Is Premier Investments' A$100m Buyback (ASX:PMV) A Sign Of Discipline Or Fewer Growth Options?

- Premier Investments Limited (ASX:PMV) recently authorised a share repurchase program of up to A$100,000,000 of its ordinary shares, running until 23 December 2025 and targeting earnings per share accretion and higher shareholder returns.

- This buyback meaningfully reduces Premier’s share count potential from its 159,879,998 issued shares, signalling management’s confidence in the company’s capital position and cash generation.

- Next, we’ll examine how Premier’s A$100,000,000 buyback plan reshapes its investment narrative, particularly around capital allocation discipline.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Premier Investments' Investment Narrative?

To own Premier Investments today, you need to believe the core retail brands can keep converting modest revenue growth and high quality earnings into attractive cash generation, even after a tough year for profits and share price performance. The A$100,000,000 buyback slots into that story as a capital allocation call: management is effectively preferring to retire shares at a time when the market has marked the stock down sharply, rather than hoard cash or pursue large expansions. In the short term, this could support earnings per share and signal confidence, but it does not remove key risks around slower forecast growth than the broader Australian market, a low but improving return on equity, and an unstable dividend history. For now, the buyback looks supportive rather than transformational.

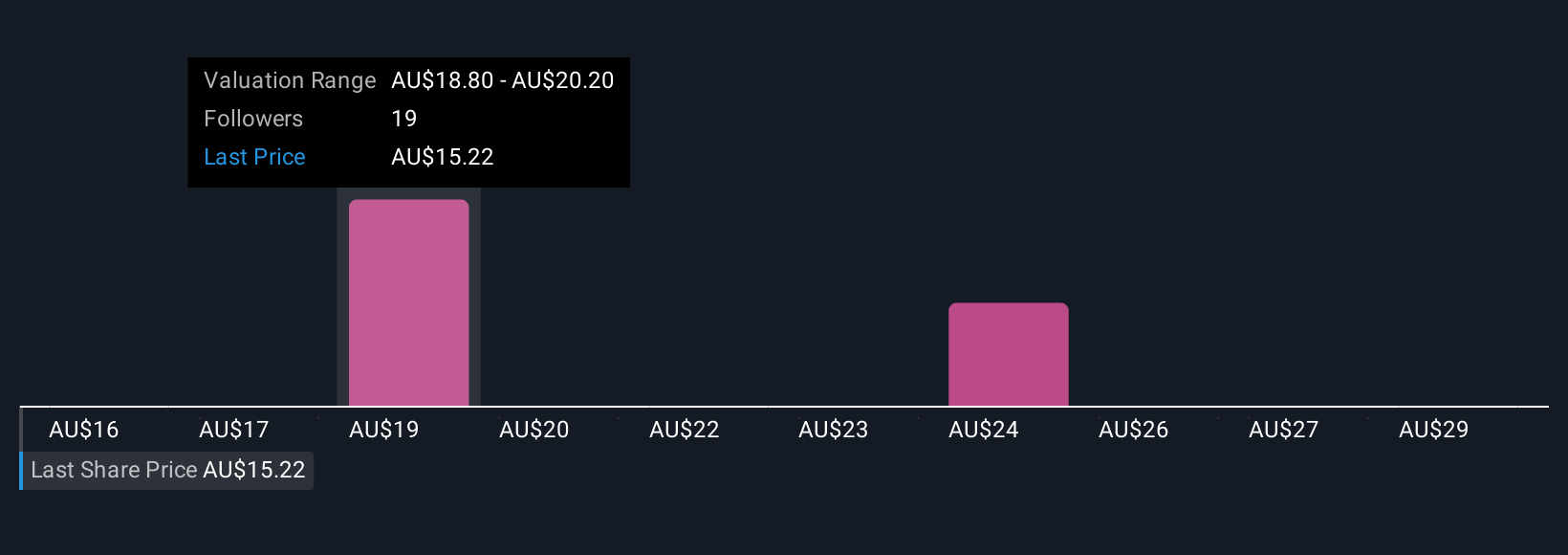

However, one risk in particular could matter more than the buyback itself for shareholders. Despite retreating, Premier Investments' shares might still be trading 40% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 7 other fair value estimates on Premier Investments - why the stock might be worth just A$16.00!

Build Your Own Premier Investments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Premier Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Premier Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Premier Investments' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal