Should Simply Good Foods’ One-Time Atkins Impairment Reshape How SMPL Investors View Its Brand Portfolio?

- The Simply Good Foods Company recently recorded a one-time, non-cash impairment of about US$60 million to revalue the Atkins brand and other intangibles, resulting in a GAAP loss per share despite otherwise steady operations.

- This accounting adjustment, which does not reflect a deterioration in the core business, has sharpened investor focus on the resilience of Simply Good Foods’ underlying brands and profitability drivers.

- Next, we’ll examine how this one-time Atkins impairment reshapes Simply Good Foods’ investment narrative and the outlook for its brand mix.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Simply Good Foods Investment Narrative Recap

To own Simply Good Foods, you need to believe in the long term appeal of its better-for-you snacks and meal replacements, and the company’s ability to manage a mixed brand portfolio that includes a slower Atkins franchise. The recent US$60 million non cash impairment is largely an accounting reset, so it does not materially change the near term focus on stabilizing Atkins trends or the ongoing risk around leadership transition and execution.

The most relevant recent announcement is Simply Good Foods’ Q4 FY2025 and full year FY2025 results, where the impairment pushed the quarter into a GAAP loss despite higher full year sales and positive net income. This puts the spotlight on whether management can keep growing revenues, protect margins under cost pressure, and use its brand mix to offset any continued drag from Atkins while integrating newer growth engines like OWYN.

Yet beneath the accounting noise, the real issue investors should be watching is how dependent Simply Good Foods still is on a shrinking Atkins brand and...

Read the full narrative on Simply Good Foods (it's free!)

Simply Good Foods' narrative projects $1.6 billion revenue and $204.1 million earnings by 2028. This requires 4.1% yearly revenue growth and about a $58.8 million earnings increase from $145.3 million today.

Uncover how Simply Good Foods' forecasts yield a $29.70 fair value, a 57% upside to its current price.

Exploring Other Perspectives

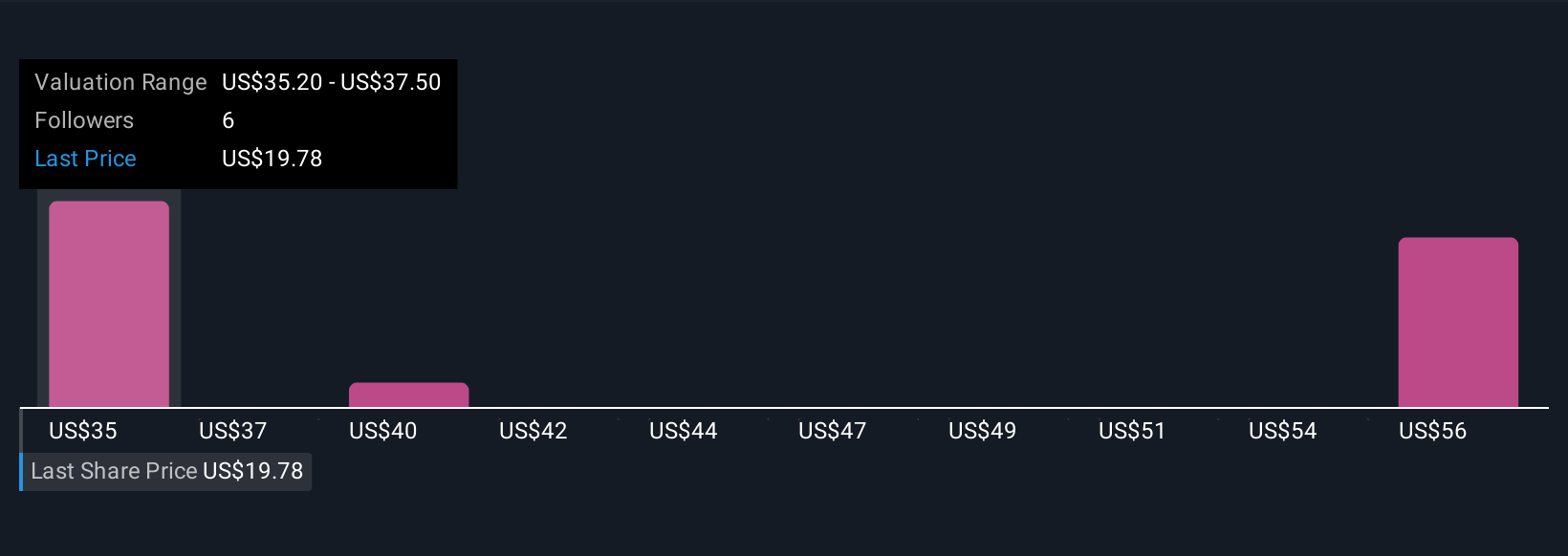

Three Simply Wall St Community fair value estimates for Simply Good Foods range from US$29.70 to about US$57.56, underlining how far opinions can diverge. You should weigh that spread against the recent Atkins impairment and brand concentration risk, and then explore several viewpoints before deciding how this fits into your portfolio.

Explore 3 other fair value estimates on Simply Good Foods - why the stock might be worth over 3x more than the current price!

Build Your Own Simply Good Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Simply Good Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Simply Good Foods' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal