Amphenol (APH): Revisiting Valuation After a Powerful Multi-Year Share Price Rally

Amphenol (APH) has quietly rewarded patient investors, with the stock nearly doubling over the past year and tripling over the past 3 years, yet its recent month-long move has been relatively flat.

See our latest analysis for Amphenol.

At a share price of $139.36, Amphenol’s 90 day share price return of 26.17 percent, alongside an 89.29 percent total shareholder return over the past year, shows momentum is still very much intact and reflects confidence in its growth and earnings resilience.

If Amphenol’s run has you thinking about what else could surprise to the upside, this is a good moment to explore high growth tech and AI stocks for more potential standouts.

With shares hovering just below analyst targets after a powerful multi year rally, the key question now is whether Amphenol is still trading below its true worth or if the market has already priced in its future growth.

Most Popular Narrative: 5.9% Undervalued

With Amphenol last closing at $139.36 against a narrative fair value near $148, the story leans toward upside embedded in accelerating structural growth.

Enhanced focus on high technology, differentiated product mix driven by customer demand for mission critical, high performance components has strengthened pricing power and operating efficiency, resulting in structurally higher conversion and operating margins, with management now targeting 30% incremental margin conversion versus the historical 25%.

Want to see how ambitious revenue growth, expanding margins, and a punchy future earnings multiple all fit together into that fair value? The narrative connects every dot. Curious which assumptions really drive it? Read on to uncover the full blueprint behind this valuation call.

Result: Fair Value of $148.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI datacenter strength is not guaranteed, and elevated capex plus acquisition execution risk could quickly challenge today’s premium growth narrative.

Find out about the key risks to this Amphenol narrative.

Another Angle on Valuation

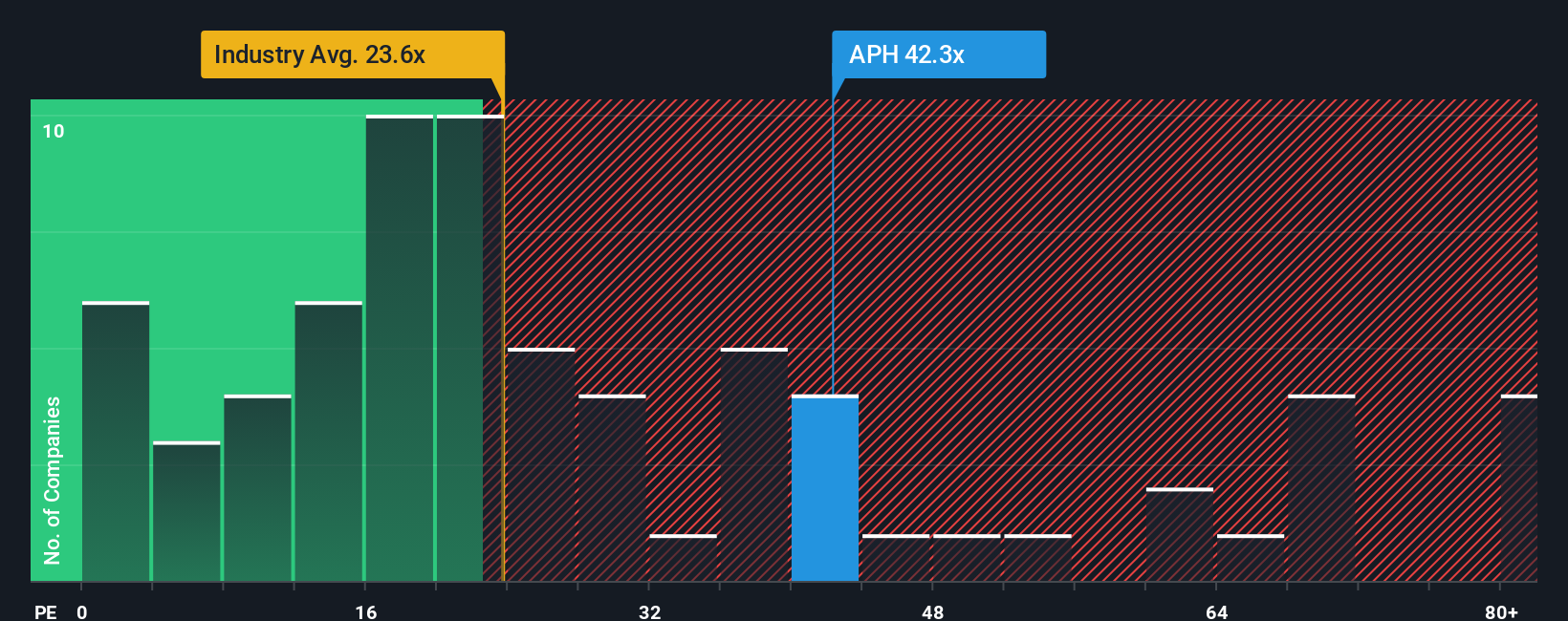

Step away from the narrative fair value and the current price of $139.36 looks demanding. On earnings, Amphenol trades at about 44.6 times, versus 24.6 times for the US Electronic industry and a fair ratio near 35 times, which tilts risk toward multiple compression if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amphenol Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Amphenol research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with focused stock ideas from the Simply Wall St Screener, built to target specific strengths the market often overlooks.

- Capture potential market mispricings by targeting companies that look cheap on cash flow metrics using these 906 undervalued stocks based on cash flows.

- Capitalize on breakthroughs at the frontier of computing by tracking innovators shaping tomorrow’s infrastructure through these 28 quantum computing stocks.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal