.8 times and also below the estimated fair price to earnings ratio of 14.7 times. These levels indicate where the market could gravitate if sentiment and fundamentals stay aligned.

Explore the SWS fair ratio for Aspen Insurance Holdings

Result: Price-to-Earnings of 8.5x (UNDERVALUED)

However, investors should note that softer reinsurance pricing or unexpectedly large catastrophe losses could quickly compress margins and challenge the improving earnings narrative.

Find out about the key risks to this Aspen Insurance Holdings narrative.

Another view on valuation

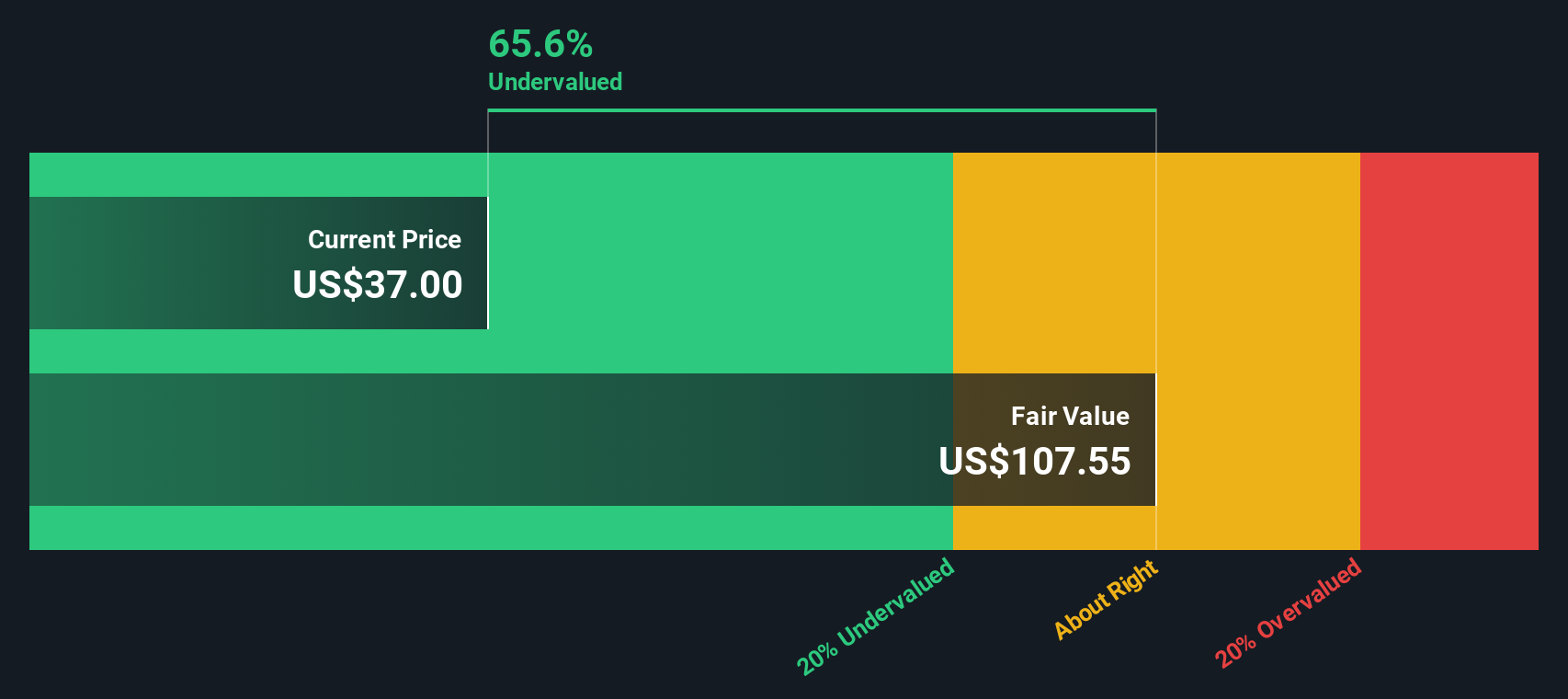

Our DCF model paints an even starker picture, putting Aspen’s fair value near $107.55 per share, around 66% above today’s $37 price. If both earnings multiples and cash flow signals are pointing to upside, is the market underestimating how durable Aspen’s recovery could be?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aspen Insurance Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aspen Insurance Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can quickly build a personalised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aspen Insurance Holdings.

Looking for more investment ideas?

Before you move on, explore your next opportunity by tapping into data driven stock ideas from our powerful screener tools so your watchlist can keep evolving.

- Seek early potential by targeting resilient small caps through these 3576 penny stocks with strong financials that combine speculative upside with solid underlying financials.

- Enhance your growth watchlist with these 26 AI penny stocks focused on companies working to turn artificial intelligence into measurable revenue.

- Explore value oriented candidates using these 906 undervalued stocks based on cash flows that highlight stocks trading below levels suggested by their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal