Evaluating Genuine Parts After 12.2% Rally and Portfolio Streamlining Moves

- If you have ever looked at Genuine Parts and wondered whether you are getting a quality business at a fair price or quietly overpaying, this breakdown is for you.

- The stock has climbed 12.2% year to date and 4.5% over the last month, even though the 3 year return is still down 22.1%. This hints at a turnaround in sentiment after a tougher stretch.

- Recent headlines have focused on Genuine Parts sharpening its portfolio and pushing further into industrial and automotive distribution efficiency. Investors often view these moves as potential long term margin and growth drivers. At the same time, discussions around the broader auto parts and industrial supply chains have highlighted both opportunities and risks that help explain the more cautious 8.9% gain over the past year.

- On our numbers, Genuine Parts scores a 3 out of 6 on our undervaluation checks. Next we will walk through what different valuation methods say about that score and then finish with a more complete way to think about what the stock is really worth.

Approach 1: Genuine Parts Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Genuine Parts, the latest twelve month Free Cash Flow is about $144.1 Million, which analysts expect to grow steadily as the company improves efficiency in its distribution networks.

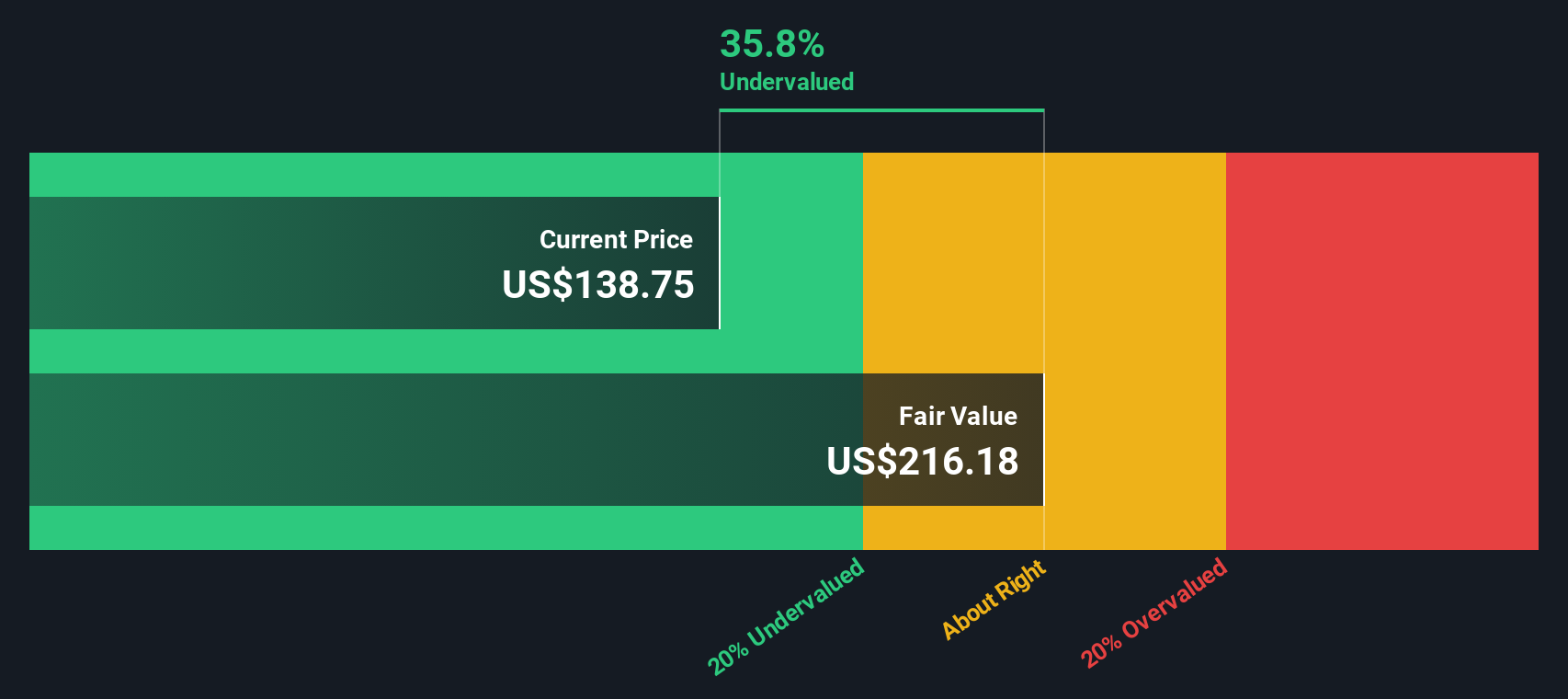

Using a 2 Stage Free Cash Flow to Equity model that combines analyst estimates for the next few years with longer term projections from Simply Wall St, Genuine Parts cash flows are expected to rise to around $1.9 Billion by 2035. All of those future $ cash flows are discounted back to today to arrive at an estimated fair value of roughly $222.34 per share.

Based on that fair value, the stock screens as about 41.4% undervalued relative to its current market price, which suggests that the market may be too cautious about Genuine Parts longer term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Genuine Parts is undervalued by 41.4%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Genuine Parts Price vs Earnings

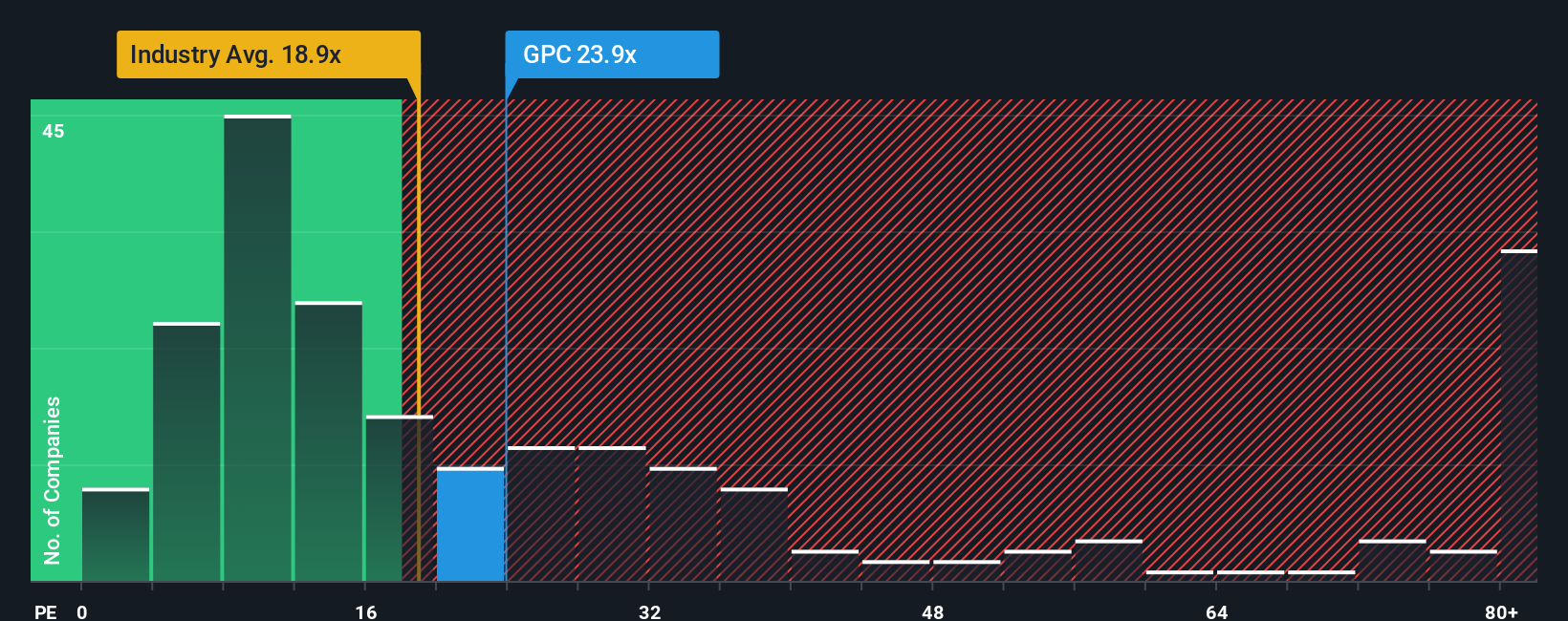

For profitable, established businesses like Genuine Parts, the price to earnings ratio is often the cleanest way to judge whether investors are paying a sensible price for each dollar of current profit. A higher PE can be justified when the market expects stronger growth or sees the earnings stream as relatively low risk, while slower or more volatile growers usually deserve a lower, more conservative PE.

Genuine Parts currently trades at about 22.4x earnings, which is above the Retail Distributors industry average of roughly 17.8x but below the broader peer group average of around 36.7x. Simply Wall St goes a step further by estimating a Fair Ratio of 19.4x, a proprietary view of what Genuine Parts PE should be once its earnings growth outlook, margins, risk profile, industry and market cap are all factored in. This tailored benchmark is more informative than a simple peer or industry comparison because it adjusts for the company specific mix of quality and risk that crude averages ignore. On that basis, the current 22.4x multiple sits noticeably above the 19.4x Fair Ratio, which indicates that the market price already reflects relatively optimistic expectations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Genuine Parts Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to match your view of a company with a financial forecast and a fair value estimate. A Narrative is your story behind the numbers, where you spell out what you believe about Genuine Parts future revenue, earnings and margins, then see what that implies for fair value. Narratives link three things together: the business story, the forecast, and the valuation. They are easy to build and compare on Simply Wall St’s Community page, which is used by millions of investors. Once you have a Narrative, you can quickly see whether your Fair Value is above or below the current share price, and then decide whether that means you want to buy, hold or sell. Narratives are dynamic too, automatically updating when new earnings, guidance or news arrives, so your view stays current without constant manual tweaking. For example, one Genuine Parts Narrative might lean bullish, assuming improving margins, a 4.1% revenue growth rate and a fair value around $146 per share. A more cautious Narrative could focus on cost and tariff risks and conclude that the stock is only worth closer to the low analyst target of $119.

Do you think there's more to the story for Genuine Parts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal